- Switzerland

- /

- Real Estate

- /

- SWX:SFPN

Here's Why I Think SF Urban Properties (VTX:SFPN) Is An Interesting Stock

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

So if you're like me, you might be more interested in profitable, growing companies, like SF Urban Properties (VTX:SFPN). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for SF Urban Properties

How Quickly Is SF Urban Properties Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. SF Urban Properties managed to grow EPS by 5.9% per year, over three years. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

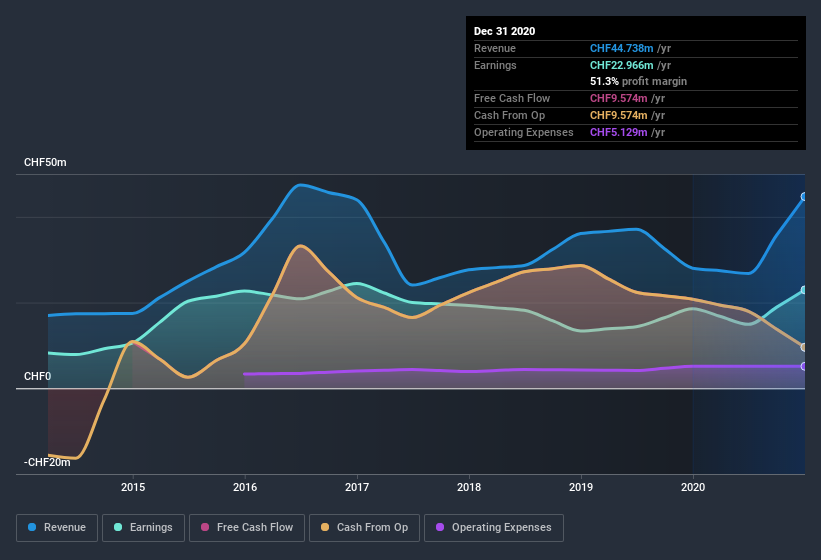

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. I note that SF Urban Properties's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. SF Urban Properties maintained stable EBIT margins over the last year, all while growing revenue 60% to CHF45m. That's a real positive.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check SF Urban Properties's balance sheet strength, before getting too excited.

Are SF Urban Properties Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. So it is good to see that SF Urban Properties insiders have a significant amount of capital invested in the stock. With a whopping CHF62m worth of shares as a group, insiders have plenty riding on the company's success. At 19% of the company, the co-investment by insiders gives me confidence that management will make long-term focussed decisions.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? A brief analysis of the CEO compensation suggests they are. For companies with market capitalizations between CHF188m and CHF752m, like SF Urban Properties, the median CEO pay is around CHF902k.

The SF Urban Properties CEO received total compensation of only CHF32k in the year to . This could be considered a token amount, and indicates that the company does not need to use payment to motivate the CEO - that is often a good sign. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Does SF Urban Properties Deserve A Spot On Your Watchlist?

One positive for SF Urban Properties is that it is growing EPS. That's nice to see. The fact that EPS is growing is a genuine positive for SF Urban Properties, but the pretty picture gets better than that. With a meaningful level of insider ownership, and reasonable CEO pay, a reasonable mind might conclude that this is one stock worth watching. Don't forget that there may still be risks. For instance, we've identified 3 warning signs for SF Urban Properties (2 are a bit unpleasant) you should be aware of.

Although SF Urban Properties certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading SF Urban Properties or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SWX:SFPN

SF Urban Properties

A real estate company, engages in the development of real estate properties in Switzerland.

Established dividend payer with acceptable track record.

Market Insights

Community Narratives