- Switzerland

- /

- Real Estate

- /

- SWX:CHAM

European Growth Companies With Strong Insider Ownership

Reviewed by Simply Wall St

As European markets experience a resurgence, buoyed by the European Central Bank's decision to cut interest rates amid trade uncertainties, investor sentiment has been bolstered across major indices. In this environment, growth companies with strong insider ownership can be particularly appealing as they often indicate confidence from those closest to the company's operations and strategic direction.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 11.8% | 40.8% |

| Vow (OB:VOW) | 13.1% | 111.2% |

| Bonesupport Holding (OM:BONEX) | 10.1% | 47.8% |

| Elicera Therapeutics (OM:ELIC) | 20.5% | 97.2% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 50.8% |

| CD Projekt (WSE:CDR) | 29.7% | 37.4% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 88.2% |

| Lokotech Group (OB:LOKO) | 13.9% | 58.1% |

| Nordic Halibut (OB:NOHAL) | 29.7% | 60.7% |

| Ortoma (OM:ORT B) | 27.7% | 68.6% |

We'll examine a selection from our screener results.

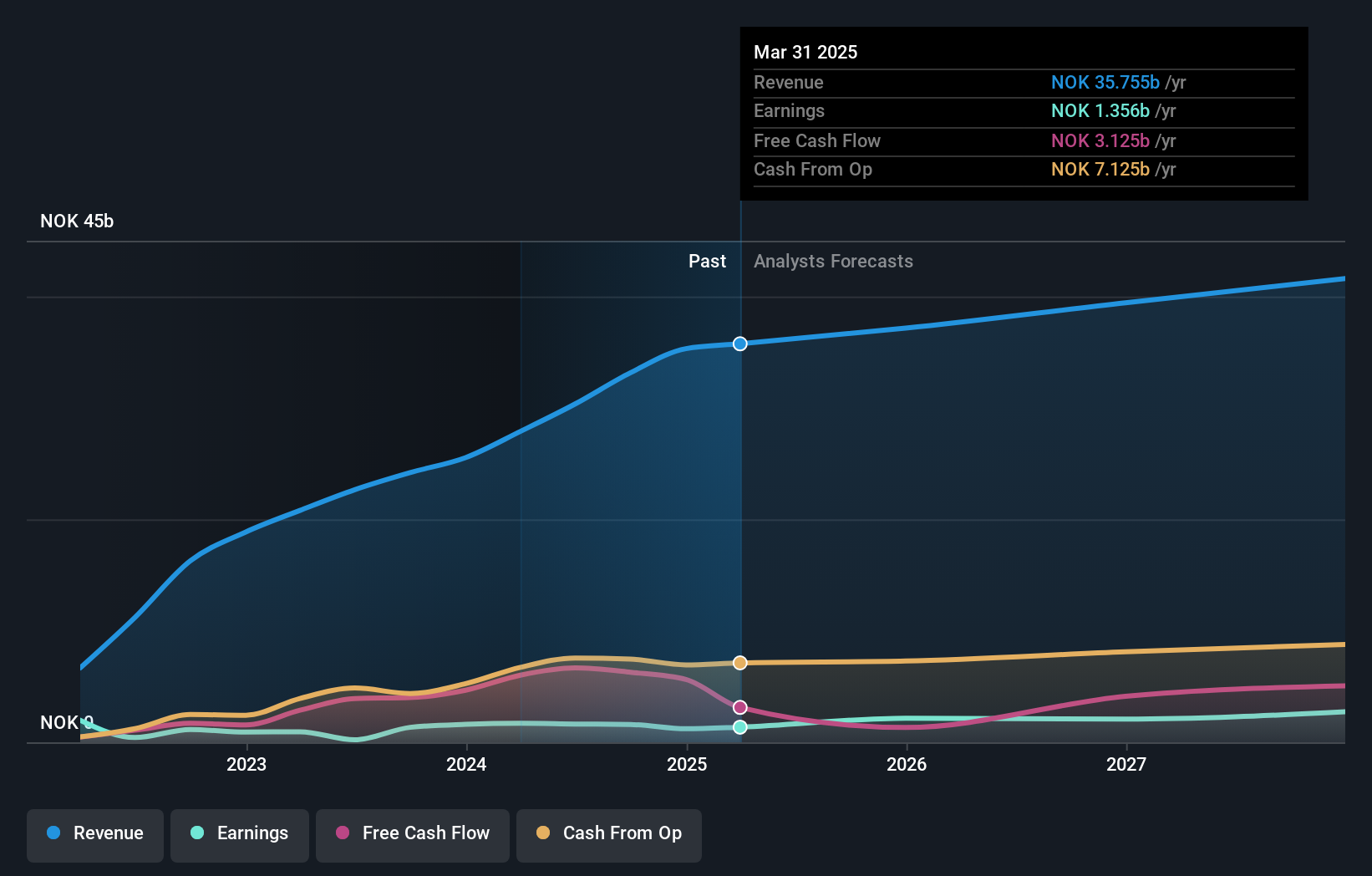

Norwegian Air Shuttle (OB:NAS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Norwegian Air Shuttle ASA, along with its subsidiaries, offers air travel services both within Norway and internationally, with a market cap of NOK12.12 billion.

Operations: The company's revenue segments include NOK7.24 billion from Widerøe and NOK28.34 billion from Norwegian.

Insider Ownership: 14.3%

Earnings Growth Forecast: 15.1% p.a.

Norwegian Air Shuttle is experiencing robust growth, with earnings forecasted to increase by 15.1% annually, outpacing the Norwegian market. The company recently secured its fleet's future by purchasing 10 Boeing 737-800 aircraft, enhancing financial flexibility and reducing ownership costs. Despite a dip in profit margins from last year, revenue is expected to grow at 5.7% per year. The airline's strategic expansion positions it well for long-term operational growth amidst high insider ownership levels.

- Take a closer look at Norwegian Air Shuttle's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Norwegian Air Shuttle is priced higher than what may be justified by its financials.

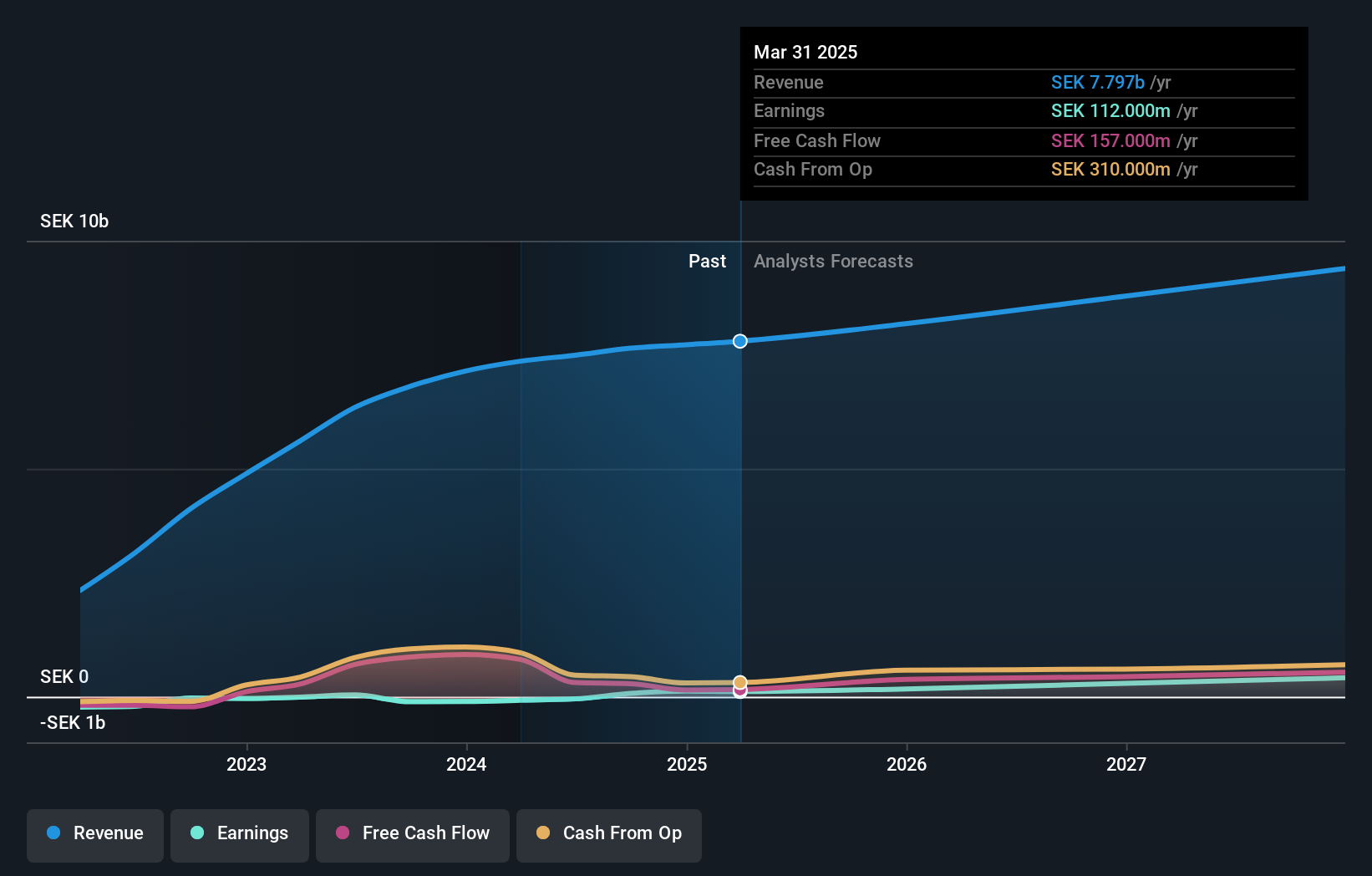

Humble Group (OM:HUMBLE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Humble Group AB (publ) refines, develops, and distributes fast-moving consumer products in Sweden and internationally, with a market cap of SEK3.69 billion.

Operations: The company's revenue segments include Future Snacking at SEK975 million, Sustainable Care at SEK2.41 billion, Quality Nutrition at SEK1.54 billion, and Nordic Distribution at SEK2.79 billion.

Insider Ownership: 14.8%

Earnings Growth Forecast: 37.6% p.a.

Humble Group's projected earnings growth of 37.6% annually significantly surpasses the Swedish market average, despite a forecasted low return on equity of 8.5%. Recent insider buying indicates strong internal confidence, aligning with its strategic move to introduce Class C 2025 shares for long-term incentives. These unlisted shares aim to enhance investment appeal without offering dividends. The company's recent profitability and revenue increase to SEK 7.72 billion underscore its growth trajectory amidst substantial insider ownership.

- Navigate through the intricacies of Humble Group with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that Humble Group is trading beyond its estimated value.

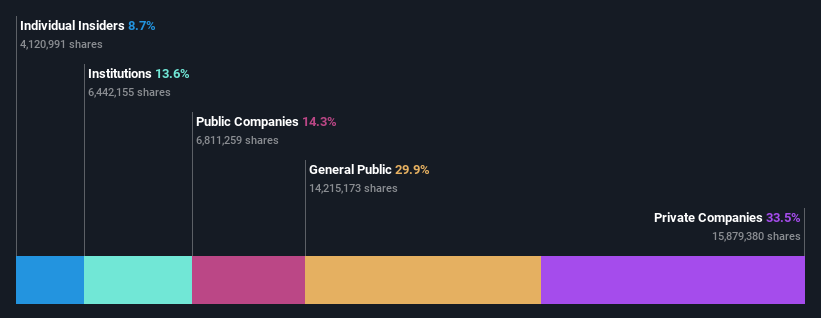

Cham Swiss Properties (SWX:CHAM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Cham Swiss Properties AG, with a market cap of CHF1.04 billion, operates as a real estate company in Switzerland through its subsidiaries.

Operations: Cham Swiss Properties AG generates revenue through its Ina Portfolio (CHF8.51 million), CERES Portfolio (CHF11.68 million), and Group Functions (CHF3.45 million).

Insider Ownership: 8.7%

Earnings Growth Forecast: 12.1% p.a.

Cham Swiss Properties is poised for substantial growth, with revenue expected to increase by 26.1% annually, outpacing the Swiss market's 4.5%. Despite a low forecasted return on equity of 7.4%, the company is projected to become profitable within three years, indicating robust future potential. However, shareholders experienced significant dilution over the past year. Recent financials show sales of CHF 15.45 million and a net loss of CHF 15.08 million for FY2024 amidst high insider ownership levels.

- Get an in-depth perspective on Cham Swiss Properties' performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Cham Swiss Properties' current price could be inflated.

Where To Now?

- Unlock more gems! Our Fast Growing European Companies With High Insider Ownership screener has unearthed 215 more companies for you to explore.Click here to unveil our expertly curated list of 218 Fast Growing European Companies With High Insider Ownership.

- Looking For Alternative Opportunities? The latest GPUs need a type of rare earth metal called Neodymium and there are only 24 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:CHAM

High growth potential with imperfect balance sheet.

Market Insights

Community Narratives