- Switzerland

- /

- Life Sciences

- /

- SWX:SKAN

Undervalued Stocks On The SIX Swiss Exchange: Partners Group Holding And 2 More

Reviewed by Simply Wall St

The Switzerland stock market recently faced notable declines, influenced by concerns over growth and the pace of Fed interest rate cuts, along with mixed economic data. However, these conditions can present opportunities for discerning investors to identify undervalued stocks that may offer potential value in a fluctuating environment.

Top 10 Undervalued Stocks Based On Cash Flows In Switzerland

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| LEM Holding (SWX:LEHN) | CHF1218.00 | CHF1821.96 | 33.1% |

| Swissquote Group Holding (SWX:SQN) | CHF293.20 | CHF570.75 | 48.6% |

| ALSO Holding (SWX:ALSN) | CHF260.00 | CHF411.64 | 36.8% |

| Georg Fischer (SWX:GF) | CHF66.35 | CHF114.05 | 41.8% |

| lastminute.com (SWX:LMN) | CHF19.70 | CHF29.69 | 33.6% |

| Barry Callebaut (SWX:BARN) | CHF1372.00 | CHF2370.57 | 42.1% |

| Clariant (SWX:CLN) | CHF12.97 | CHF21.68 | 40.2% |

| Comet Holding (SWX:COTN) | CHF335.00 | CHF532.76 | 37.1% |

| SoftwareONE Holding (SWX:SWON) | CHF15.38 | CHF22.02 | 30.2% |

| SGS (SWX:SGSN) | CHF94.32 | CHF145.06 | 35% |

We'll examine a selection from our screener results.

Partners Group Holding (SWX:PGHN)

Overview: Partners Group Holding AG is a private equity firm specializing in direct, secondary, and primary investments across private equity, real estate, infrastructure, and debt with a market cap of CHF28.85 billion.

Operations: Partners Group Holding AG generates revenue from private equity, real estate, infrastructure, and debt investments.

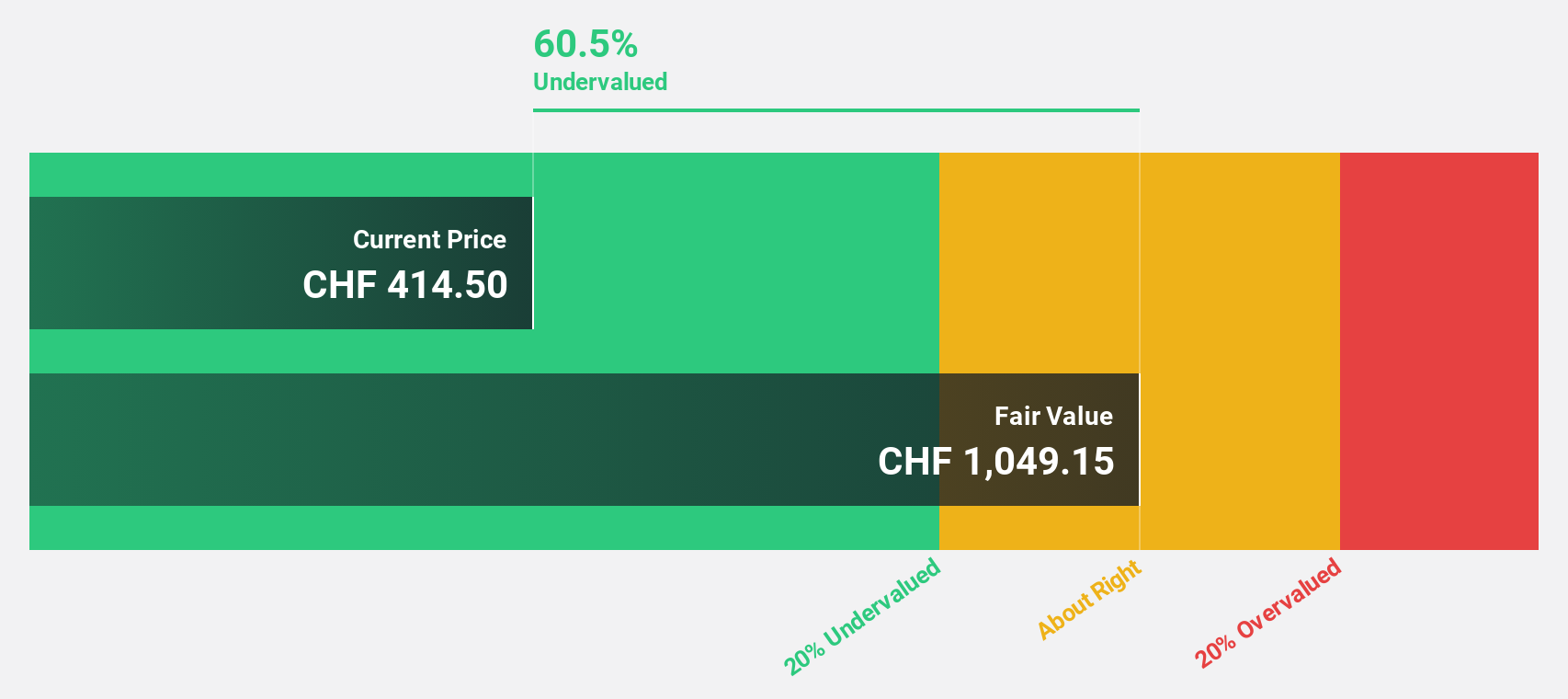

Estimated Discount To Fair Value: 16.1%

Partners Group Holding AG is trading 16.1% below its fair value estimate of CHF1323.97, with current shares at CHF1110.5. Despite a high level of debt and recent earnings decline (CHF 508 million for H1 2024 vs. CHF 551.2 million a year ago), the company's revenue and earnings are forecast to grow faster than the Swiss market, at 15.3% and 14.6% per year respectively, making it an undervalued stock based on cash flows in Switzerland's market context.

- In light of our recent growth report, it seems possible that Partners Group Holding's financial performance will exceed current levels.

- Dive into the specifics of Partners Group Holding here with our thorough financial health report.

SKAN Group (SWX:SKAN)

Overview: SKAN Group AG, with a market cap of CHF 1.83 billion, provides isolators, cleanroom devices, and decontamination processes for the pharmaceutical and chemical industries across Asia, Europe, the Americas, and internationally.

Operations: The company's revenue segments include Equipment & Solutions, generating CHF 254.17 million, and Services & Consumables, contributing CHF 89.84 million.

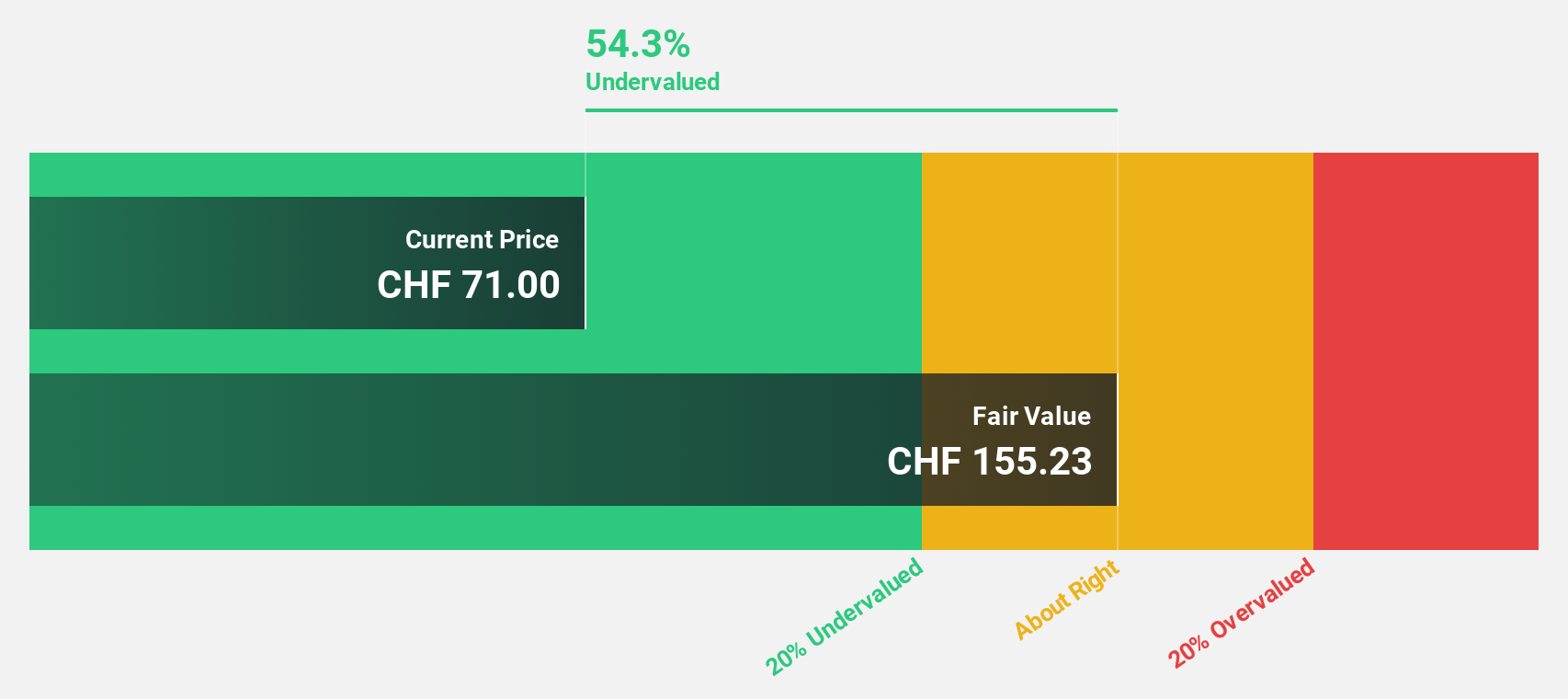

Estimated Discount To Fair Value: 12.9%

SKAN Group is trading at CHF81.6, below its fair value estimate of CHF93.7. Recent earnings results for H1 2024 showed net income of CHF13.73 million, up from CHF7.8 million a year ago, with basic earnings per share rising to CHF0.61 from CHF0.35. SKAN's forecasted annual profit growth (20.1%) and revenue growth (16.2%) are both expected to outpace the Swiss market averages, indicating it may be undervalued based on cash flows despite high non-cash earnings levels.

- Our earnings growth report unveils the potential for significant increases in SKAN Group's future results.

- Take a closer look at SKAN Group's balance sheet health here in our report.

Ypsomed Holding (SWX:YPSN)

Overview: Ypsomed Holding AG, with a market cap of CHF 5.86 billion, develops, manufactures, and sells injection and infusion systems for pharmaceutical and biotechnology companies.

Operations: Ypsomed's revenue segments include Ypsomed Diabetes Care, generating CHF 151.05 million, and Ypsomed Delivery Systems, contributing CHF 385.15 million.

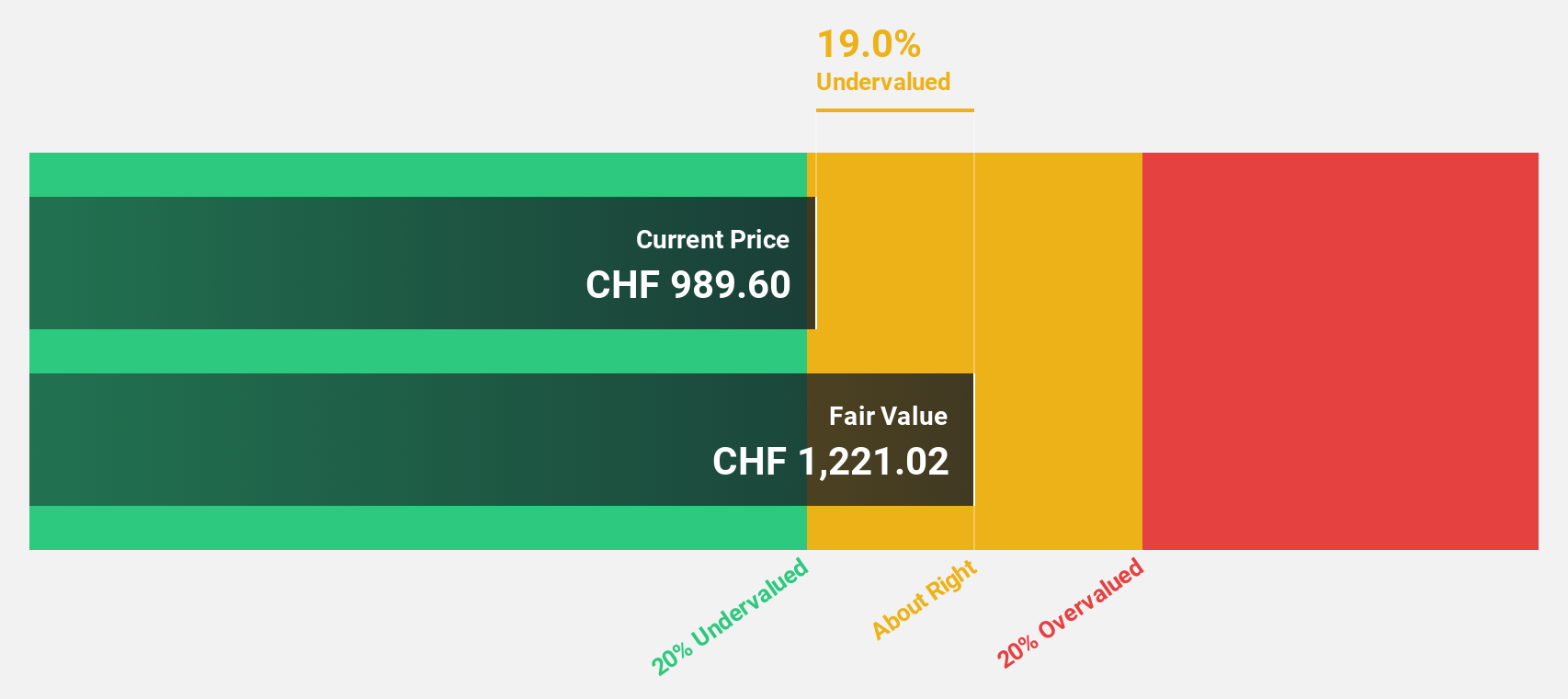

Estimated Discount To Fair Value: 19.6%

Ypsomed Holding (CHF429) trades 19.6% below its estimated fair value of CHF533.89, suggesting it might be undervalued based on cash flows. Earnings grew by 52.8% last year and are forecast to grow significantly at 33.3% annually over the next three years, outpacing Swiss market averages. Recent partnership with Astria Therapeutics for an autoinjector could bolster future revenue growth, which is expected to rise by 18.4% per year, also above market rates.

- The analysis detailed in our Ypsomed Holding growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Ypsomed Holding's balance sheet health report.

Where To Now?

- Navigate through the entire inventory of 20 Undervalued SIX Swiss Exchange Stocks Based On Cash Flows here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SKAN

SKAN Group

Provides isolators, cleanroom devices, and decontamination processes for pharmaceutical and chemical industries in Asia, Europe, the Americas, and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives