- Sweden

- /

- Specialty Stores

- /

- OM:HAYPP

Exploring Europe's Undiscovered Gems in June 2025

Reviewed by Simply Wall St

As European markets navigate the complexities of trade negotiations and economic indicators, recent developments have seen the pan-European STOXX Europe 600 Index rise by 0.65%, buoyed by easing inflation and expectations of potential interest rate cuts from the European Central Bank. In this dynamic environment, identifying stocks that can withstand market volatility while capitalizing on regional growth opportunities is crucial for investors seeking to uncover Europe's undiscovered gems.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| Martifer SGPS | 102.88% | -0.23% | 7.16% | ★★★★★★ |

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 19.46% | 0.47% | 7.14% | ★★★★★☆ |

| Viohalco | 93.48% | 11.98% | 14.19% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Evergent Investments | 5.39% | 9.41% | 21.17% | ★★★★☆☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 5.17% | -13.11% | ★★★★☆☆ |

| Eurofins-Cerep | 0.46% | 6.80% | 6.93% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Haypp Group (OM:HAYPP)

Simply Wall St Value Rating: ★★★★★★

Overview: Haypp Group AB (publ) is an online retailer specializing in tobacco-free nicotine pouches and snus products across Sweden, Norway, the rest of Europe, and the United States, with a market capitalization of approximately SEK3.62 billion.

Operations: Haypp Group generates revenue primarily from three segments: Core (SEK2.68 billion), Growth (SEK946.56 million), and Emerging Market (SEK94.82 million).

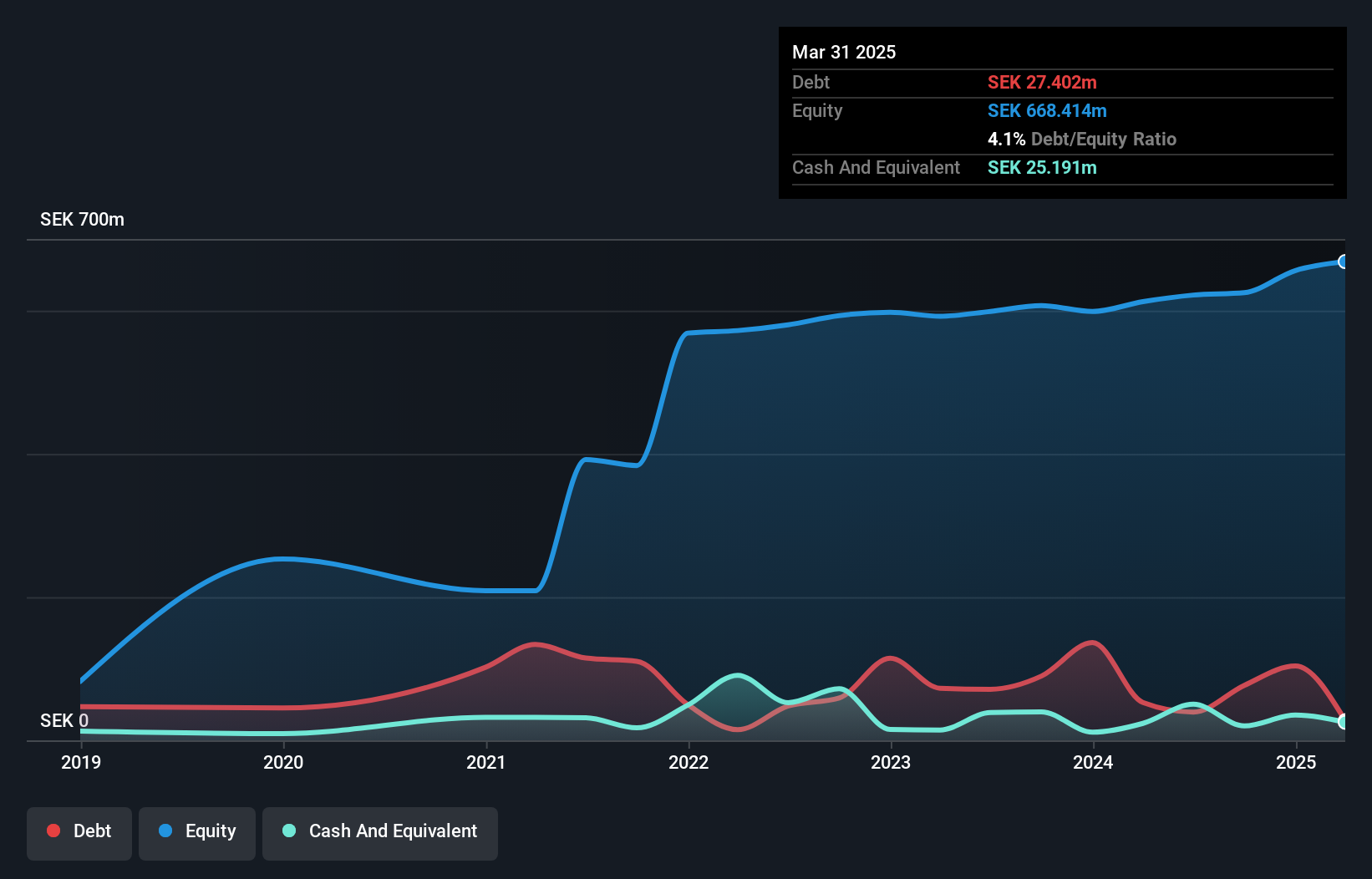

Haypp Group, an online retailer specializing in tobacco-free nicotine pouches, is making strides with impressive figures. Over the past year, earnings surged by 280%, outpacing the Specialty Retail industry’s growth of 6.7%. The company's debt to equity ratio has significantly decreased from 24.5% to just 4.1% over five years, reflecting strong financial management. Trading at a notable discount of 64% below estimated fair value suggests potential upside for investors. Recent regulatory approvals in the U.S., alongside warehouse automation efforts in Texas, are expected to enhance operational efficiency and profit margins as sales volumes grow stateside.

Linc (OM:LINC)

Simply Wall St Value Rating: ★★★★★★

Overview: Linc AB is a private equity and venture capital firm focusing on early and mature stage investments in pharmaceutical, life-science, and med-tech companies, with a market cap of approximately SEK4.16 billion.

Operations: Linc AB's revenue primarily stems from its listed holdings, contributing SEK297.02 million, while unlisted holdings add SEK22.68 million.

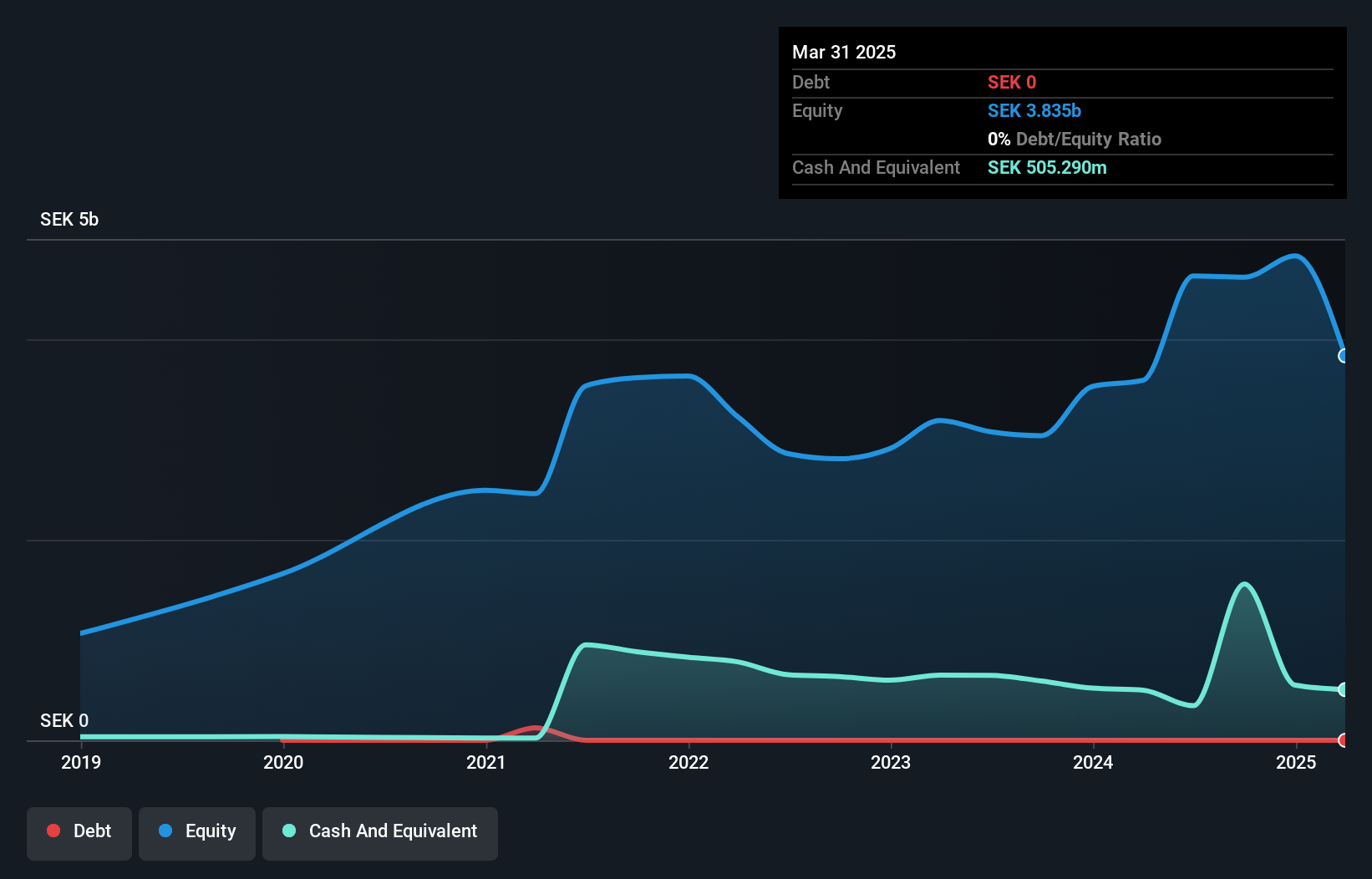

Linc AB, a smaller player in the market, shows a mixed financial landscape. Despite being debt-free for five years and having no interest coverage concerns, it reported negative earnings growth of 39% over the past year against the industry’s 15% average. Its price-to-earnings ratio stands at 17x, undercutting the Swedish market's 22.6x. The company has experienced significant insider selling recently and faced a net loss of SEK 995.96 million in Q1 2025 compared to last year's net income of SEK 61.31 million, hinting at challenges ahead despite its high-quality earnings history and positive free cash flow status.

- Click here to discover the nuances of Linc with our detailed analytical health report.

Gain insights into Linc's past trends and performance with our Past report.

SKAN Group (SWX:SKAN)

Simply Wall St Value Rating: ★★★★★☆

Overview: SKAN Group AG, with a market cap of CHF1.64 billion, specializes in providing isolators, cleanroom devices, and decontamination processes for the pharmaceutical and chemical industries across Europe, the Americas, Asia, and other international markets.

Operations: SKAN Group AG generates revenue primarily from its Equipment & Solutions segment, contributing CHF270.90 million, and its Services & Consumables segment, which adds CHF90.39 million.

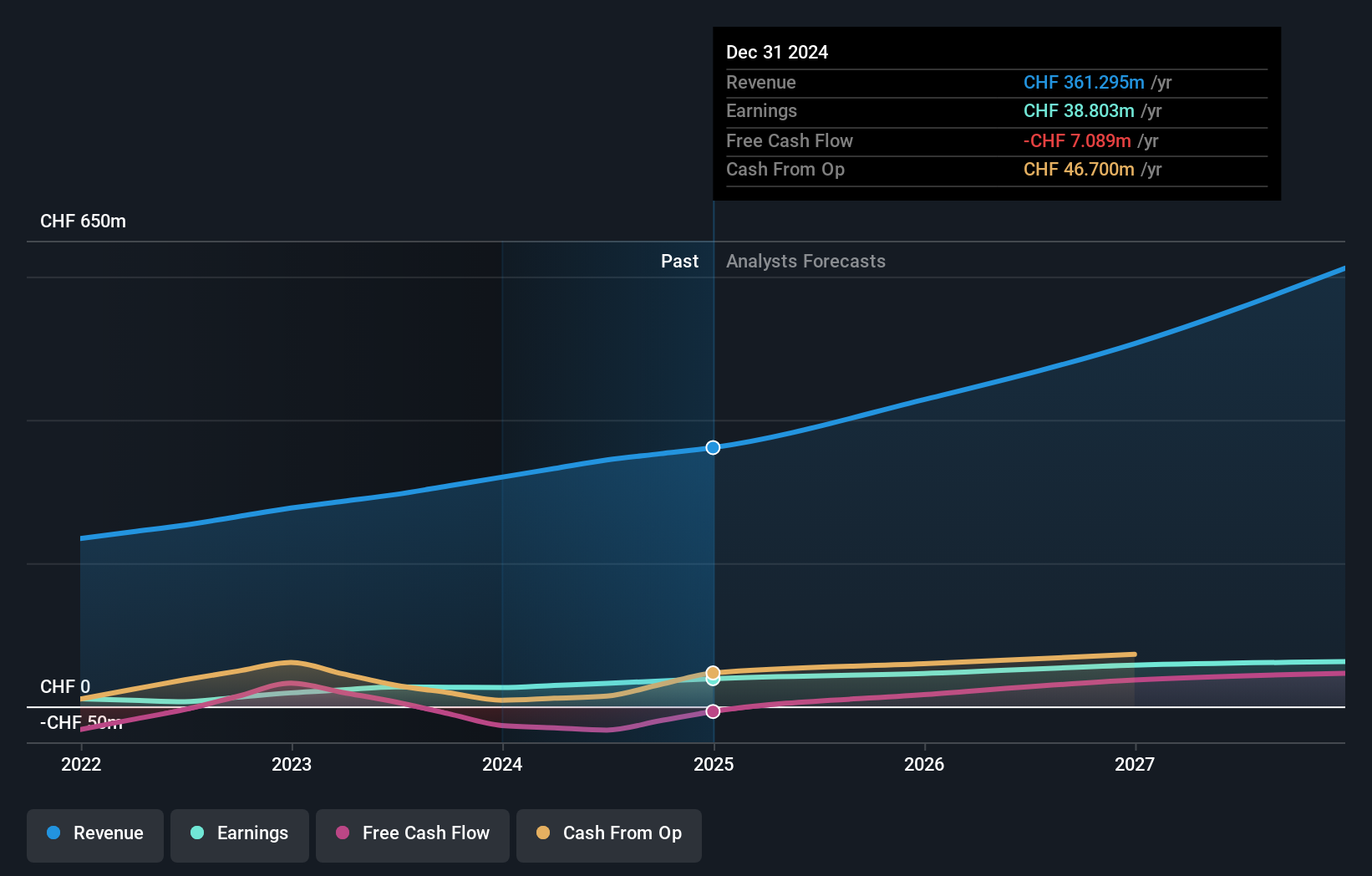

SKAN Group, a promising player in the life sciences sector, has seen its earnings surge by 47.5% over the past year, outpacing industry growth. Trading at a discount of 19.3% below estimated fair value, SKAN's financial health is bolstered by more cash than total debt and robust interest coverage of 108 times EBIT. The company's recent dividend increase to CHF 0.40 per share reflects confidence in its financial position. Despite an increased debt-to-equity ratio from 0% to 2.7%, SKAN's strategic expansion and R&D investments suggest potential for sustained growth and improved profitability moving forward.

Key Takeaways

- Click this link to deep-dive into the 331 companies within our European Undiscovered Gems With Strong Fundamentals screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Haypp Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HAYPP

Haypp Group

Operates as an online retailer of tobacco-free nicotine pouches and snus products in Sweden, Norway, the rest of Europe, and the United States.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives