- Switzerland

- /

- Pharma

- /

- SWX:SDZ

Is There Still Value in Sandoz Group After Strong 2024 Gains?

Reviewed by Bailey Pemberton

If you've been eyeing Sandoz Group stock lately, you're not alone, and you're probably asking the same question as many investors: what’s the real story behind these price moves, and is there value left on the table? Over the past year, Sandoz Group shares have soared by 37.4%, while posting an even more impressive 28.4% gain so far this year. Yet, despite that strength, the last month has brought a mild pullback of 1.4%. This serves as a healthy reminder that strong uptrends rarely move in a straight line. The stock even managed to tack on a steady 1.5% over the last week, which hints at renewed buyer interest.

Part of this recent performance can be traced to broader market optimism around the pharmaceutical and healthcare sectors, as well as changing risk perceptions following regulatory updates that have generally favored generic drug makers. For investors wondering if there’s still upside, it all boils down to valuation: how much room Sandoz Group really has to run, and whether the current price offers a margin of safety.

Using a range of classic valuation methods, Sandoz Group comes in with a valuation score of 2 out of 6, meaning the company appears undervalued in only two key measures. Is that enough to justify a fresh investment? In the next section, we’ll break down the main approaches to valuing Sandoz Group and where they each agree or disagree on whether the stock is a bargain. We will also look toward an even sharper way to judge its worth at the end of the article.

Sandoz Group scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Sandoz Group Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to their present value. This approach is widely used because it focuses on the company’s ability to generate cash for shareholders over time.

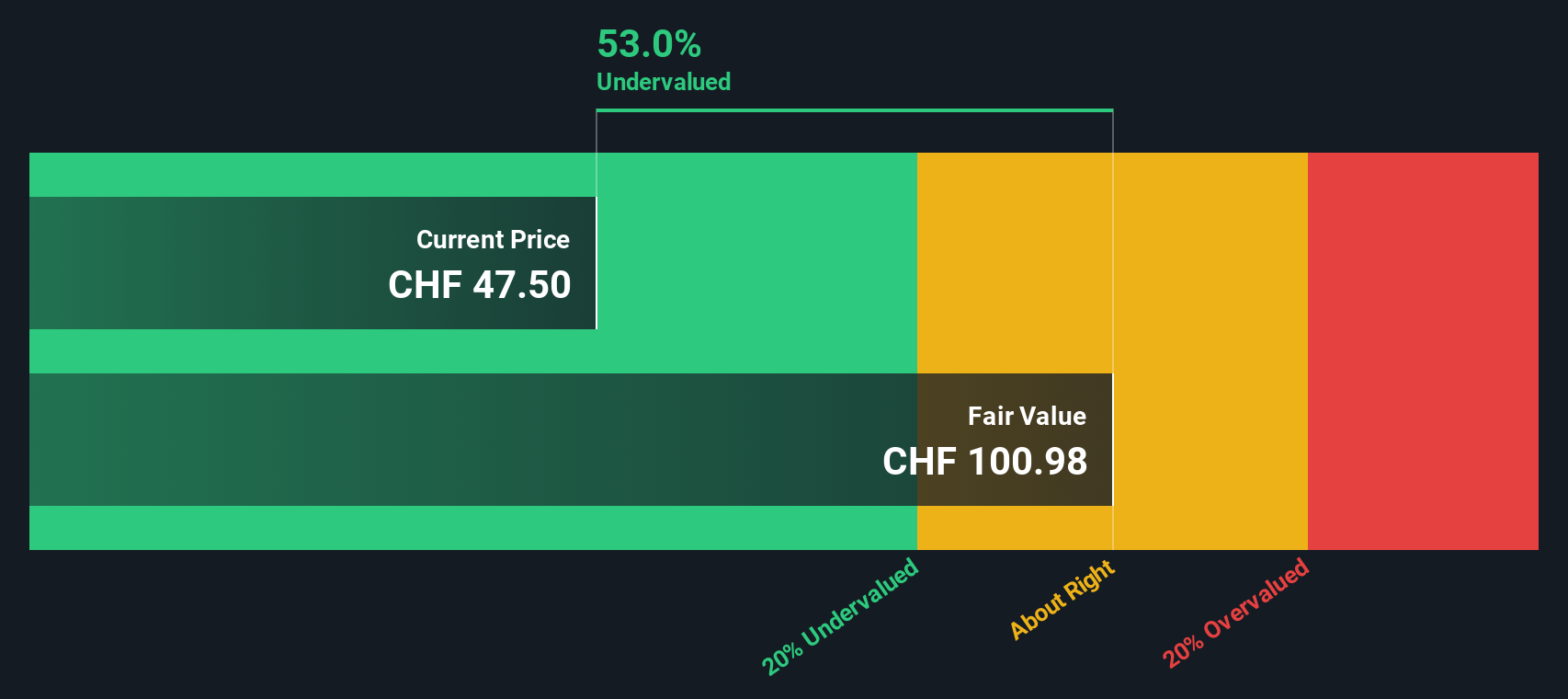

For Sandoz Group, the current Free Cash Flow (FCF) over the last twelve months stands at $332 million. Looking ahead, analysts predict significant growth, with FCF expected to reach approximately $1.54 billion by the end of 2029. The first five years of these forecasts are based on direct analyst estimates, while projections beyond 2029 rely on extrapolation. These forecasts suggest a strong upward trajectory in Sandoz Group’s ability to generate cash.

Based on the DCF model, the estimated intrinsic value for Sandoz Group shares is $100.71. This means the stock is currently trading at a 52.1% discount to its calculated fair value, indicating it appears significantly undervalued according to these cash flow projections.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Sandoz Group is undervalued by 52.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Sandoz Group Price vs Earnings

The Price-to-Earnings (PE) ratio is widely considered one of the best ways to value profitable companies, as it compares the market price to the company’s actual earnings performance. For well-established, consistently profitable businesses like Sandoz Group, PE ratios help investors gauge how much they are paying for each unit of current profit and set expectations for future growth.

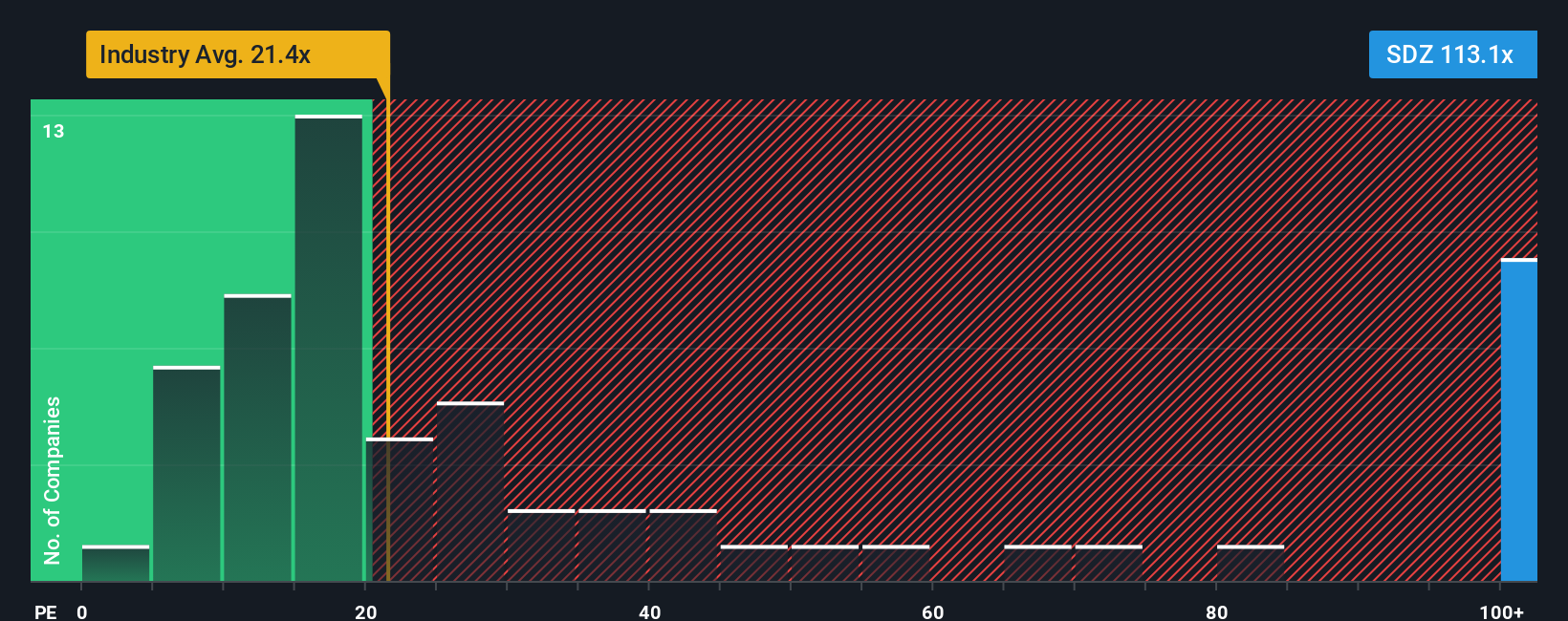

What counts as a fair or “normal” PE ratio depends on both the company’s growth prospects and perceived risks. Higher expected earnings growth or greater stability often justify a higher PE, whereas slower growth or greater uncertainty generally result in a lower ratio. For context, Sandoz Group currently trades at a PE of 115.08, which is well above the pharmaceuticals industry average of 24.62 and the peer average of 49.77. This suggests the market is assigning a substantial premium for Sandoz Group relative to its sector.

Simply Wall St’s proprietary Fair Ratio offers an additional perspective beyond basic industry or peer comparisons. It factors in a broader mix of elements, such as Sandoz Group’s specific earnings growth outlook, risk profile, profit margins, size, and industry nuances to arrive at a more tailored benchmark. For Sandoz Group, the Fair Ratio stands at 31.04. Since the current PE is significantly higher than this Fair Ratio, the shares appear overvalued versus what would typically be justified by fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Sandoz Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story about what you think will happen with a company like Sandoz Group, backed up by your own forecasts, including your expected future revenues, profits, and margins, all tied to a fair value for the stock.

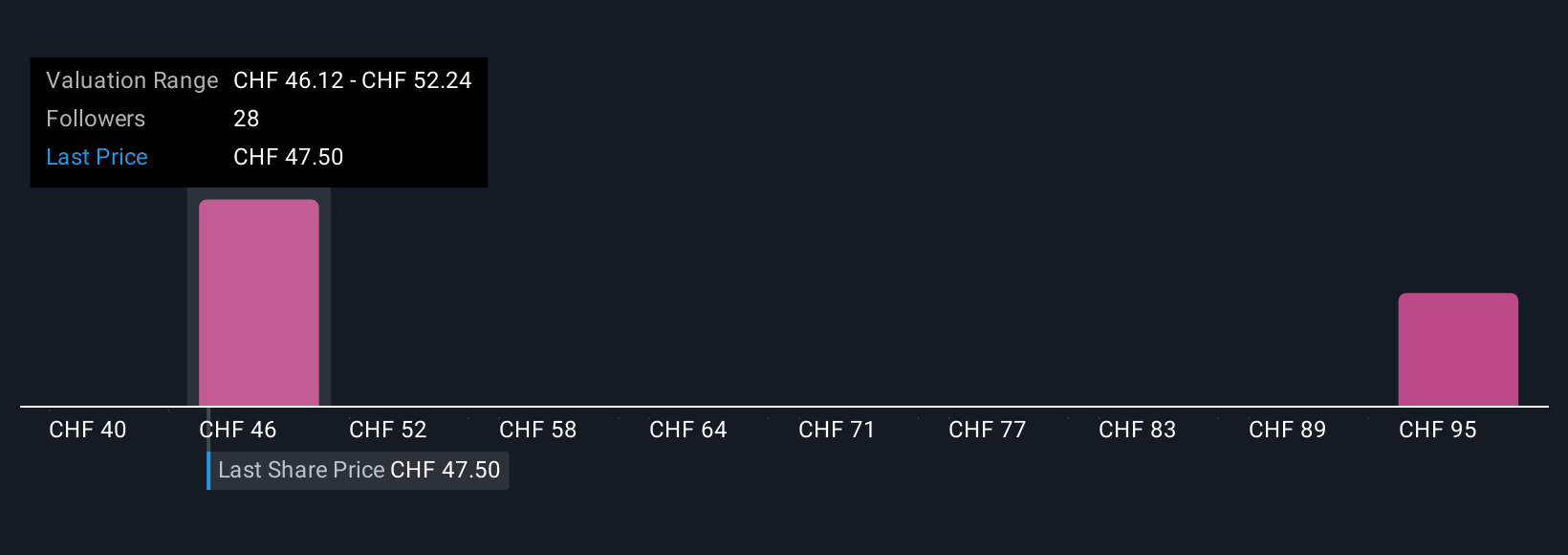

Instead of relying only on fixed valuation models, Narratives let you combine your perspective on Sandoz Group’s business drivers, such as the rollout of new biosimilars or overseas expansion, into a financial forecast. Narratives connect the dots between "what’s happening" and what the company is worth, helping you see exactly where your view fits against others in the community.

Available right on Simply Wall St’s Community page, Narratives are easy for anyone to use and update. Millions of investors tap into them to actively monitor their investments. They adapt automatically as new news, earnings results, or market events reshape the picture, giving you an up-to-date basis for smart decisions.

Narratives give you instant clarity about whether Sandoz Group is a buy, hold, or sell by comparing its Fair Value (based on your assumptions or consensus) to the current share price. For example, one investor might set a bullish Narrative targeting CHF60.37 based on aggressive growth and margin expansion, while another takes a more cautious stance with a fair value of CHF38.02 reflecting tougher competition and margin risk.

Do you think there's more to the story for Sandoz Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SDZ

Sandoz Group

Develops, manufactures, and markets generic pharmaceuticals and biosimilars worldwide.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives