- Switzerland

- /

- Pharma

- /

- SWX:ROG

Roche Shares Rally as Generics Excluded From US Tariff Plan — What Does Valuation Say?

Reviewed by Bailey Pemberton

If you find yourself wondering what to do next with Roche Holding, you are not alone. The stock has been on a bit of a ride lately, with a strong 8.9% pop over the last month that has turned heads and reignited conversations about its longer-term potential. While there was a slight dip this past week at -2.2%, Roche is still up 10.6% year-to-date and 7.2% over the past year, which highlights its staying power in a changing pharmaceutical landscape.

Much of the recent attention can be traced back to shifting headlines around drug pricing and international tariffs. For instance, the announcement that generics may be excluded from planned U.S. pharma tariffs removed a significant portion of regulatory overhang, and recent talks between Swiss leaders and major pharma players like Roche signaled the company’s continued global relevance. Even as price negotiations and political headlines swirl, Roche’s long-term price return over five years stands at a solid 12.6%, indicating that investors have generally been rewarded for patience.

So, is Roche Holding undervalued or is it fairly priced after this run? According to our latest valuation score, the company is undervalued on 4 out of 6 key checks. We will dig deeper into what makes up these checks and how they matter, and just as important, we will look beyond the usual ratios to uncover a smarter way to value Roche that most investors overlook. Let’s break down the numbers.

Why Roche Holding is lagging behind its peers

Approach 1: Roche Holding Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a foundational tool for estimating a company’s intrinsic value. It works by projecting Roche Holding’s future cash flows and discounting them back to today’s value using an appropriate discount rate. This method is favored because it focuses on the core value driver for shareholders, which is the company’s ability to generate free cash flow over time.

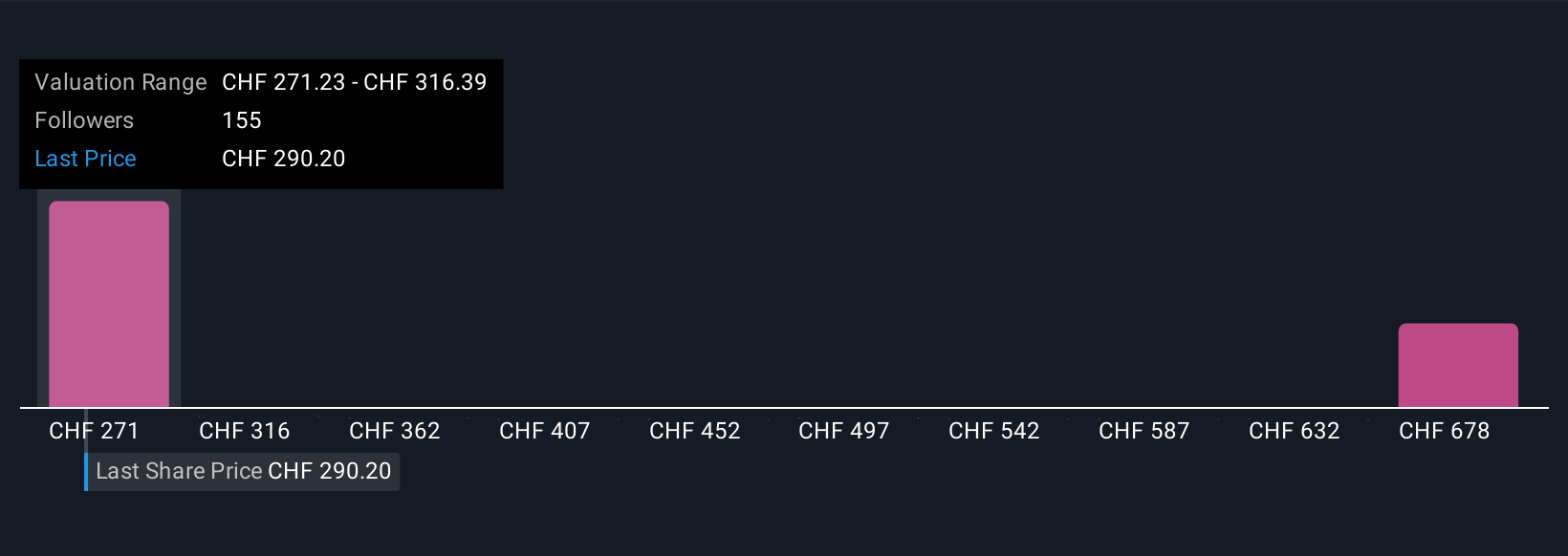

Currently, Roche Holding reports trailing twelve months Free Cash Flow of CHF 14.08 billion. Analyst consensus projects steady growth, with Free Cash Flow expected to reach CHF 17.98 billion by 2029. While the first five years rely on analyst estimates, projections beyond this are modeled by Simply Wall St based on prudent growth assumptions to complete a full decade of cash flow outlook.

By discounting these projected cash flows to their present value, the DCF model calculates Roche Holding’s intrinsic value to be CHF 657.93 per share. This is significantly higher than its current market price, which implies the stock is trading at a 56.9% discount to its estimated fair value.

This suggests a compelling margin of safety for long-term investors and highlights the stock’s potential upside.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Roche Holding is undervalued by 56.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

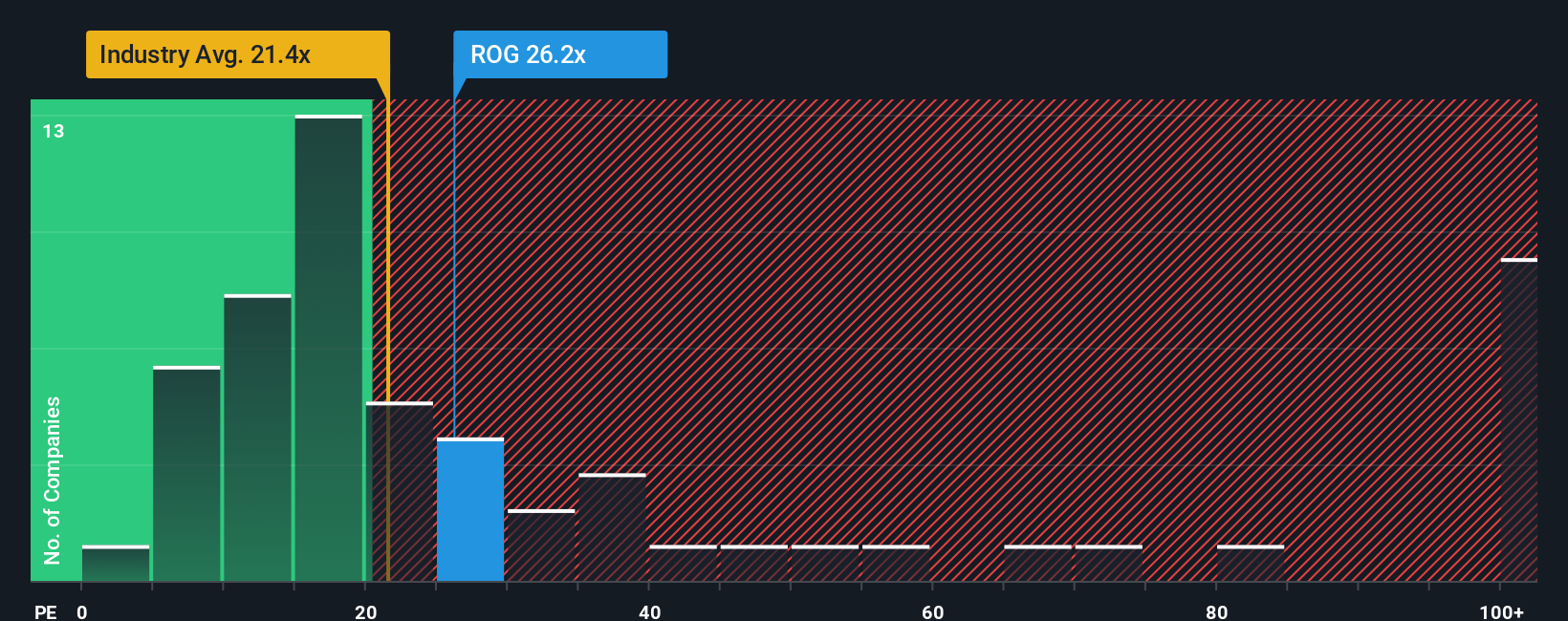

Approach 2: Roche Holding Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric, especially effective for mature, profitable companies like Roche Holding. It reflects how much investors are willing to pay for each franc of current earnings, making it an accessible way to measure market expectations for growth and risk.

Generally, a “normal” or “fair” PE ratio will be higher for businesses expected to grow faster or with more stable earnings, while companies with greater risks or lower potential see lower ratios. Factors such as industry dynamics, profit margins, and future growth prospects all play a part in determining where a company’s PE should land.

Roche currently trades on a PE of 25.6x compared to the pharmaceuticals industry average of 24.5x and a peer average of 71.0x. At first glance, Roche appears moderately above the sector norm, but well below the peer group. This is where the proprietary “Fair Ratio” from Simply Wall St provides additional clarity. Roche’s Fair PE Ratio is estimated at 33.5x, reflecting considerations like its unique market position, earnings quality, growth outlook, margin profile, and risks, all tailored to the company rather than relying solely on blunt industry or peer averages.

Because the Fair Ratio accounts for Roche’s specific circumstances, it delivers a more nuanced and realistic valuation benchmark. Comparing the current 25.6x PE to the Fair Ratio of 33.5x, the stock trades below what would be expected given its fundamentals. This points to potential undervaluation based on this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Roche Holding Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. Narratives are a simple but powerful approach that lets you connect the story you believe about Roche Holding, such as its future revenue growth, margin expansion, or pipeline breakthroughs, with your own financial estimates of fair value.

Instead of relying solely on ratios or analyst targets, Narratives empower you to lay out your personal viewpoint, tying together your assumptions for future performance and seeing what value those assumptions lead to.

On Simply Wall St’s Community page, millions of investors use Narratives to share and compare their Roche Holding stories, making it easy to frame investment decisions around both numbers and events. This tool helps you decide when to buy or sell by comparing your Narrative’s fair value with the current share price, and automatically updates as new news, earnings, or company developments occur.

For example, some investors currently see a fair value for Roche Holding as high as CHF 438.00 based on bullish growth scenarios, while others use more cautious assumptions and arrive at CHF 230.00. This demonstrates how Narratives put your own outlook in the driver’s seat.

Do you think there's more to the story for Roche Holding? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:ROG

Roche Holding

Engages in the pharmaceuticals and diagnostics businesses in Europe, North America, Latin America, Asia, Africa, Australia, and New Zealand.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives