- Switzerland

- /

- Pharma

- /

- SWX:ROG

Roche Holding (SWX:ROG) Invests US$550 Million In Indianapolis Diagnostics Expansion

Reviewed by Simply Wall St

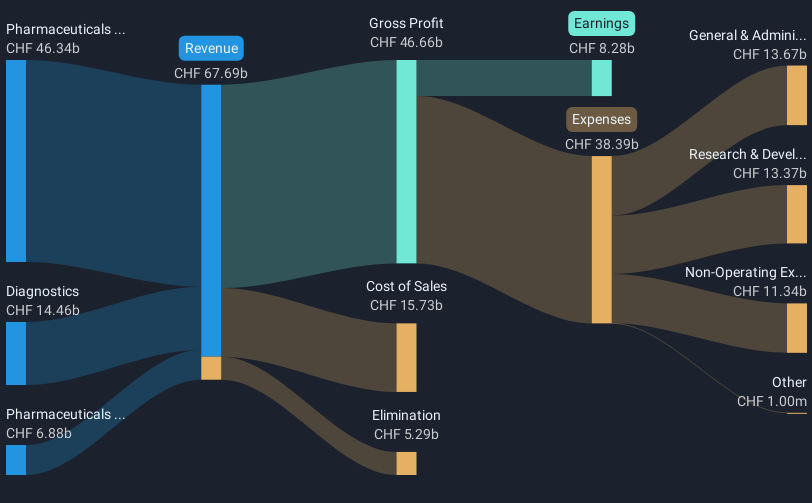

Roche Holding (SWX:ROG) recently announced a significant investment of $550 million in its Indianapolis Diagnostics site to expand its continuous glucose monitoring systems, a move set to create thousands of jobs and significantly impact diabetes management in the U.S. Over the past month, the company's stock experienced a 6% rise. While this expansion underscores Roche's commitment to healthcare innovation and may have added positive weight to its share price movement, broader market trends, like the recent easing of U.S.-China tariffs, have likely also influenced this upward trajectory amid a strong overall market performance.

Every company has risks, and we've spotted 4 risks for Roche Holding you should know about.

The recent announcement of Roche Holding's $550 million investment in its Indianapolis Diagnostics site for continuous glucose monitoring systems could have significant implications for its narrative. This development reinforces Roche’s commitment to innovation in the healthcare sector and may bolster its long-term revenue and earnings potential, particularly within the U.S. market for diabetes management. Such an expansion is likely to enhance Roche's diagnostics revenue, augmenting the company’s comprehensive offering in both pharmaceuticals and diagnostics, potentially driving sustained revenue growth.

Roche's shares demonstrated a 16.82% total return over the last year, showcasing a robust performance over this longer-term period. This suggests that the company's strategic initiatives, including investment and growth in its diagnostics division, have been well-received in the market. When compared to the Swiss Market's 2.2% return and the Swiss Pharmaceuticals industry's 7.1% over the past year, Roche's performance stands out as strong relative to both its market and industry peers.

In terms of revenue and earnings forecasts, this strategic investment potentially supports the anticipated 3% annual revenue growth over the next three years. At the same time, Roche aims to nearly double earnings to CHF16.3 billion by May 2028. Analysts expect these financial maneuvers to help justify a consensus price target of CHF305.08, approximately 11.7% above the current share price of CHF269.3. This investment may play a crucial role in boosting investor confidence, aligning future earnings with these optimistic projections.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Roche Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:ROG

Roche Holding

Engages in the pharmaceuticals and diagnostics businesses in Europe, North America, Latin America, Asia, Africa, Australia, and New Zealand.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives