- Switzerland

- /

- Pharma

- /

- SWX:NWRN

Newron Pharmaceuticals S.p.A. (VTX:NWRN) About To Shift From Loss To Profit

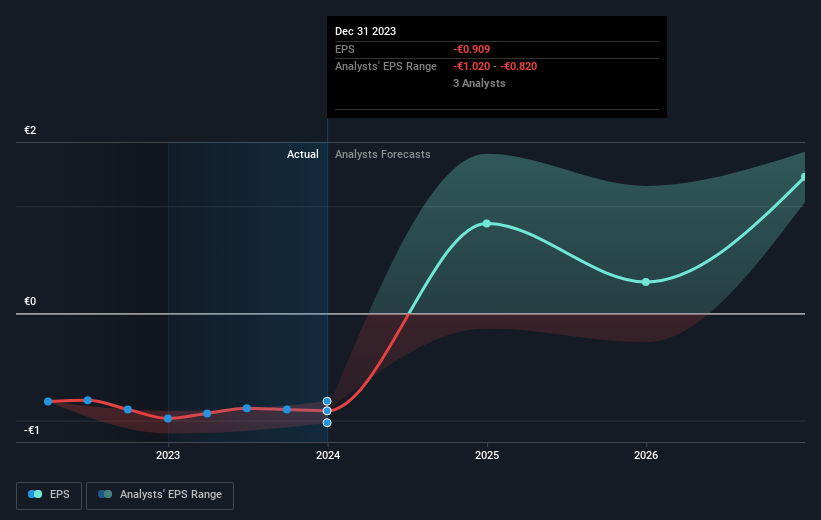

We feel now is a pretty good time to analyse Newron Pharmaceuticals S.p.A.'s (VTX:NWRN) business as it appears the company may be on the cusp of a considerable accomplishment. Newron Pharmaceuticals S.p.A., a biopharmaceutical company, focus on the development of novel therapies for the treatment of central nervous system (CNS) and pain in Italy and the United States. On 31 December 2023, the CHF147m market-cap company posted a loss of €16m for its most recent financial year. Many investors are wondering about the rate at which Newron Pharmaceuticals will turn a profit, with the big question being “when will the company breakeven?” In this article, we will touch on the expectations for the company's growth and when analysts expect it to become profitable.

Check out our latest analysis for Newron Pharmaceuticals

According to the 3 industry analysts covering Newron Pharmaceuticals, the consensus is that breakeven is near. They expect the company to post a final loss in 2023, before turning a profit of €15m in 2024. So, the company is predicted to breakeven approximately a year from now or less! At what rate will the company have to grow in order to realise the consensus estimates forecasting breakeven in under 12 months? Using a line of best fit, we calculated an average annual growth rate of 51%, which is extremely buoyant. If this rate turns out to be too aggressive, the company may become profitable much later than analysts predict.

Underlying developments driving Newron Pharmaceuticals' growth isn’t the focus of this broad overview, but, take into account that by and large pharmaceuticals, depending on the stage of product development, have irregular periods of cash flow. This means that a high growth rate is not unusual, especially if the company is currently in an investment period.

Before we wrap up, there’s one issue worth mentioning. Newron Pharmaceuticals currently has negative equity on its balance sheet. This can sometimes arise from accounting methods used to deal with accumulated losses from prior years, which are viewed as liabilities carried forward until it cancels out in the future. These losses tend to occur only on paper, however, in other cases it can be forewarning.

Next Steps:

There are too many aspects of Newron Pharmaceuticals to cover in one brief article, but the key fundamentals for the company can all be found in one place – Newron Pharmaceuticals' company page on Simply Wall St. We've also compiled a list of relevant factors you should further research:

- Valuation: What is Newron Pharmaceuticals worth today? Has the future growth potential already been factored into the price? The intrinsic value infographic in our free research report helps visualize whether Newron Pharmaceuticals is currently mispriced by the market.

- Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on Newron Pharmaceuticals’s board and the CEO’s background.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

Valuation is complex, but we're here to simplify it.

Discover if Newron Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:NWRN

Newron Pharmaceuticals

A biopharmaceutical company, focus on the development of novel therapies for the treatment of central nervous system (CNS) and pain in Italy and the United States.

Exceptional growth potential slight.