- Switzerland

- /

- Pharma

- /

- SWX:NOVN

Is Novartis (SWX:NOVN) Overvalued After Its Recent 20% Year‑to‑Date Share Price Gain?

Reviewed by Simply Wall St

Novartis (SWX:NOVN) has quietly pushed higher over the past month, adding about 5 %, and is now up roughly 20 % year to date, comfortably outpacing many large pharma peers.

See our latest analysis for Novartis.

That move comes on top of a strong year to date, with a roughly 20 % year to date share price return and a 22 % one year total shareholder return, signaling steady momentum as investors warm to Novartis’ pipeline and earnings profile.

If Novartis’ steady climb appeals to you, this could be a good moment to explore other established drug makers through pharma stocks with solid dividends for more ideas with income and defensiveness in mind.

With revenue and earnings still growing and the share price now hovering slightly above analyst targets but well below some intrinsic value estimates, is Novartis offering a fresh entry point, or is the market already pricing in its next leg of growth?

Most Popular Narrative: 2.2% Overvalued

With Novartis last closing at CHF106.88 against a most popular narrative fair value of CHF104.58, the story points to only a modest premium.

Operational efficiency gains from portfolio streamlining (for example, previous spin offs and exiting non core lines) and productivity improvements are driving core margin expansion and higher free cash flow. This can be reinvested in R&D and shareholder returns, supporting long term earnings and net margin growth. An announced $10 billion share buyback program, together with a strong dividend and significant free cash flow, enhances potential EPS growth and return on equity, which could result in rerating of the stock as medium term demand and profitability tailwinds materialize.

Want to see how steady revenue growth, rising margins and shrinking share count combine into that price tag? The full narrative reveals the numbers behind it.

Result: Fair Value of $104.58 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, looming patent expiries on key drugs and intensifying global pricing pressure could quickly undermine the growth and margin assumptions that support this narrative.

Find out about the key risks to this Novartis narrative.

Another Lens On Value

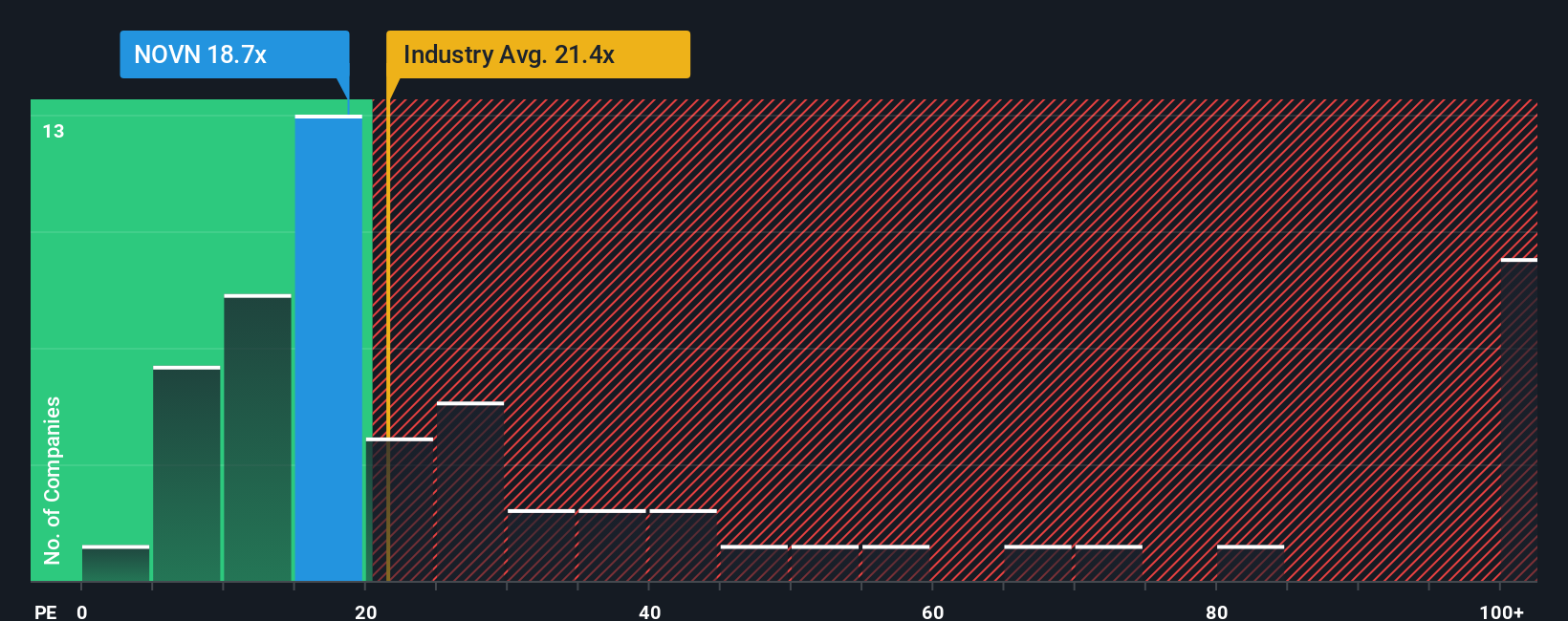

Step away from narratives and Novartis looks cheap on a simple price to earnings view. It is trading at 17.8 times earnings versus 24.7 times for the European pharma sector and a fair ratio of 32 times. Is the market underpricing its staying power or rightly cautious?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Novartis Narrative

If you see things differently or simply prefer to dig into the numbers yourself, you can build a personalised Novartis story in just a few minutes: Do it your way.

A great starting point for your Novartis research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunity by using the Simply Wall St Screener to uncover focused lists of stocks that match your exact strategy.

- Identify potential multi baggers early by scanning these 3572 penny stocks with strong financials that already show improving fundamentals instead of vague hype.

- Explore structural tech opportunities through these 26 AI penny stocks that harness artificial intelligence and automation in their business models.

- Find income-focused ideas with these 15 dividend stocks with yields > 3% offering yields above 3 % from businesses that aim to support and grow their payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novartis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:NOVN

Novartis

Researches, develops, manufactures, distributes, markets, and sells pharmaceutical medicines in Switzerland and internationally.

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026