- Switzerland

- /

- Pharma

- /

- SWX:NOVN

Assessing Novartis (SWX:NOVN) Valuation After Steady Gains and Positive Financial Growth

Reviewed by Kshitija Bhandaru

Novartis (SWX:NOVN) shares have edged higher recently, gaining nearly 1% over the past month. Investors seem to be focusing on the company's steady financial performance, as both annual revenue and net income growth are trending positively.

See our latest analysis for Novartis.

Momentum for Novartis has been gradually building, with its share price holding firm at $105.22 and the 1-year total shareholder return sitting at over 11%. These steady gains suggest investors are seeing value in the company’s consistent results, even as the broader pharmaceutical sector faces ongoing shifts.

If recent progress in pharma piques your interest, this could be a good time to explore other industry leaders. See the full list for free.

With the stock trading above some analyst price targets and boasting solid fundamentals, the key question remains: Is Novartis currently undervalued, or is the market already factoring in future growth, leaving little room for upside?

Most Popular Narrative: 6% Overvalued

Novartis’s most widely followed narrative sets a fair value just below the current share price, putting fresh focus on whether recent optimism has run a little too far for now. This perspective weighs ambitious growth drivers against a backdrop of price target uncertainty, highlighting real debate about what comes next.

Novartis' robust pipeline and rapid regulatory progress in advanced therapies (including biologics, gene, and cell therapies) positions the company to benefit from emerging healthcare technologies, potentially accelerating future earnings and margin growth as new high-value products launch.

What is behind this bold valuation? Analysts are banking on powerful numbers: faster earnings growth, a leaner share count, and margin expansion, all against a discount rate that could reshape expectations. Will these bets pay off? The full narrative crunches these key projections and reveals what makes the fair value target tick.

Result: Fair Value of $99.08 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could shift if Novartis faces accelerated patent expirations or heightened global pricing pressure, as both of these factors threaten future profitability.

Find out about the key risks to this Novartis narrative.

Another View: Multiple-Based Valuation Tells a Different Story

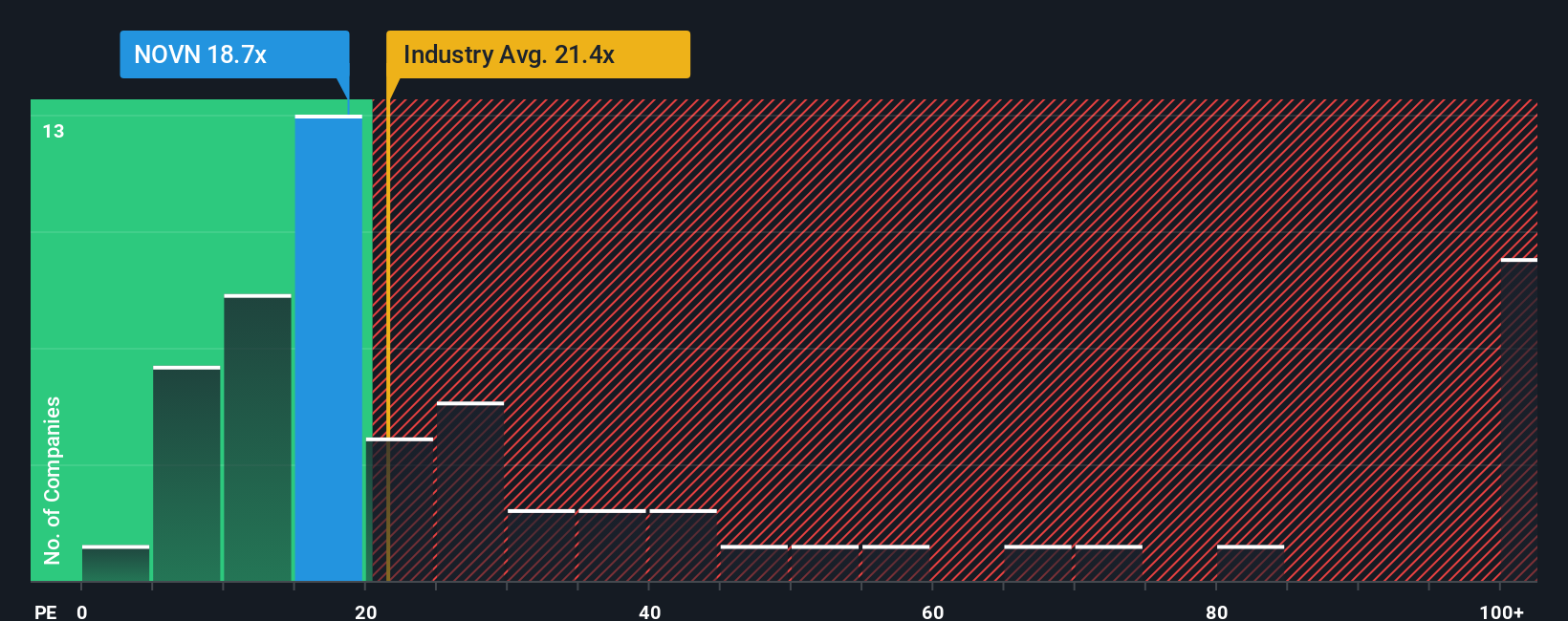

Looking at Novartis from a price-to-earnings lens, the shares appear attractively valued. With a P/E ratio of 18.8x, Novartis trades not only below the industry average of 21.3x but also well under the peer average of 72.2x. In addition, its ratio is significantly below the fair ratio of 29.4x, suggesting more value for investors compared to sector norms. Does this discount reflect overlooked opportunity, or is the market wary of something ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Novartis Narrative

Of course, you can always dig into the numbers and develop your own perspective in just a few minutes. There is plenty of room for original thinking, too. Do it your way

A great starting point for your Novartis research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep options open. Why stick with just one stock when you could pinpoint tomorrow’s opportunities and seize the advantage ahead of the crowd?

- Capture impressive yields and reliable income by checking out these 19 dividend stocks with yields > 3%, which is delivering returns above 3% right now.

- Jump ahead of the curve with these 24 AI penny stocks, found at the intersection of artificial intelligence and market innovation.

- Spot real value by reviewing these 896 undervalued stocks based on cash flows, a group that stands out for strong cash flows and attractive fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novartis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:NOVN

Novartis

Researches, develops, manufactures, distributes, markets, and sells pharmaceutical medicines in Switzerland and internationally.

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives