- Switzerland

- /

- Biotech

- /

- SWX:IDIA

Improved Revenues Required Before Idorsia Ltd (VTX:IDIA) Stock's 71% Jump Looks Justified

Idorsia Ltd (VTX:IDIA) shareholders are no doubt pleased to see that the share price has bounced 71% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 41% over that time.

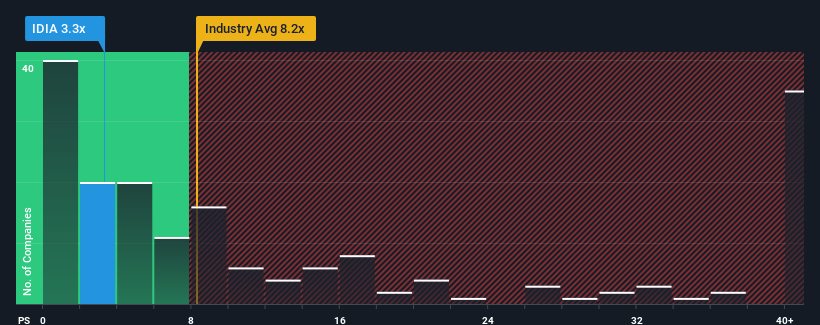

Even after such a large jump in price, Idorsia may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 3.3x, considering almost half of all companies in the Biotechs industry in Switzerland have P/S ratios greater than 6x and even P/S higher than 12x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Idorsia

How Has Idorsia Performed Recently?

Idorsia could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Idorsia's future stacks up against the industry? In that case, our free report is a great place to start.How Is Idorsia's Revenue Growth Trending?

Idorsia's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a frustrating 60% decrease to the company's top line. Still, the latest three year period has seen an excellent 105% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 59% each year during the coming three years according to the two analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 74% per annum, which is noticeably more attractive.

With this in consideration, its clear as to why Idorsia's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

The latest share price surge wasn't enough to lift Idorsia's P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Idorsia's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You need to take note of risks, for example - Idorsia has 5 warning signs (and 3 which are concerning) we think you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:IDIA

Idorsia

A biopharmaceutical company, engages in the discovery, development, and commercialization of drugs for unmet medical needs in Switzerland, the United States, Japan, Europe, China, and Canada.

Slight risk and slightly overvalued.

Market Insights

Community Narratives