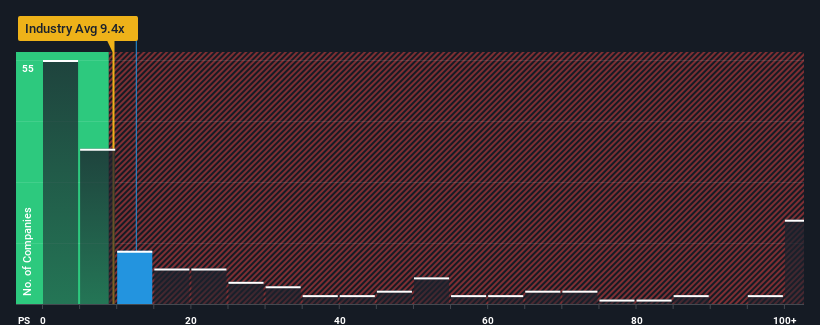

Idorsia Ltd's (VTX:IDIA) price-to-sales (or "P/S") ratio of 12.5x might make it look like a strong sell right now compared to the Biotechs industry in Switzerland, where around half of the companies have P/S ratios below 6.1x and even P/S below 1.6x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Idorsia

What Does Idorsia's Recent Performance Look Like?

Recent times haven't been great for Idorsia as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Idorsia.What Are Revenue Growth Metrics Telling Us About The High P/S?

Idorsia's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 235% last year. This great performance means it was also able to deliver immense revenue growth over the last three years. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 77% each year during the coming three years according to the ten analysts following the company. That's shaping up to be materially higher than the 36% each year growth forecast for the broader industry.

With this in mind, it's not hard to understand why Idorsia's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Idorsia maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Biotechs industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

You should always think about risks. Case in point, we've spotted 4 warning signs for Idorsia you should be aware of, and 2 of them shouldn't be ignored.

If you're unsure about the strength of Idorsia's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Idorsia, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:IDIA

Idorsia

A biopharmaceutical company, engages in the discovery, development, and commercialization of drugs for unmet medical needs in Switzerland, the United States, Japan, Europe, and Canada.

Slight and slightly overvalued.

Market Insights

Community Narratives