- Switzerland

- /

- Pharma

- /

- SWX:GALD

European Stocks Estimated Below Fair Value In May 2025

Reviewed by Simply Wall St

As European markets face renewed pressure from proposed U.S. tariffs, major indices like the STOXX Europe 600 and Germany's DAX have seen declines, reflecting broader economic uncertainties and revised growth forecasts. In this environment of volatility and contraction, identifying stocks that are estimated to be undervalued can present unique opportunities for investors seeking potential value plays amidst market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| ILPRA (BIT:ILP) | €4.54 | €8.73 | 48% |

| Alfio Bardolla Training Group (BIT:ABTG) | €1.91 | €3.70 | 48.4% |

| Lectra (ENXTPA:LSS) | €23.70 | €47.09 | 49.7% |

| Clemondo Group (OM:CLEM) | SEK10.70 | SEK21.24 | 49.6% |

| Absolent Air Care Group (OM:ABSO) | SEK215.00 | SEK416.92 | 48.4% |

| Cavotec (OM:CCC) | SEK16.80 | SEK32.27 | 47.9% |

| dormakaba Holding (SWX:DOKA) | CHF731.00 | CHF1401.73 | 47.9% |

| Claranova (ENXTPA:CLA) | €2.82 | €5.45 | 48.3% |

| illimity Bank (BIT:ILTY) | €3.742 | €7.12 | 47.4% |

| Arlandastad Group (OM:AGROUP) | SEK26.20 | SEK49.91 | 47.5% |

We're going to check out a few of the best picks from our screener tool.

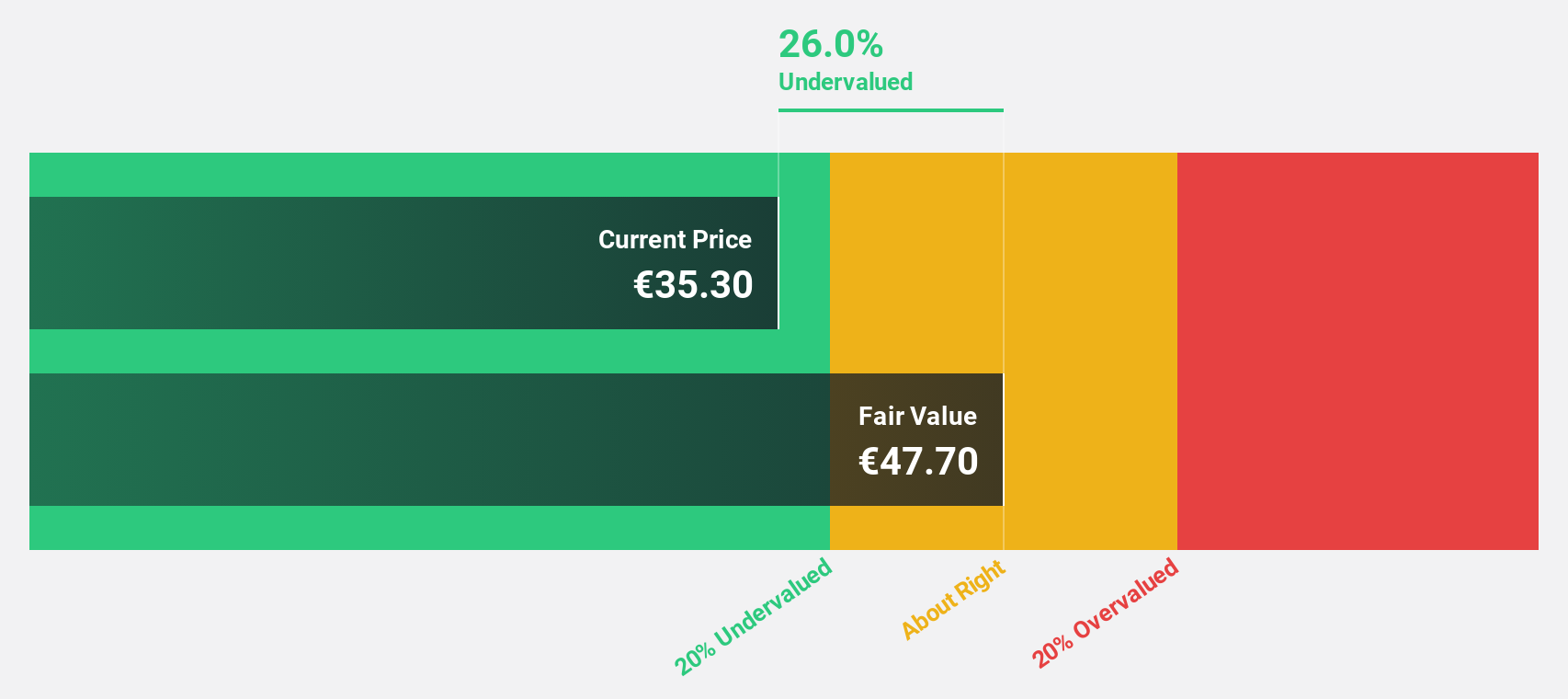

Kinepolis Group (ENXTBR:KIN)

Overview: Kinepolis Group NV operates cinema complexes across several countries including Belgium, the Netherlands, France, Spain, Luxembourg, Switzerland, Poland, Canada, and the United States with a market cap of €866.66 million.

Operations: The company's revenue segments include Box Office (€301.47 million), Brightfish (€10.39 million), Real Estate (€14.53 million), In-Theatre Sales (€184.04 million), Film Distribution (€3.10 million), and Business-To-Business services (€64.67 million).

Estimated Discount To Fair Value: 30.4%

Kinepolis Group is trading at €32.4, significantly below its estimated fair value of €46.53, suggesting it may be undervalued based on cash flows. Despite a high level of debt, the company's earnings are forecast to grow significantly at 22.4% annually over the next three years, outpacing the Belgian market's growth rate. However, recent results showed a decline in sales and net income for 2024 compared to the previous year.

- Our earnings growth report unveils the potential for significant increases in Kinepolis Group's future results.

- Click to explore a detailed breakdown of our findings in Kinepolis Group's balance sheet health report.

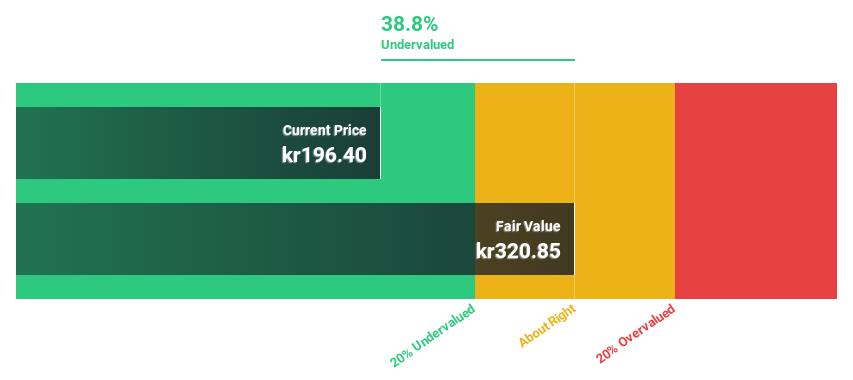

Borregaard (OB:BRG)

Overview: Borregaard ASA is a company that develops, produces, and markets specialized biochemicals and biomaterials globally, with a market cap of NOK18.75 billion.

Operations: The company's revenue is derived from three main segments: Bio Materials at NOK2.61 billion, Bio Solutions at NOK4.33 billion, and Fine Chemicals at NOK786 million.

Estimated Discount To Fair Value: 10.6%

Borregaard ASA's recent earnings report showed a rise in net income to NOK 251 million, with sales increasing to NOK 2.04 billion for Q1 2025. Trading at NOK 188, it is below its estimated fair value of NOK 210.29, indicating potential undervaluation based on cash flows. The company's earnings are forecast to grow annually by 11%, surpassing the Norwegian market average of 8.8%. However, revenue growth remains modest at an expected rate of 4.5% per year.

- In light of our recent growth report, it seems possible that Borregaard's financial performance will exceed current levels.

- Navigate through the intricacies of Borregaard with our comprehensive financial health report here.

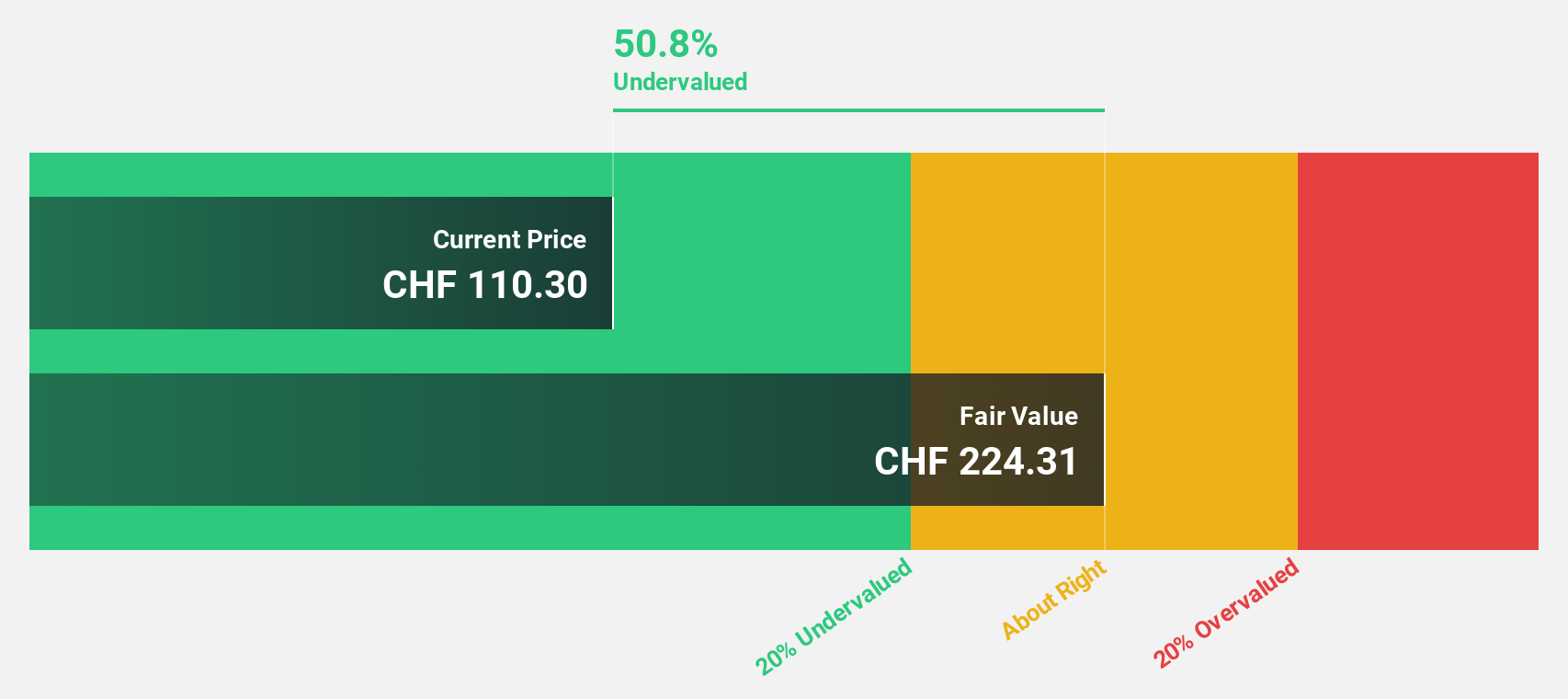

Galderma Group (SWX:GALD)

Overview: Galderma Group AG is a global dermatology company with a market cap of CHF24.26 billion.

Operations: The company's revenue segment in dermatology amounts to $4.44 billion.

Estimated Discount To Fair Value: 42%

Galderma Group AG is currently trading at CHF 102.2, significantly below its estimated fair value of CHF 176.07, suggesting potential undervaluation based on cash flows. The company's earnings are forecast to grow by 31.4% annually, outpacing the Swiss market's average growth rate of 10.4%. Despite a volatile share price recently and a low projected return on equity of 12%, Galderma's profitability turnaround and strategic expansions in China bolster its growth outlook.

- The analysis detailed in our Galderma Group growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Galderma Group stock in this financial health report.

Summing It All Up

- Click this link to deep-dive into the 184 companies within our Undervalued European Stocks Based On Cash Flows screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:GALD

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives