- Switzerland

- /

- Biotech

- /

- SWX:BSLN

If You Had Bought Basilea Pharmaceutica's (VTX:BSLN) Shares Three Years Ago You Would Be Down 19%

For many investors, the main point of stock picking is to generate higher returns than the overall market. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. We regret to report that long term Basilea Pharmaceutica AG (VTX:BSLN) shareholders have had that experience, with the share price dropping 19% in three years, versus a market return of about 26%. Unhappily, the share price slid 1.4% in the last week.

View our latest analysis for Basilea Pharmaceutica

Given that Basilea Pharmaceutica only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Over three years, Basilea Pharmaceutica grew revenue at 15% per year. That's a pretty good rate of top-line growth. Shareholders have seen the share price fall at 6% per year, for three years. This implies the market had higher expectations of Basilea Pharmaceutica. However, that's in the past now, and it's the future is more important - and the future looks brighter (based on revenue, anyway).

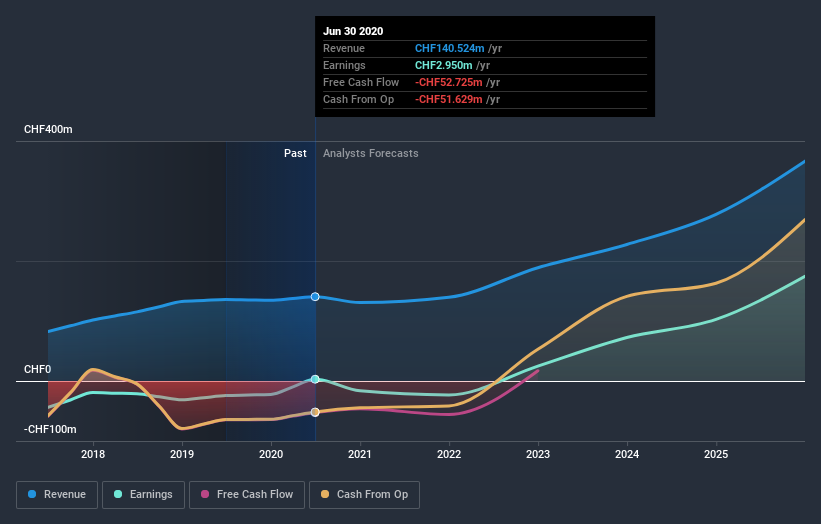

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It is of course excellent to see how Basilea Pharmaceutica has grown profits over the years, but the future is more important for shareholders. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

While the broader market gained around 0.2% in the last year, Basilea Pharmaceutica shareholders lost 1.0%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 3% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Basilea Pharmaceutica has 3 warning signs (and 2 which make us uncomfortable) we think you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CH exchanges.

When trading Basilea Pharmaceutica or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Basilea Pharmaceutica might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SWX:BSLN

Basilea Pharmaceutica

A commercial-stage biopharmaceutical company, focuses on the development of products that address the medical needs in the therapeutic areas of oncology and anti-infectives.

Excellent balance sheet with reasonable growth potential.