It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Basilea Pharmaceutica (VTX:BSLN), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Basilea Pharmaceutica

Basilea Pharmaceutica's Improving Profits

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. So for many budding investors, improving EPS is considered a good sign. Commendations have to be given in seeing that Basilea Pharmaceutica grew its EPS from CHF0.072 to CHF4.69, in one short year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future. Could this be a sign that the business has reached an inflection point?

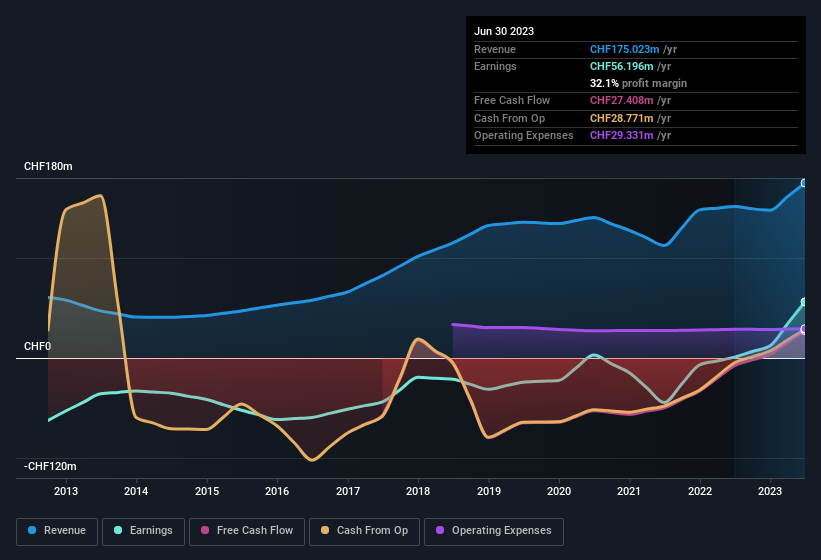

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. It's noted that Basilea Pharmaceutica's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. The good news is that Basilea Pharmaceutica is growing revenues, and EBIT margins improved by 33.1 percentage points to 39%, over the last year. Both of which are great metrics to check off for potential growth.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Basilea Pharmaceutica.

Are Basilea Pharmaceutica Insiders Aligned With All Shareholders?

It's a necessity that company leaders act in the best interest of shareholders and so insider investment always comes as a reassurance to the market. So it is good to see that Basilea Pharmaceutica insiders have a significant amount of capital invested in the stock. To be specific, they have CHF16m worth of shares. That's a lot of money, and no small incentive to work hard. Despite being just 3.1% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Does Basilea Pharmaceutica Deserve A Spot On Your Watchlist?

Basilea Pharmaceutica's earnings per share growth have been climbing higher at an appreciable rate. This level of EPS growth does wonders for attracting investment, and the large insider investment in the company is just the cherry on top. At times fast EPS growth is a sign the business has reached an inflection point, so there's a potential opportunity to be had here. So at the surface level, Basilea Pharmaceutica is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. It is worth noting though that we have found 3 warning signs for Basilea Pharmaceutica (2 make us uncomfortable!) that you need to take into consideration.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Basilea Pharmaceutica might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:BSLN

Basilea Pharmaceutica

A commercial-stage biopharmaceutical company, focuses on the development of products that address the medical needs in the therapeutic areas of oncology and anti-infectives.

High growth potential with excellent balance sheet.