- Switzerland

- /

- Media

- /

- SWX:TXGN

Top Dividend Stocks On SIX Swiss Exchange For October 2024

Reviewed by Simply Wall St

In the last week, the Swiss market has been flat, but over the past 12 months, it has risen by an impressive 16%, with earnings forecasted to grow by 12% annually. In this dynamic environment, identifying dividend stocks that offer stable returns and potential for growth can be a valuable strategy for investors seeking income and capital appreciation.

Top 10 Dividend Stocks In Switzerland

| Name | Dividend Yield | Dividend Rating |

| Cembra Money Bank (SWX:CMBN) | 5.12% | ★★★★★★ |

| Vaudoise Assurances Holding (SWX:VAHN) | 4.73% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 4.48% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.84% | ★★★★★★ |

| EFG International (SWX:EFGN) | 4.62% | ★★★★★☆ |

| Julius Bär Gruppe (SWX:BAER) | 4.81% | ★★★★★☆ |

| Luzerner Kantonalbank (SWX:LUKN) | 3.83% | ★★★★★☆ |

| Holcim (SWX:HOLN) | 3.39% | ★★★★★☆ |

| Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.71% | ★★★★★☆ |

| DKSH Holding (SWX:DKSH) | 3.59% | ★★★★★☆ |

Let's take a closer look at a couple of our picks from the screened companies.

Berner Kantonalbank (SWX:BEKN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Berner Kantonalbank AG provides banking products and services to private individuals and corporate customers in Switzerland, with a market cap of CHF2.14 billion.

Operations: Berner Kantonalbank AG generates revenue primarily through its banking segment, which accounts for CHF539.60 million.

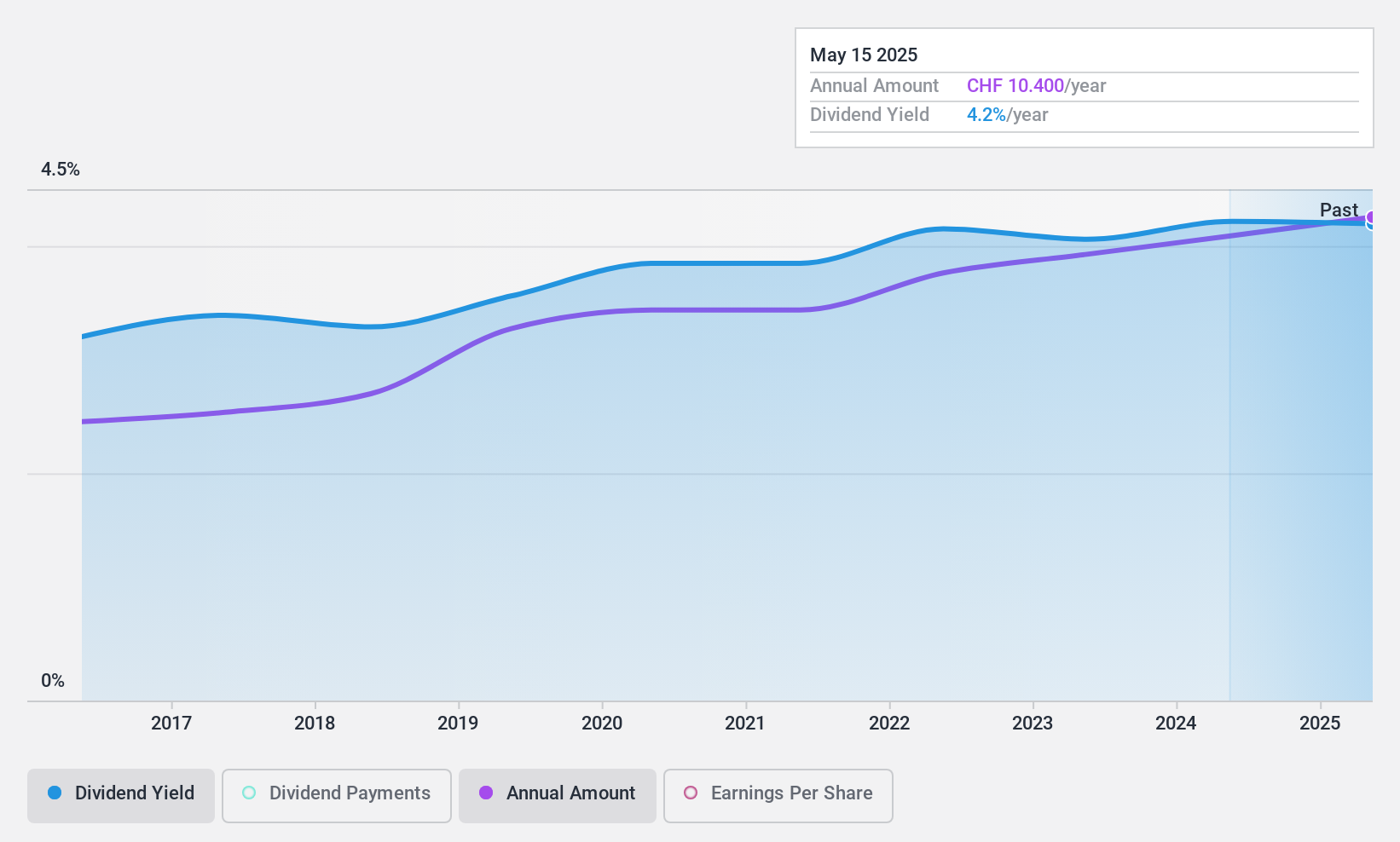

Dividend Yield: 4.3%

Berner Kantonalbank offers a stable and reliable dividend profile, with consistent payments over the past decade and a current yield of 4.31%, placing it in the top 25% of Swiss dividend payers. The payout ratio stands at a reasonable 52.8%, indicating dividends are covered by earnings. Despite minor fluctuations in recent earnings, with net income slightly down to CHF 75.29 million, the bank's price-to-earnings ratio remains attractive at 12.3x compared to the broader Swiss market.

- Dive into the specifics of Berner Kantonalbank here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Berner Kantonalbank is trading beyond its estimated value.

Burkhalter Holding (SWX:BRKN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Burkhalter Holding AG, with a market cap of CHF960.64 million, operates through its subsidiaries to provide electrical engineering services to the construction sector in Switzerland.

Operations: Burkhalter Holding AG generates its revenue of CHF1.18 billion from providing electrical engineering services to the Swiss construction industry.

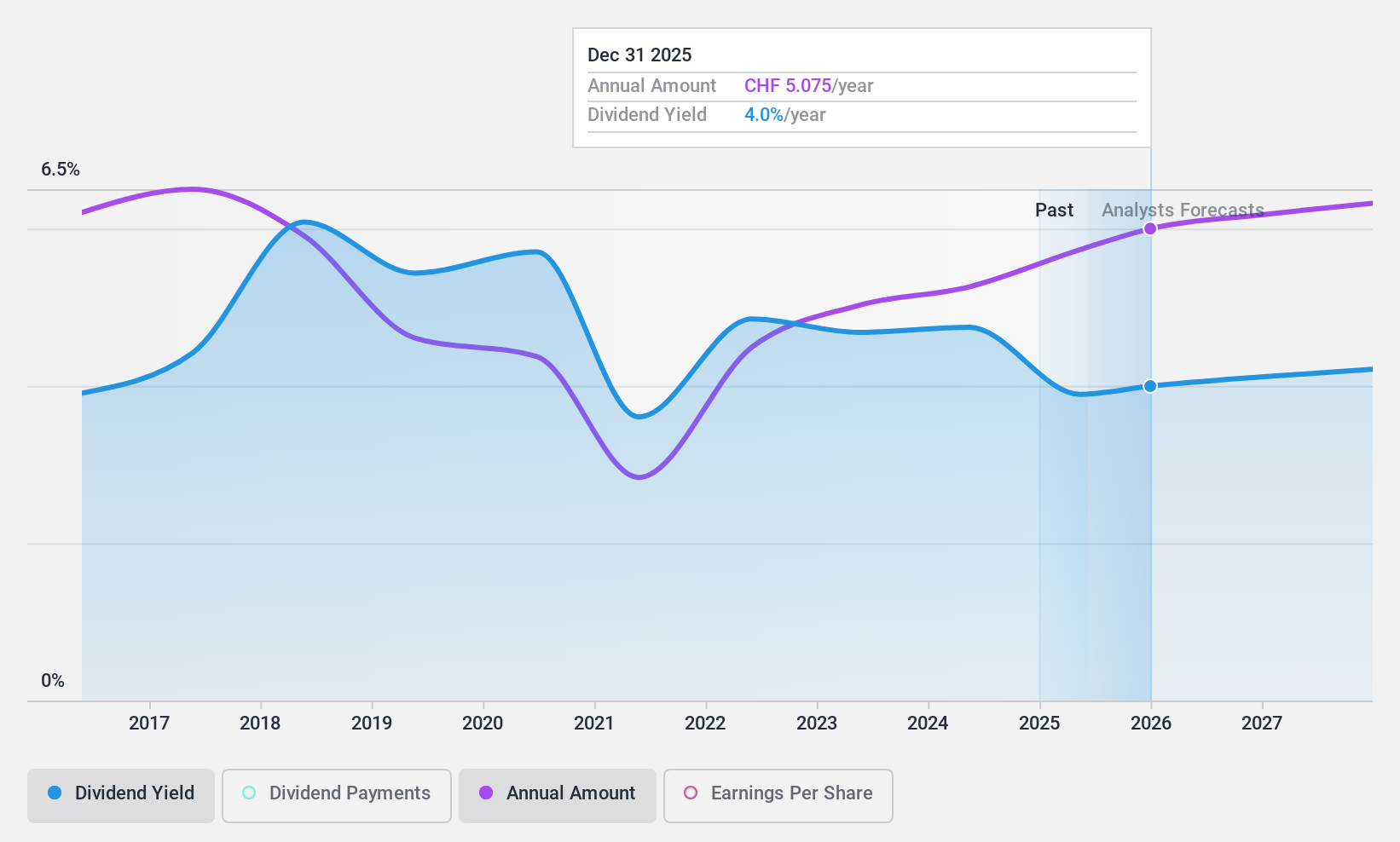

Dividend Yield: 4.9%

Burkhalter Holding's dividend yield of 4.92% ranks it among the top 25% of Swiss dividend payers, yet its track record is marked by volatility and unreliability over the past decade. Despite recent earnings growth to CHF 23.3 million for H1 2024, its high payout ratio of 87.4% raises sustainability concerns. The company also faces financial pressure with significant debt levels and was recently dropped from the S&P Global BMI Index, potentially impacting investor confidence.

- Unlock comprehensive insights into our analysis of Burkhalter Holding stock in this dividend report.

- Upon reviewing our latest valuation report, Burkhalter Holding's share price might be too optimistic.

TX Group (SWX:TXGN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TX Group AG operates a network of platforms offering information, orientation, entertainment, and support services in Switzerland, with a market cap of CHF1.55 billion.

Operations: TX Group AG generates revenue from several segments, including Tamedia (CHF427 million), Goldbach (CHF299.10 million), 20 Minutes (CHF115.60 million), TX Markets (CHF126.40 million), and Groups & Ventures (CHF159.40 million).

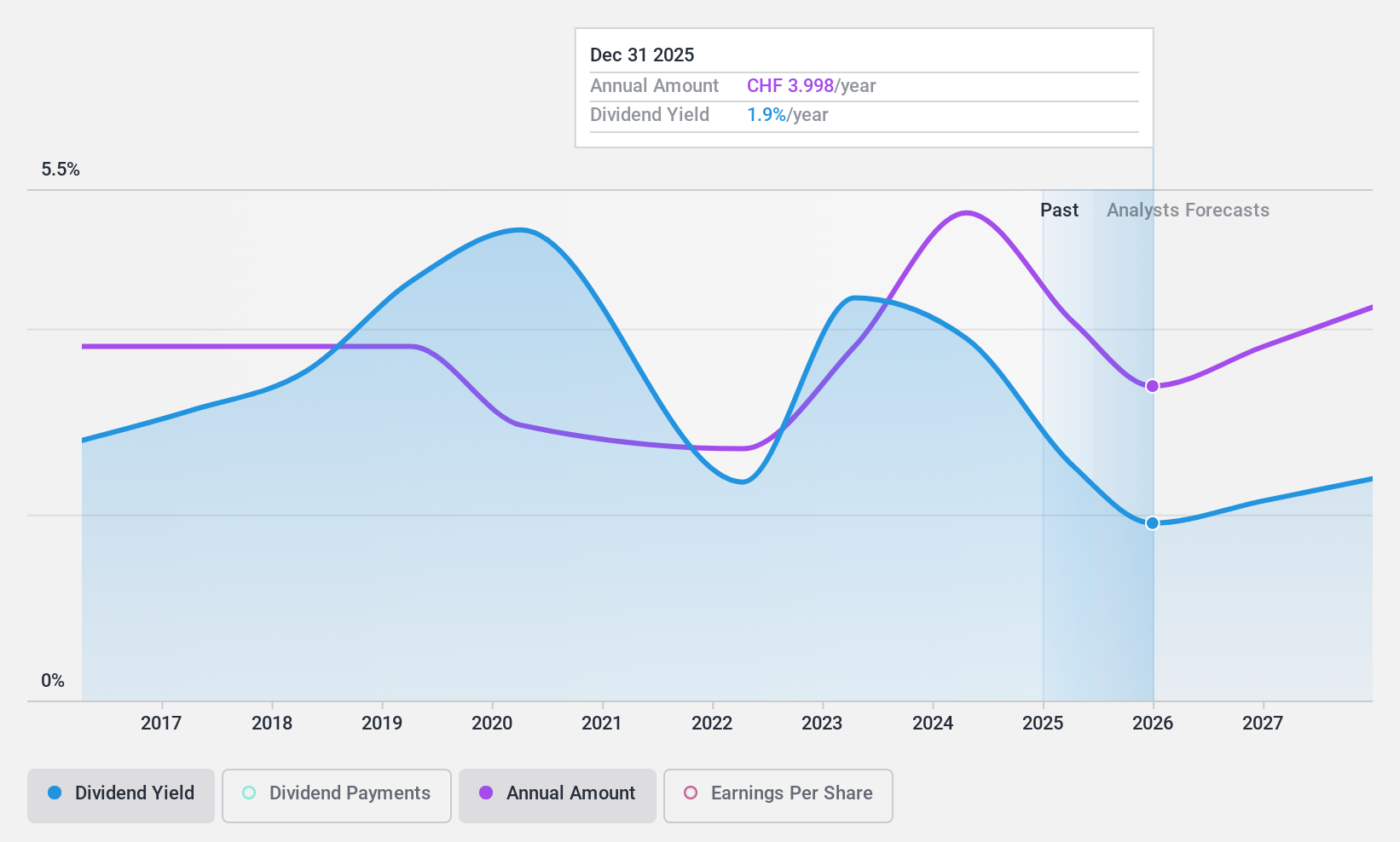

Dividend Yield: 4.2%

TX Group's dividend yield of 4.23% falls short of the top quartile in Switzerland, and its history shows volatility with significant annual drops. However, dividends are currently sustainable, supported by a payout ratio of 59.6% from earnings and a cash payout ratio of 43.4%. The company recently returned to profitability with a net income of CHF 9.6 million for H1 2024, following a previous loss, and was added to the S&P Global BMI Index in September 2024.

- Take a closer look at TX Group's potential here in our dividend report.

- Our valuation report unveils the possibility TX Group's shares may be trading at a premium.

Seize The Opportunity

- Discover the full array of 27 Top SIX Swiss Exchange Dividend Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TX Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:TXGN

TX Group

Operates a network of platforms and participations that provides users with information, orientation, entertainment, and other services in Switzerland.

Excellent balance sheet and fair value.

Market Insights

Community Narratives