- Switzerland

- /

- Media

- /

- SWX:TXGN

Exploring Switzerland's Undiscovered Gems in October 2024

Reviewed by Simply Wall St

As the Swiss market navigates through fluctuations, with the SMI recently experiencing minor losses despite a late recovery, investors are keenly observing economic indicators and market sentiment that could impact small-cap stocks. In this environment, identifying promising opportunities often involves looking beyond short-term volatility to find companies with robust fundamentals and growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals In Switzerland

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| TX Group | 0.93% | -1.67% | 7.21% | ★★★★★★ |

| IVF Hartmann Holding | NA | 0.24% | 0.63% | ★★★★★★ |

| naturenergie holding | NA | 17.32% | 34.71% | ★★★★★★ |

| Datacolor | NA | 3.59% | 30.14% | ★★★★★★ |

| Elma Electronic | 36.60% | 3.13% | 3.10% | ★★★★★★ |

| Compagnie Financière Tradition | 47.15% | 1.91% | 11.44% | ★★★★★☆ |

| Vaudoise Assurances Holding | NA | 1.52% | 1.85% | ★★★★★☆ |

| Bergbahnen Engelberg-Trübsee-Titlis | 1.66% | -2.00% | 12.78% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| lastminute.com | 42.65% | 4.93% | 3.11% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

APG|SGA (SWX:APGN)

Simply Wall St Value Rating: ★★★★★☆

Overview: APG|SGA SA operates in the advertising sector, offering services mainly in Switzerland and Serbia, with a market capitalization of CHF602.02 million.

Operations: APG|SGA generates revenue primarily from the acquisition, sale, and management of advertising spaces, amounting to CHF329.12 million. The company operates with a market capitalization of CHF602.02 million.

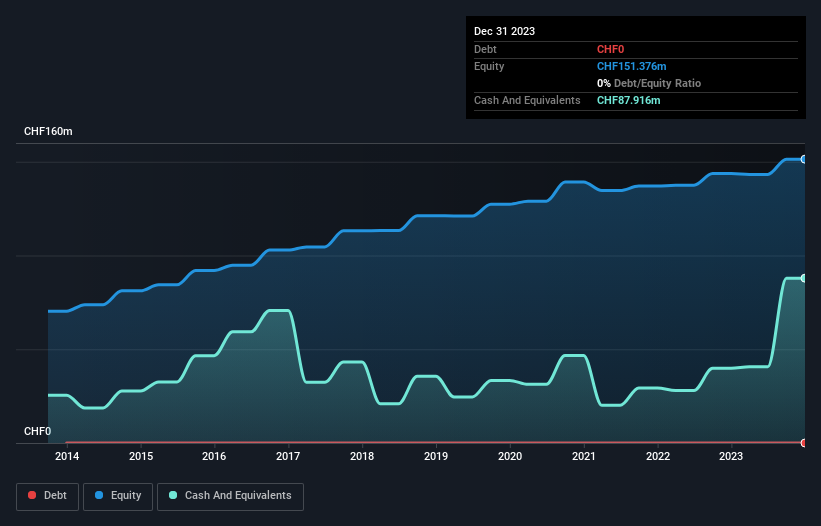

APG|SGA, operating in the Swiss media landscape, offers a compelling mix of financial stability and value. Despite a 6.4% annual earnings decline over five years, recent figures show improvement with net income reaching CHF 11.85 million for the first half of 2024, up from CHF 10.52 million previously. The company trades at a notable discount to its estimated fair value by about 40%, suggesting potential upside for investors seeking undervalued opportunities. With no debt on its books and positive free cash flow of CHF 36 million as of June 2024, APG|SGA remains financially robust amidst industry challenges.

TX Group (SWX:TXGN)

Simply Wall St Value Rating: ★★★★★★

Overview: TX Group AG operates a network of platforms offering information, orientation, entertainment, and support services in Switzerland, with a market cap of CHF1.53 billion.

Operations: TX Group AG generates revenue primarily from its segments: Tamedia (CHF427 million), Goldbach (CHF299.10 million), 20 Minutes (CHF115.60 million), TX Markets (CHF126.40 million), and Groups & Ventures (CHF159.40 million). The company also records eliminations and reconciliation under IAS 19 amounting to -CHF144.60 million, impacting the overall financials.

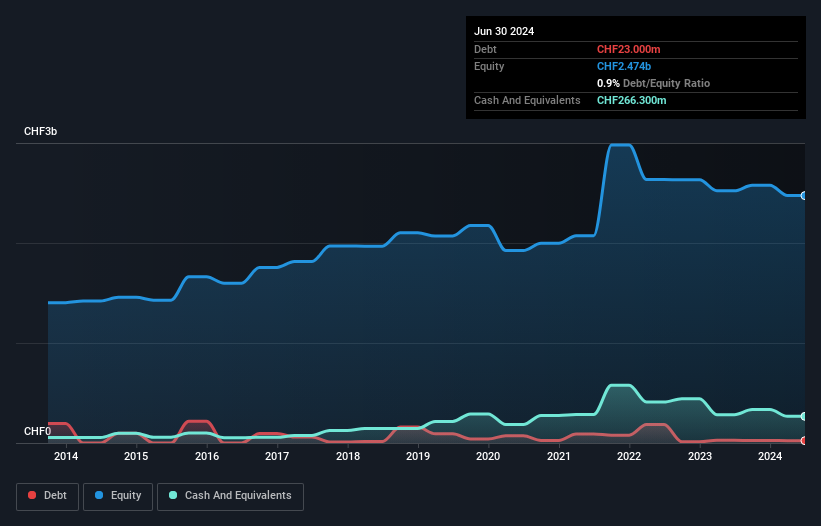

TX Group, a small player in the Swiss market, has shown significant financial improvement. With a debt to equity ratio dropping from 4.4 to 0.9 over five years and more cash than total debt, its financial health seems robust. The company reported CHF 461 million in revenue for the first half of 2024, slightly up from CHF 460.5 million last year, while net income turned positive at CHF 9.6 million compared to a loss previously recorded. Earnings per share rose to CHF 0.9 from a loss of CHF 0.13 per share last year, reflecting its newfound profitability and potential for growth within the media industry landscape.

- Click here and access our complete health analysis report to understand the dynamics of TX Group.

Assess TX Group's past performance with our detailed historical performance reports.

IVF Hartmann Holding (SWX:VBSN)

Simply Wall St Value Rating: ★★★★★★

Overview: IVF Hartmann Holding AG is a company that supplies medical consumer goods both in Switzerland and internationally, with a market capitalization of CHF335.81 million.

Operations: With a market capitalization of CHF335.81 million, IVF Hartmann Holding AG generates revenue primarily from its Infection Management segment (CHF56.41 million) and Wound Care segment (CHF41.97 million), complemented by Incontinence Management (CHF33.07 million).

IVF Hartmann Holding, a Swiss company in the medical equipment sector, has shown impressive financial health with earnings growth of 33.4% over the past year, outpacing the industry average of 2.9%. This debt-free entity reported net income of CHF 9.53 million for the half-year ending June 2024, up from CHF 7.04 million previously. Its basic earnings per share rose to CHF 3.97 from CHF 2.93, reflecting robust profitability and operational efficiency. With sales climbing to CHF 76.51 million compared to last year's CHF 71.57 million, IVF Hartmann seems well-positioned within its market niche and offers notable value trading at a significant discount below estimated fair value.

- Take a closer look at IVF Hartmann Holding's potential here in our health report.

Gain insights into IVF Hartmann Holding's past trends and performance with our Past report.

Key Takeaways

- Unlock more gems! Our SIX Swiss Exchange Undiscovered Gems With Strong Fundamentals screener has unearthed 15 more companies for you to explore.Click here to unveil our expertly curated list of 18 SIX Swiss Exchange Undiscovered Gems With Strong Fundamentals.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TX Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:TXGN

TX Group

Operates a network of platforms and participations that provides users with information, orientation, entertainment, and other services in Switzerland.

Excellent balance sheet and fair value.

Market Insights

Community Narratives