- Switzerland

- /

- Capital Markets

- /

- SWX:SQN

Three Growth Companies On SIX Swiss Exchange With High Insider Ownership And 25% ROE

Reviewed by Simply Wall St

Amidst a fluctuating session, the Swiss market demonstrated resilience, closing slightly higher as key stocks managed to support the broader index. This context of modest gains amidst economic uncertainties highlights the value of investing in growth companies with high insider ownership and robust financial metrics like a Return on Equity (ROE) of 25%, which can offer stability and potential growth in such market conditions.

Top 10 Growth Companies With High Insider Ownership In Switzerland

| Name | Insider Ownership | Earnings Growth |

| Stadler Rail (SWX:SRAIL) | 14.5% | 23.4% |

| VAT Group (SWX:VACN) | 10.2% | 21.2% |

| Straumann Holding (SWX:STMN) | 32.7% | 21% |

| Swissquote Group Holding (SWX:SQN) | 11.4% | 14.3% |

| Temenos (SWX:TEMN) | 17.4% | 14.7% |

| Sonova Holding (SWX:SOON) | 17.7% | 10.3% |

| Kudelski (SWX:KUD) | 37.6% | 106.5% |

| Sensirion Holding (SWX:SENS) | 20.7% | 78.3% |

| SHL Telemedicine (SWX:SHLTN) | 17.9% | 96.2% |

| Arbonia (SWX:ARBN) | 28.8% | 100.1% |

We'll examine a selection from our screener results.

Gurit Holding (SWX:GURN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Gurit Holding AG specializes in developing, manufacturing, marketing, and selling advanced composite materials, composite tooling equipment, and kitting services globally with a market capitalization of CHF 294.14 million.

Operations: The company generates revenue through three primary segments: Composite Materials (CHF 307.09 million), Marine and Industrial (CHF 101.63 million), and Manufacturing Solutions (CHF 51.29 million).

Insider Ownership: 30.2%

Return On Equity Forecast: 22% (2026 estimate)

Gurit Holding is poised for significant growth with earnings expected to increase by 35.1% annually, outpacing the Swiss market's 8.3%. Despite this, its revenue growth of 4% yearly lags behind the Swiss average of 4.4%. Analysts believe Gurit’s stock price could rise by 34.7%, noting it trades at a substantial discount—52% below estimated fair value. However, the company's share price has shown high volatility recently. No recent insider trading data suggests stability in ownership stakes.

- Click to explore a detailed breakdown of our findings in Gurit Holding's earnings growth report.

- The valuation report we've compiled suggests that Gurit Holding's current price could be quite moderate.

Swissquote Group Holding (SWX:SQN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Swissquote Group Holding Ltd operates globally, offering a range of online financial services to retail, affluent, and institutional clients with a market capitalization of approximately CHF 4.16 billion.

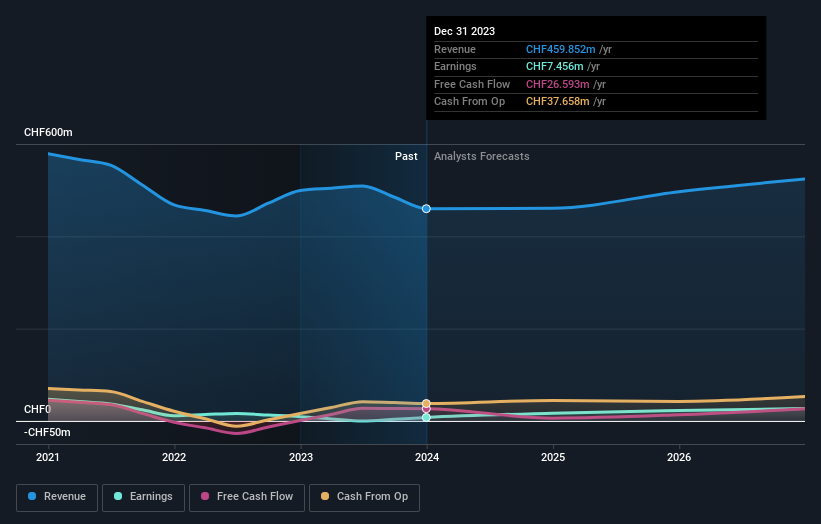

Operations: The company generates revenue primarily through leveraged Forex and securities trading, which amounted to CHF 101.09 million and CHF 429.78 million respectively.

Insider Ownership: 11.4%

Return On Equity Forecast: 23% (2026 estimate)

Swissquote Group Holding demonstrated robust financial performance with a significant increase in net income to CHF 217.63 million, up from CHF 157.39 million the previous year. The company's earnings per share also rose, reflecting strong profitability. Despite this growth, revenue and earnings forecasts indicate moderate expansion below high-growth benchmarks, with expected revenue and earnings growth outpacing the Swiss market but not by a wide margin. Insider ownership remains stable with no substantial buying or selling reported recently.

- Unlock comprehensive insights into our analysis of Swissquote Group Holding stock in this growth report.

- The valuation report we've compiled suggests that Swissquote Group Holding's current price could be inflated.

Temenos (SWX:TEMN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Temenos AG is a global provider of integrated banking software systems to financial institutions, with a market capitalization of approximately CHF 4.28 billion.

Operations: The firm offers integrated banking software systems globally, achieving a market capitalization of around CHF 4.28 billion.

Insider Ownership: 17.4%

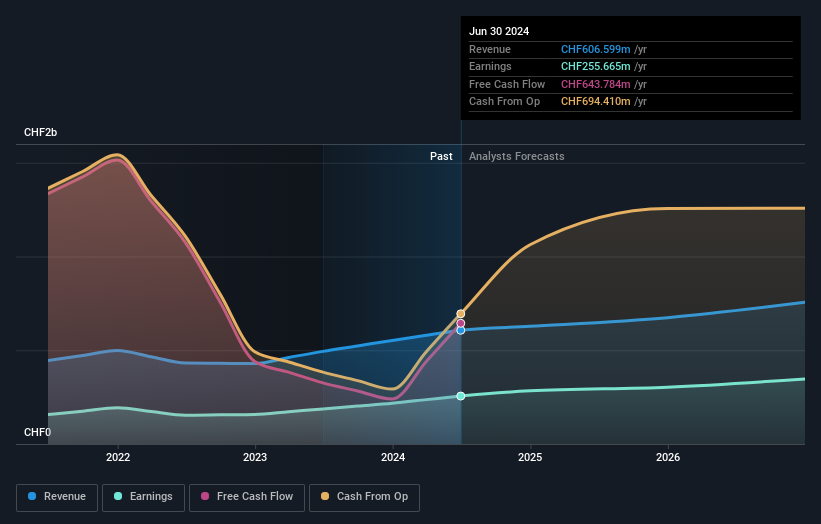

Return On Equity Forecast: 26% (2027 estimate)

Temenos, a Swiss-based company, has shown promising growth with a 16.2% increase in earnings over the past year. Analysts predict annual earnings to grow by 14.72%, outpacing the Swiss market's average of 8.3%. Despite trading at 29% below its estimated fair value and offering a reliable dividend yield of 1.98%, it carries high debt levels and experiences significant share price volatility. Recent advancements include enhancing its cloud-native banking platform's efficiency on Microsoft Azure, reducing carbon impact significantly while boosting transaction handling capabilities.

- Dive into the specifics of Temenos here with our thorough growth forecast report.

- Our expertly prepared valuation report Temenos implies its share price may be lower than expected.

Taking Advantage

- Get an in-depth perspective on all 16 Fast Growing SIX Swiss Exchange Companies With High Insider Ownership by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SQN

Swissquote Group Holding

Provides a suite of online financial services to retail investors, affluent investors, and professional and institutional customers worldwide.

Outstanding track record, good value and pays a dividend.