- Switzerland

- /

- Machinery

- /

- SWX:STGN

3 Dividend Stocks On SIX Swiss Exchange With Up To 5.9% Yield

Reviewed by Simply Wall St

The Swiss market has shown resilience, with the benchmark SMI managing a small gain despite early fluctuations and recent developments in the luxury sector. In this dynamic environment, dividend stocks on the SIX Swiss Exchange can offer stability and income potential, making them an attractive option for investors seeking consistent returns amidst market shifts.

Top 10 Dividend Stocks In Switzerland

| Name | Dividend Yield | Dividend Rating |

| Cembra Money Bank (SWX:CMBN) | 5.14% | ★★★★★★ |

| Vaudoise Assurances Holding (SWX:VAHN) | 4.74% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 4.57% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.84% | ★★★★★★ |

| EFG International (SWX:EFGN) | 4.68% | ★★★★★☆ |

| TX Group (SWX:TXGN) | 4.35% | ★★★★★☆ |

| Julius Bär Gruppe (SWX:BAER) | 4.94% | ★★★★★☆ |

| Luzerner Kantonalbank (SWX:LUKN) | 3.86% | ★★★★★☆ |

| Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.71% | ★★★★★☆ |

| DKSH Holding (SWX:DKSH) | 3.45% | ★★★★★☆ |

Let's uncover some gems from our specialized screener.

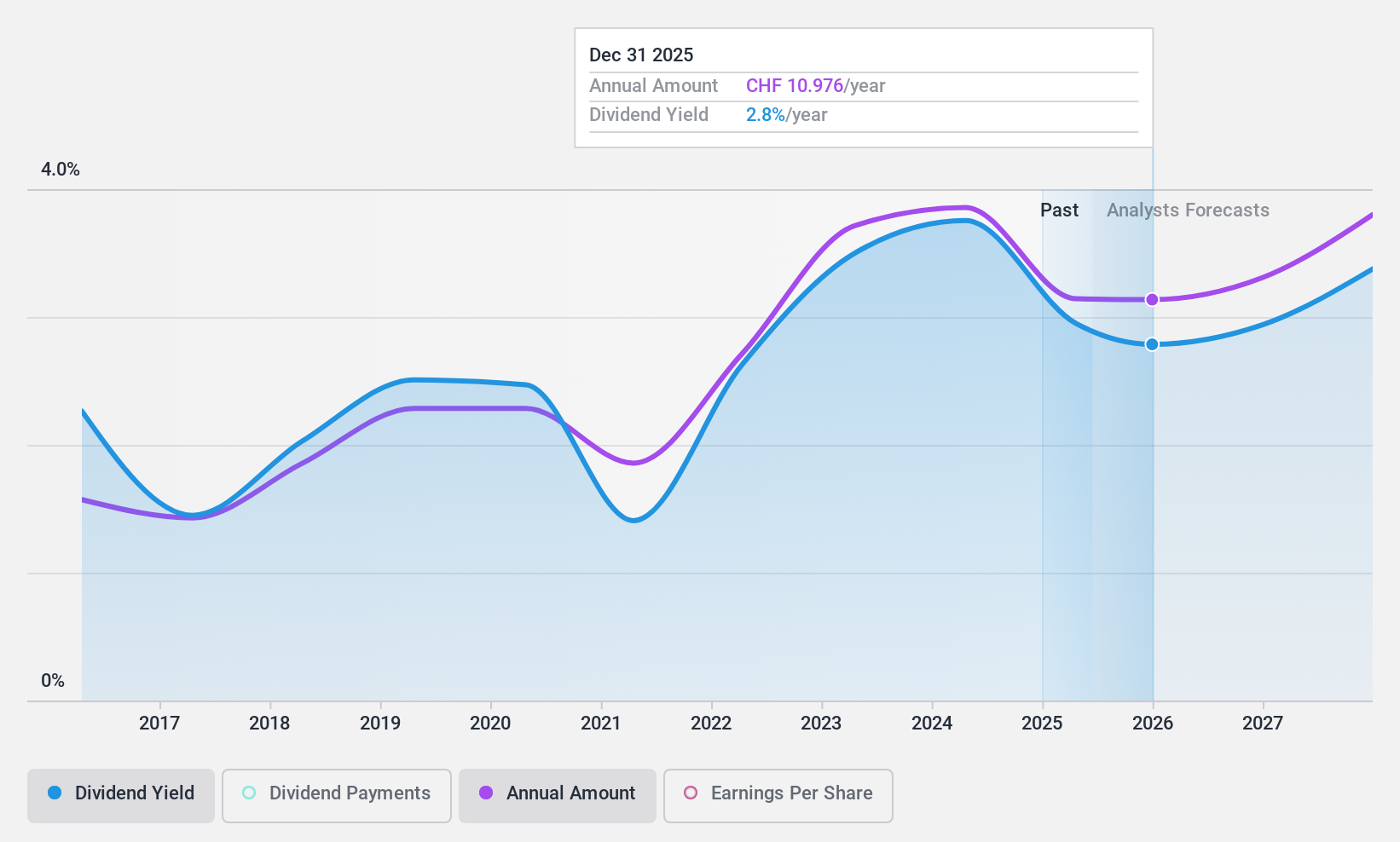

Bucher Industries (SWX:BUCN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bucher Industries AG manufactures and sells machinery, systems, and hydraulic components for agriculture, food production, packaging, and public space maintenance across Asia, the Americas, Europe, and globally with a market cap of CHF3.88 billion.

Operations: Bucher Industries AG's revenue segments are comprised of Kuhn Group (CHF1.27 billion), Bucher Specials (CHF373.90 million), Bucher Municipal (CHF593.40 million), Bucher Hydraulics (CHF699.20 million), and Bucher Emhart Glass (CHF502.10 million).

Dividend Yield: 3.6%

Bucher Industries offers a mixed picture for dividend investors. While its dividends have been stable and growing over the past decade, recent earnings reports show a decline in both sales and net income, with CHF 1.72 billion in sales and CHF 144.1 million in net income for the first half of 2024. The dividend yield of 3.56% is below top-tier Swiss payers, and high cash payout ratios indicate potential sustainability concerns despite a low payout ratio from earnings.

- Click here to discover the nuances of Bucher Industries with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Bucher Industries shares in the market.

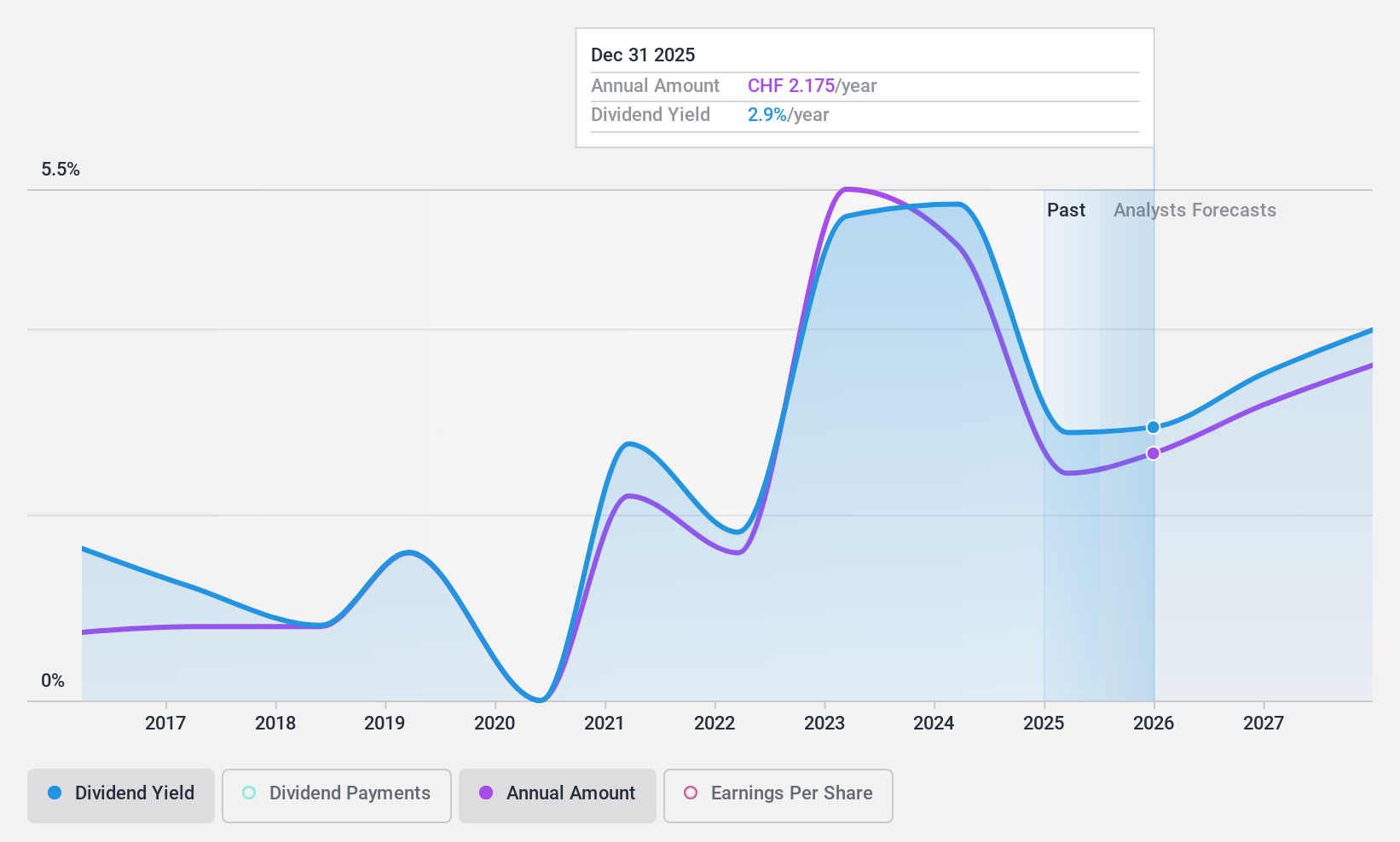

CPH Group (SWX:CPHN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CPH Group AG is a Swiss company that manufactures and sells chemicals and packaging films globally, with a market capitalization of CHF449.64 million.

Operations: The revenue segments for CPH Group AG are comprised of Chemistry at CHF128.62 million, Packaging at CHF219.70 million, and Spun-off divisions (Paper) at CHF245.37 million.

Dividend Yield: 5.3%

CPH Group's dividend profile reveals challenges for investors. Despite a top-tier yield of 5.33% in the Swiss market, dividends have been volatile and unreliable over the past decade, with a high payout ratio of 249.1% indicating unsustainable coverage by earnings. Recent financials show declining sales and a net loss of CHF 8.66 million for H1 2024, raising concerns about future payouts despite adequate cash flow coverage with a cash payout ratio of 47%.

- Click here and access our complete dividend analysis report to understand the dynamics of CPH Group.

- Our valuation report unveils the possibility CPH Group's shares may be trading at a premium.

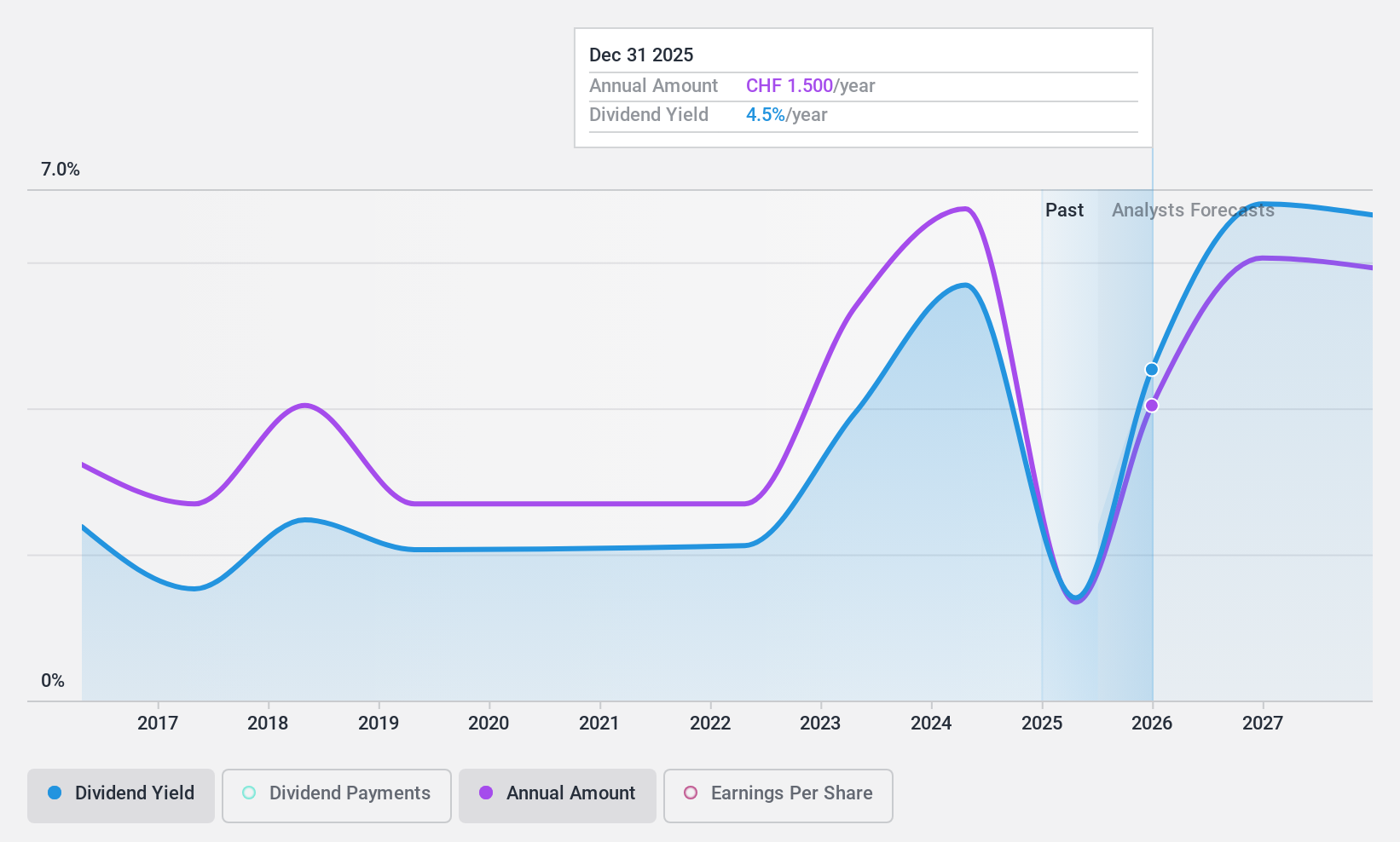

StarragTornos Group (SWX:STGN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: StarragTornos Group AG is a company that develops, manufactures, and distributes precision machine tools for various machining processes involving metal, composite materials, and ceramics with a market cap of CHF229.40 million.

Operations: StarragTornos Group AG generates revenue through the development, manufacturing, and distribution of precision machine tools designed for milling, turning, boring, grinding, and machining workpieces made from metal, composite materials, and ceramics.

Dividend Yield: 5.9%

StarragTornos Group's dividend yield of 5.92% ranks in the top 25% for Swiss dividend payers, yet it faces sustainability issues as dividends are not covered by free cash flows and earnings. Despite a reasonable payout ratio of 62.7%, dividends have been volatile over the past decade. Recent financials show sales increased to CHF 254.95 million for H1 2024, but net income dropped to CHF 6.57 million, reflecting potential challenges in maintaining consistent payouts amidst executive changes.

- Delve into the full analysis dividend report here for a deeper understanding of StarragTornos Group.

- The analysis detailed in our StarragTornos Group valuation report hints at an deflated share price compared to its estimated value.

Next Steps

- Click through to start exploring the rest of the 23 Top SIX Swiss Exchange Dividend Stocks now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:STGN

StarragTornos Group

Develops, manufactures, and distributes precision machine tools for milling, turning, boring, grinding, and machining of work pieces of metal, composite materials, and ceramics.

Undervalued with adequate balance sheet and pays a dividend.