- Switzerland

- /

- Machinery

- /

- SWX:GF

Top 3 Stocks On SIX Swiss Exchange That Investors Might Be Undervaluing

Reviewed by Simply Wall St

The Swiss market has climbed 1.0% in the last 7 days and is up 8.6% over the past 12 months, with earnings forecasted to grow by 12% annually. In this favorable environment, identifying undervalued stocks that have strong fundamentals and growth potential can be a strategic move for investors looking to capitalize on future gains.

Top 10 Undervalued Stocks Based On Cash Flows In Switzerland

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| LEM Holding (SWX:LEHN) | CHF1238.00 | CHF1815.39 | 31.8% |

| Swissquote Group Holding (SWX:SQN) | CHF306.40 | CHF567.86 | 46% |

| Georg Fischer (SWX:GF) | CHF64.95 | CHF112.48 | 42.3% |

| Clariant (SWX:CLN) | CHF13.27 | CHF21.78 | 39.1% |

| lastminute.com (SWX:LMN) | CHF19.86 | CHF29.81 | 33.4% |

| SoftwareONE Holding (SWX:SWON) | CHF15.76 | CHF21.94 | 28.2% |

| Comet Holding (SWX:COTN) | CHF337.00 | CHF663.50 | 49.2% |

| Emmi (SWX:EMMN) | CHF883.00 | CHF1606.37 | 45% |

| SGS (SWX:SGSN) | CHF93.90 | CHF145.89 | 35.6% |

| Dätwyler Holding (SWX:DAE) | CHF172.40 | CHF249.51 | 30.9% |

Let's explore several standout options from the results in the screener.

Clariant (SWX:CLN)

Overview: Clariant AG is a global company involved in the development, manufacture, distribution, and sale of specialty chemicals with a market cap of CHF4.36 billion.

Operations: The company's revenue segments include Catalysis (CHF927 million), Care Chemicals (CHF2.22 billion), and Adsorbents & Additives (CHF1.02 billion).

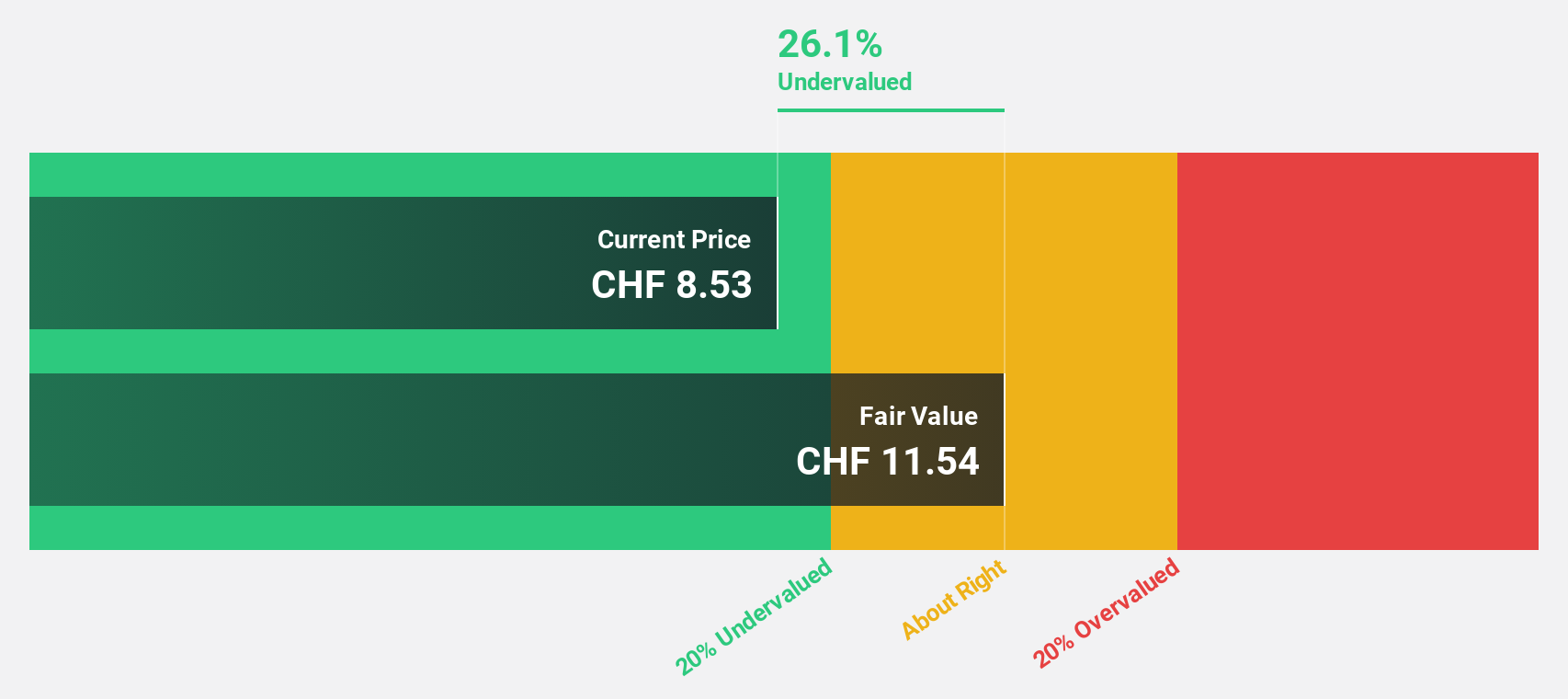

Estimated Discount To Fair Value: 39.1%

Clariant AG is trading at CHF 13.27, significantly below its estimated fair value of CHF 21.78, making it highly undervalued based on discounted cash flow analysis. Despite recent earnings showing a decline in net income to CHF 157 million from CHF 232 million a year ago, the company's earnings are forecast to grow at an impressive rate of over 30% per year, outpacing the Swiss market's growth rate. However, its dividend yield of 3.17% is not well covered by current earnings and it has a high level of debt.

- Our expertly prepared growth report on Clariant implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Clariant stock in this financial health report.

Georg Fischer (SWX:GF)

Overview: Georg Fischer AG provides piping systems and casting and machining solutions across Europe, the Americas, Asia, and internationally, with a market cap of CHF5.32 billion.

Operations: The company's revenue segments include CHF1.99 billion from GF Piping Systems, CHF901 million from GF Casting Solutions, and CHF853 million from GF Machining Solutions.

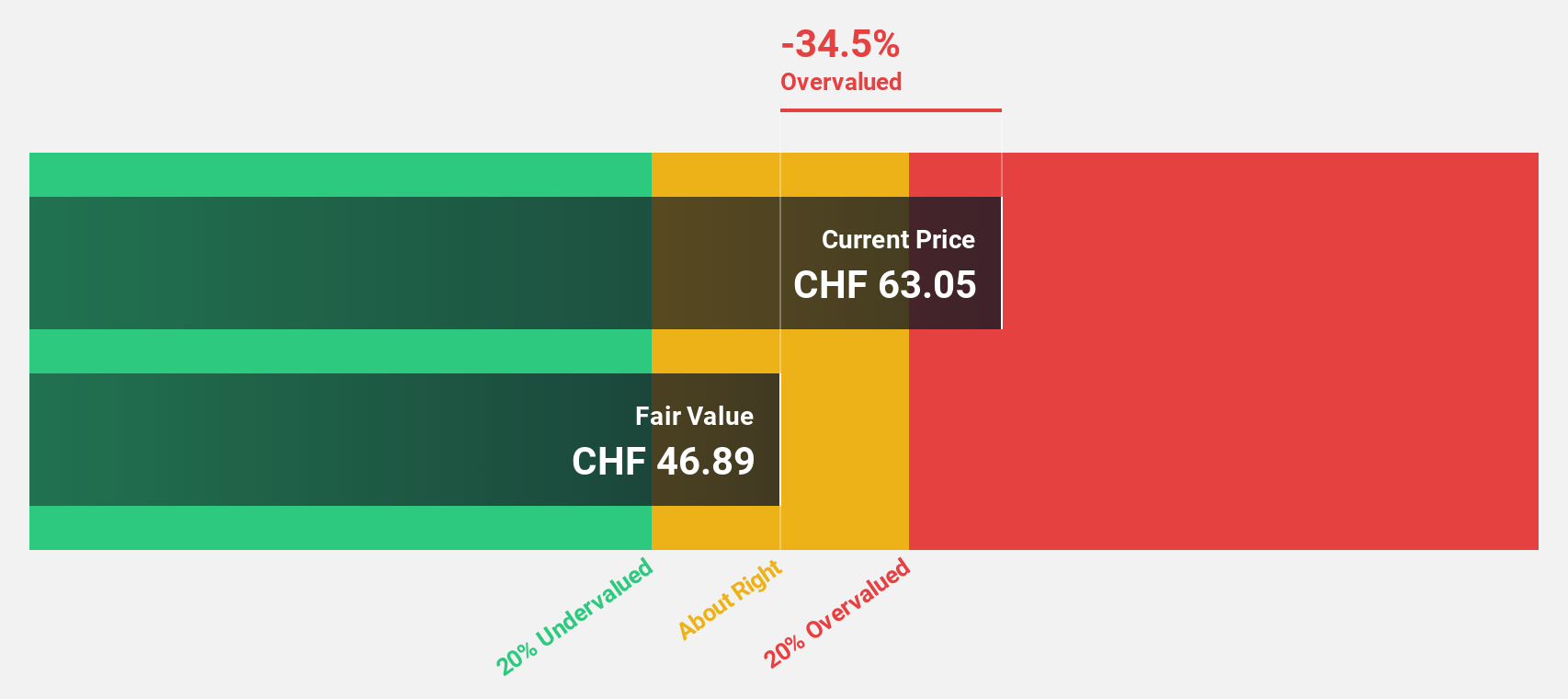

Estimated Discount To Fair Value: 42.3%

Georg Fischer AG is trading at CHF 64.95, significantly below its estimated fair value of CHF 112.48, indicating it is highly undervalued based on discounted cash flow analysis. Despite a decline in profit margins from 6.8% to 4.6% over the past year and net income dropping to CHF 97 million from CHF 123 million, earnings are forecast to grow at an impressive rate of over 23% per year, outpacing the Swiss market's growth rate.

- Insights from our recent growth report point to a promising forecast for Georg Fischer's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Georg Fischer.

Temenos (SWX:TEMN)

Overview: Temenos AG develops, markets, and sells integrated banking software systems to financial institutions globally and has a market cap of CHF4.26 billion.

Operations: Temenos generates revenue from licensing software, providing software-as-a-service (SaaS), offering maintenance services, and delivering professional services to financial institutions globally.

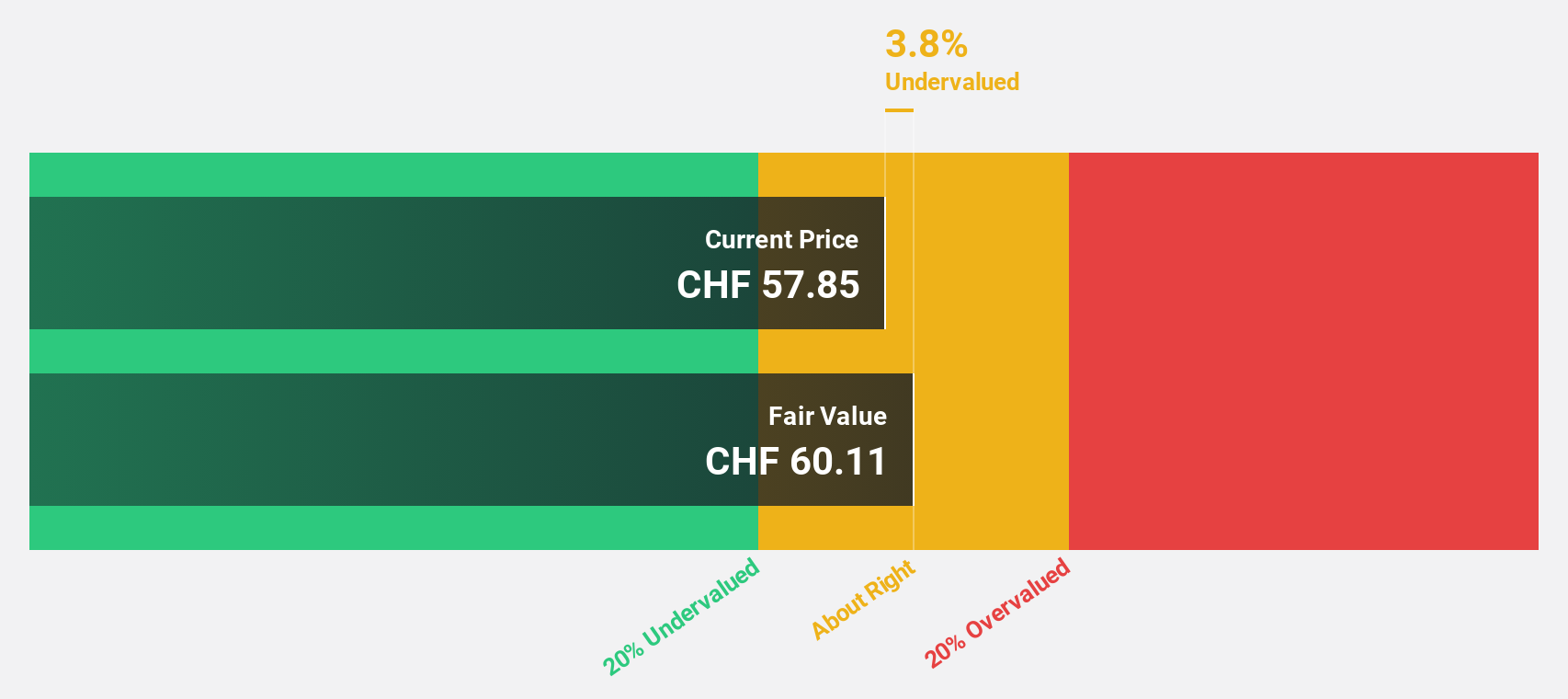

Estimated Discount To Fair Value: 25.2%

Temenos AG, trading at CHF 58.8, is highly undervalued with an estimated fair value of CHF 78.62 based on discounted cash flow analysis. Despite a high level of debt, its earnings are forecast to grow at 14.32% per year, outpacing the Swiss market's growth rate of 11.9%. Recent executive appointments aim to accelerate business growth in SaaS and the US market, potentially enhancing cash flows and overall financial performance.

- Our growth report here indicates Temenos may be poised for an improving outlook.

- Take a closer look at Temenos' balance sheet health here in our report.

Turning Ideas Into Actions

- Gain an insight into the universe of 16 Undervalued SIX Swiss Exchange Stocks Based On Cash Flows by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:GF

Georg Fischer

Engages in the provision of piping systems, and casting and machining solutions in Europe, the Americas, Asia, and internationally.

Undervalued with reasonable growth potential and pays a dividend.