- Switzerland

- /

- Insurance

- /

- SWX:HELN

What Helvetia Holding (SWX:HELN)'s Top GRESB Ratings Mean for Its Sustainable Investing Strategy

Reviewed by Sasha Jovanovic

- Earlier this month, Helvetia Holding AG’s real estate investment vehicles achieved top results in the 2025 Global Real Estate Sustainability Benchmark (GRESB), with two vehicles earning the highest 5-star rating and one receiving a 4-star rating.

- This achievement highlights Helvetia’s commitment to sustainable investing and advancing climate protection by prioritizing building certification, energy management, and a net-zero emissions goal by 2050.

- With these GRESB recognitions emphasizing Helvetia's sustainability leadership, we'll explore how this could influence the company's overall positioning and investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Helvetia Holding Investment Narrative Recap

Owning Helvetia Holding stock means believing in the company's ability to deliver steady growth, maintain dividends, and execute strategic initiatives such as the planned Baloise merger. While the recent top GRESB sustainability ratings spotlight Helvetia’s ESG leadership, they do not significantly shift the current short-term catalyst, which remains focused on successful integration and realization of merger-driven efficiency gains; the key risk continues to be execution and integration challenges from the Baloise deal, which could impact profit margins and disrupt operations if mishandled.

Among recent company updates, Helvetia’s H1 2025 earnings report stands out, with net income rising to CHF 307.2 million, providing evidence that operational efficiency programs and premium growth from ESG initiatives are supporting robust bottom-line performance, an important factor as investors watch for merger-related impacts in upcoming quarters.

However, despite these green credentials, investors should be aware that integration risks around the Baloise merger could still ...

Read the full narrative on Helvetia Holding (it's free!)

Helvetia Holding's outlook anticipates CHF10.7 billion in revenue and CHF654.5 million in earnings by 2028. This projection is based on a 3.7% annual revenue growth rate and a CHF179.2 million increase in earnings from the current CHF475.3 million.

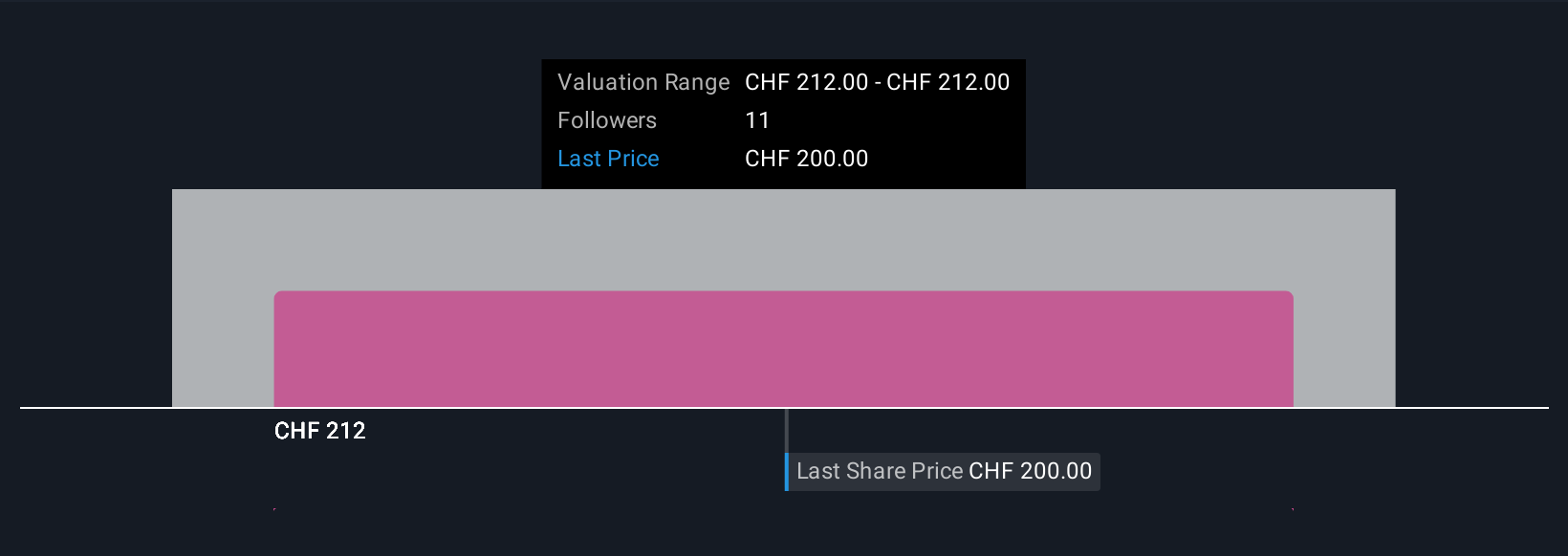

Uncover how Helvetia Holding's forecasts yield a CHF212.00 fair value, a 6% upside to its current price.

Exploring Other Perspectives

All ten Simply Wall St Community fair value estimates for Helvetia stand at CHF 212 per share, reflecting a shared view among retail investors. Yet with execution risks linked to the Baloise merger still in focus, it is worth comparing these opinions to see how your outlook aligns.

Explore another fair value estimate on Helvetia Holding - why the stock might be worth as much as 6% more than the current price!

Build Your Own Helvetia Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Helvetia Holding research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Helvetia Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Helvetia Holding's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Helvetia Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:HELN

Helvetia Holding

Engages in life and non-life insurance, and reinsurance business in Switzerland, Germany, Austria, Spain, Italy, France, and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.