- Switzerland

- /

- Insurance

- /

- SWX:HELN

Don't Buy Helvetia Holding AG (VTX:HELN) For Its Next Dividend Without Doing These Checks

It looks like Helvetia Holding AG (VTX:HELN) is about to go ex-dividend in the next 4 days. The ex-dividend date is usually set to be one business day before the record date which is the cut-off date on which you must be present on the company's books as a shareholder in order to receive the dividend. The ex-dividend date is an important date to be aware of as any purchase of the stock made on or after this date might mean a late settlement that doesn't show on the record date. In other words, investors can purchase Helvetia Holding's shares before the 28th of May in order to be eligible for the dividend, which will be paid on the 30th of May.

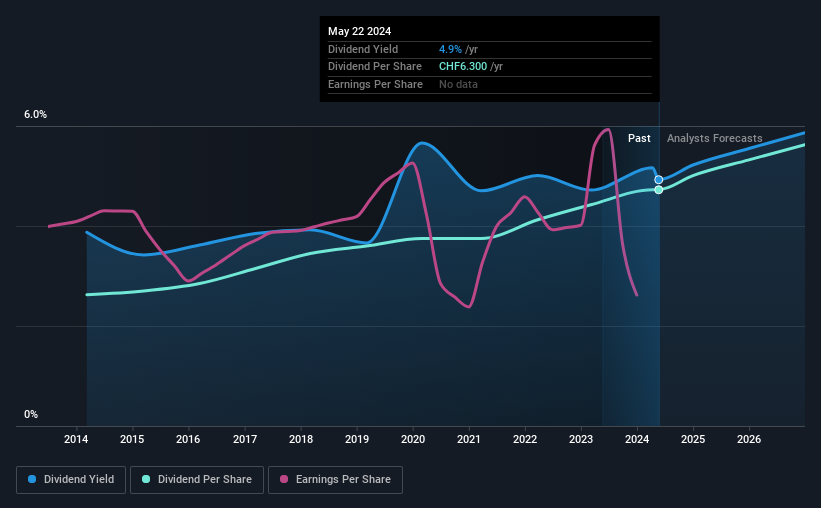

The company's next dividend payment will be CHF06.30 per share. Last year, in total, the company distributed CHF6.30 to shareholders. Last year's total dividend payments show that Helvetia Holding has a trailing yield of 4.9% on the current share price of CHF0127.90. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to check whether the dividend payments are covered, and if earnings are growing.

View our latest analysis for Helvetia Holding

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Helvetia Holding paid out 120% of profit in the past year, which we think is typically not sustainable unless there are mitigating characteristics such as unusually strong cash flow or a large cash balance.

Generally, the higher a company's payout ratio, the more the dividend is at risk of being reduced.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. Readers will understand then, why we're concerned to see Helvetia Holding's earnings per share have dropped 9.0% a year over the past five years. Ultimately, when earnings per share decline, the size of the pie from which dividends can be paid, shrinks.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Helvetia Holding has delivered an average of 6.1% per year annual increase in its dividend, based on the past 10 years of dividend payments. That's intriguing, but the combination of growing dividends despite declining earnings can typically only be achieved by paying out a larger percentage of profits. Helvetia Holding is already paying out a high percentage of its income, so without earnings growth, we're doubtful of whether this dividend will grow much in the future.

Final Takeaway

Is Helvetia Holding worth buying for its dividend? Not only are earnings per share shrinking, but Helvetia Holding is paying out a disconcertingly high percentage of its profit as dividends. Generally we think dividend investors should avoid businesses in this situation, as high payout ratios and declining earnings can lead to the dividend being cut. These characteristics don't generally lead to outstanding dividend performance, and investors may not be happy with the results of owning this stock for its dividend.

With that being said, if you're still considering Helvetia Holding as an investment, you'll find it beneficial to know what risks this stock is facing. Our analysis shows 2 warning signs for Helvetia Holding and you should be aware of them before buying any shares.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Helvetia Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:HELN

Helvetia Holding

Engages in life and non-life insurance, and reinsurance business in Switzerland, Germany, Austria, Spain, Italy, France, and internationally.

Moderate growth potential with mediocre balance sheet.