Stock Analysis

- Switzerland

- /

- Capital Markets

- /

- SWX:PGHN

Discover Partners Group Holding And Two More Growth Leaders With High Insider Stakes On SIX Swiss Exchange

Reviewed by Simply Wall St

The Swiss market recently displayed robust performance, with the benchmark SMI index closing strongly higher amid investor optimism about potential interest rate cuts by major central banks. Such a buoyant backdrop sets an intriguing stage for examining growth companies in Switzerland, particularly those with high insider ownership which can signal strong confidence in the company’s future from those who know it best.

Top 10 Growth Companies With High Insider Ownership In Switzerland

| Name | Insider Ownership | Earnings Growth |

| Stadler Rail (SWX:SRAIL) | 14.5% | 23.4% |

| VAT Group (SWX:VACN) | 10.2% | 21.2% |

| Straumann Holding (SWX:STMN) | 32.7% | 21% |

| Swissquote Group Holding (SWX:SQN) | 11.4% | 14.0% |

| INFICON Holding (SWX:IFCN) | 10.3% | 10% |

| Temenos (SWX:TEMN) | 17.4% | 14.7% |

| Sonova Holding (SWX:SOON) | 17.7% | 9.9% |

| Sensirion Holding (SWX:SENS) | 20.7% | 79.9% |

| SHL Telemedicine (SWX:SHLTN) | 17.9% | 96.2% |

| Arbonia (SWX:ARBN) | 28.8% | 100.1% |

Below we spotlight a couple of our favorites from our exclusive screener.

Partners Group Holding (SWX:PGHN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Partners Group Holding AG is a global private equity firm that focuses on direct, secondary, and primary investments in private equity, real estate, infrastructure, and debt, with a market capitalization of approximately CHF 29.98 billion.

Operations: The firm generates revenue from various segments, notably CHF 1.17 billion from private equity, CHF 379.20 million from infrastructure, CHF 211.30 million from private credit, and CHF 186.90 million from real estate.

Insider Ownership: 17.1%

Return On Equity Forecast: 51% (2026 estimate)

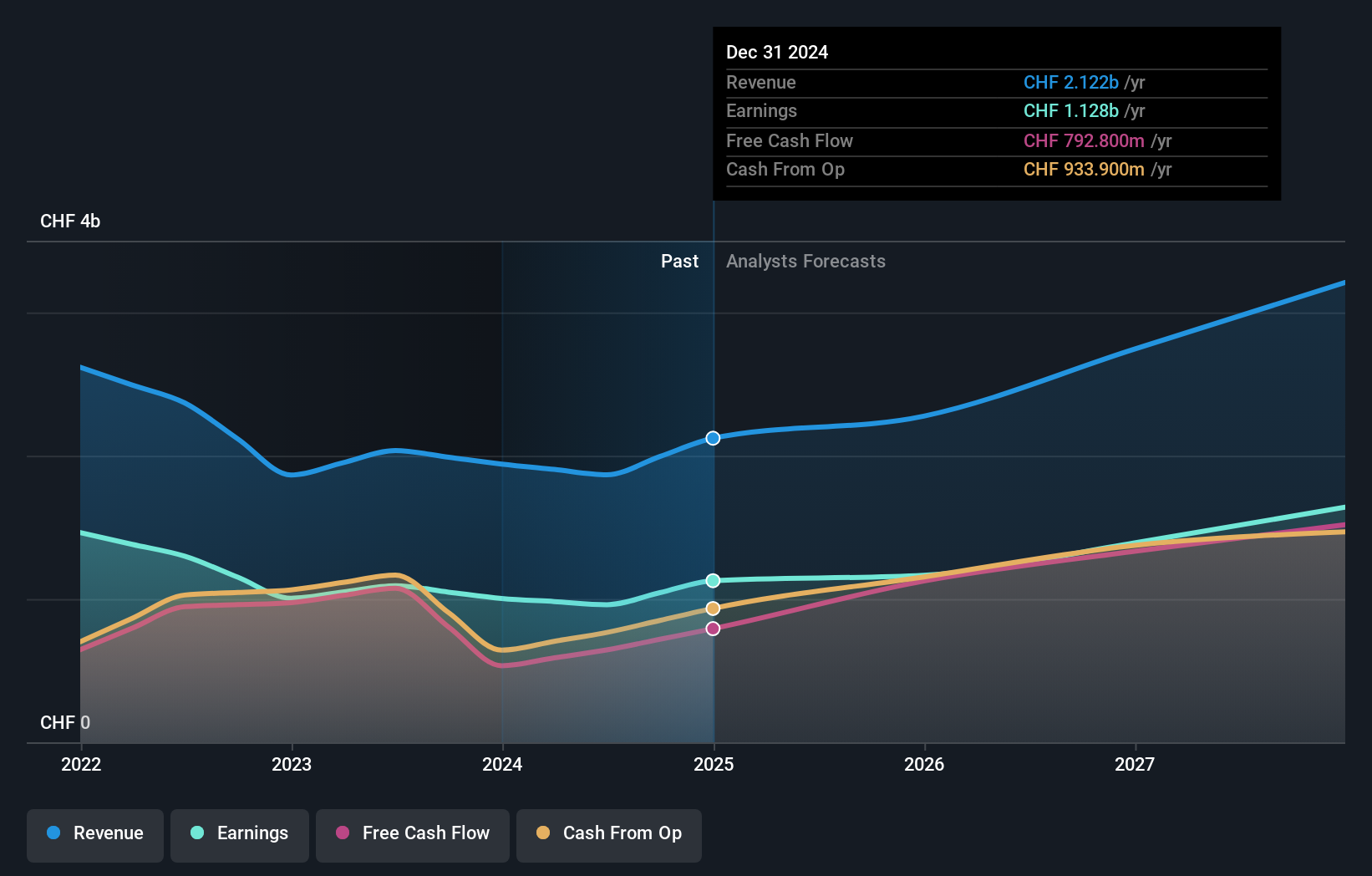

Partners Group Holding AG, a Swiss private equity firm, is actively involved in strategic financial activities and potential M&A, indicating a proactive management approach. Recently, they completed a CHF 300 million fixed-income offering and explored the sale of Formosa Solar with possible valuations up to US$400 million. Despite its high level of debt, PGHN's revenue is expected to outpace the Swiss market with an annual growth rate of 13.8%, and earnings are also set to grow at 13.7% annually. However, their dividend coverage by earnings and cash flows remains weak. The company's Return on Equity is projected to be very high at 51.1% in three years, reflecting efficient use of shareholder equity amidst these developments.

- Unlock comprehensive insights into our analysis of Partners Group Holding stock in this growth report.

- Our valuation report unveils the possibility Partners Group Holding's shares may be trading at a premium.

Straumann Holding (SWX:STMN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Straumann Holding AG specializes in providing tooth replacement and orthodontic solutions globally, with a market capitalization of approximately CHF 17.30 billion.

Operations: The company's revenue is generated from various regional sales: CHF 451.27 million in Asia Pacific, CHF 793.05 million in North America, CHF 265.82 million in Latin America, and CHF 1.17 billion in Europe, Middle East and Africa.

Insider Ownership: 32.7%

Return On Equity Forecast: 24% (2026 estimate)

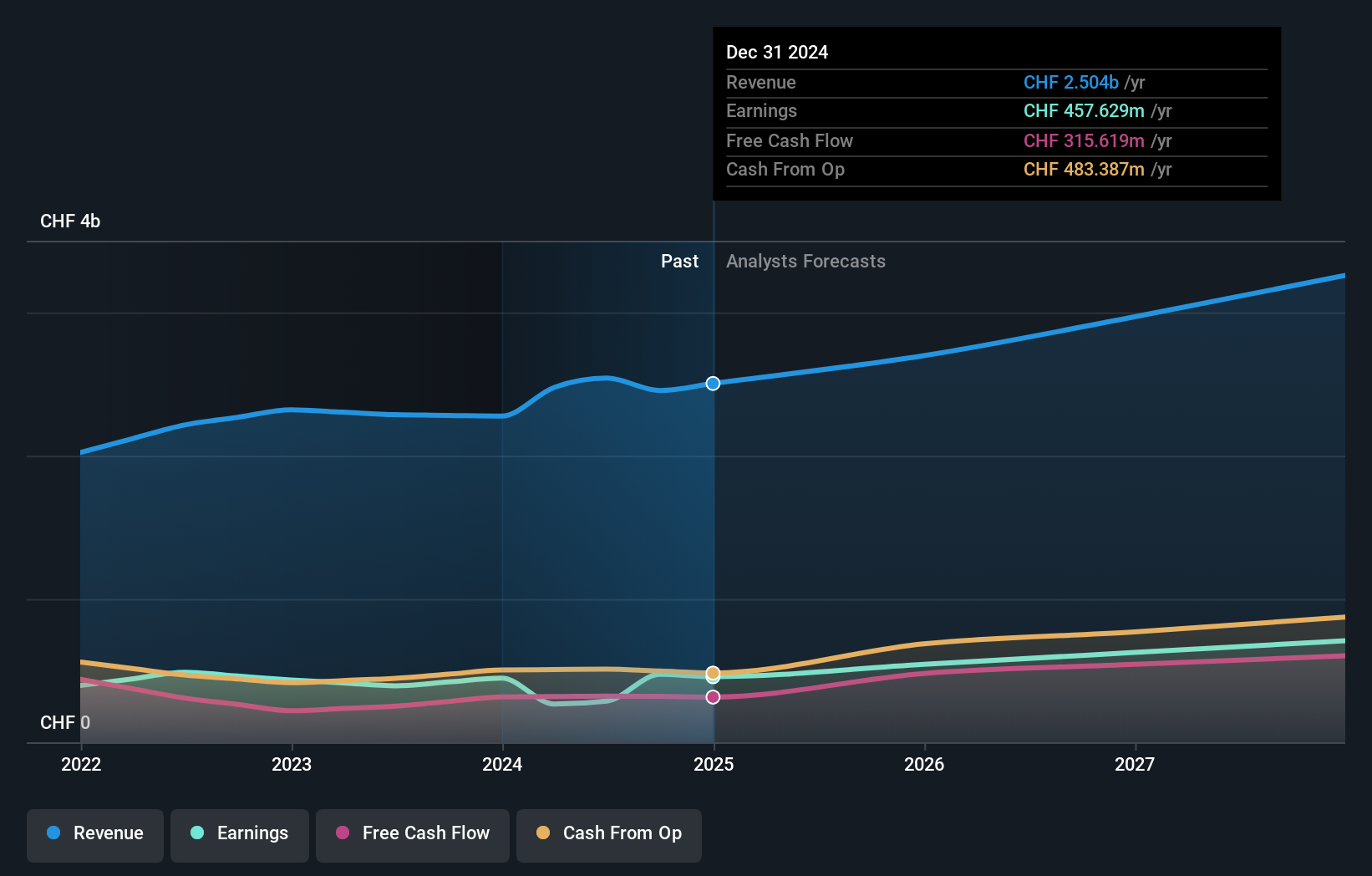

Straumann Holding AG, a key player in the Swiss dental sector, is trading at 9% below its estimated fair value, signaling potential undervaluation. The company's earnings are expected to grow by 21% annually, outpacing the Swiss market's average of 8.3%. Despite a forecasted revenue growth rate of 9.6%, which exceeds the national average (4.4%), it falls short of more aggressive growth benchmarks. Straumann has recently been active in international conferences, enhancing its industry presence. However, its share price has shown high volatility recently and profit margins have declined from last year’s figures.

- Get an in-depth perspective on Straumann Holding's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Straumann Holding shares in the market.

Temenos (SWX:TEMN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Temenos AG is a global provider of integrated banking software systems, serving banks and financial institutions worldwide, with a market capitalization of approximately CHF 4.42 billion.

Operations: The company generates revenue from the development, marketing, and sales of integrated banking software systems globally.

Insider Ownership: 17.4%

Return On Equity Forecast: 26% (2027 estimate)

Temenos, a Swiss software company, has recently announced a share repurchase program valued at CHF 200 million, signaling confidence in its financial health and commitment to shareholder value. The company's earnings are projected to grow by 14.7% annually, outperforming the Swiss market average of 8.3%. Despite trading below its estimated fair value by 27.4%, Temenos faces challenges with high debt levels and highly volatile share prices over the past three months. Additionally, recent product enhancements and strategic client acquisitions reflect ongoing innovation and market expansion efforts.

- Navigate through the intricacies of Temenos with our comprehensive analyst estimates report here.

- The analysis detailed in our Temenos valuation report hints at an deflated share price compared to its estimated value.

Next Steps

- Investigate our full lineup of 16 Fast Growing SIX Swiss Exchange Companies With High Insider Ownership right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Partners Group Holding is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:PGHN

Partners Group Holding

A private equity firm specializing in direct, secondary, and primary investments across private equity, private real estate, private infrastructure, and private debt.

Reasonable growth potential with adequate balance sheet.