- Switzerland

- /

- Healthcare Services

- /

- SWX:SHLTN

Investors Who Bought SHL Telemedicine (VTX:SHLTN) Shares A Year Ago Are Now Up 120%

When you buy shares in a company, there is always a risk that the price drops to zero. But if you pick the right stock, you can make a lot more than 100%. Take, for example SHL Telemedicine Ltd. (VTX:SHLTN). Its share price is already up an impressive 120% in the last twelve months. It's up an even more impressive 136% over the last quarter. It is also impressive that the stock is up 84% over three years, adding to the sense that it is a real winner.

View our latest analysis for SHL Telemedicine

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year, SHL Telemedicine actually saw its earnings per share drop 60%.

Given the share price gain, we doubt the market is measuring progress with EPS. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

We haven't seen SHL Telemedicine increase dividend payments yet, so the yield probably hasn't helped drive the share higher. It saw it's revenue decline by 5.0% over twelve months. Usually that correlates with a lower share price, but let's face it, the gyrations of the market are sometimes only as clear as mud.

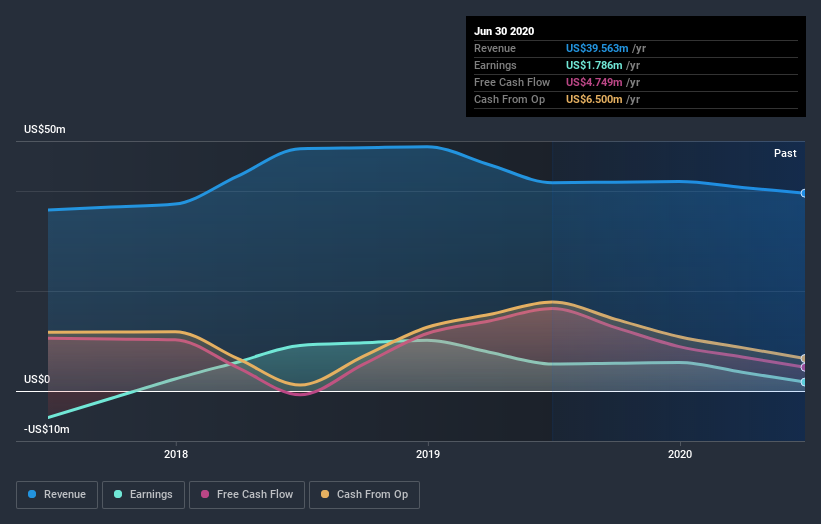

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. It might be well worthwhile taking a look at our free report on SHL Telemedicine's earnings, revenue and cash flow.

A Different Perspective

It's good to see that SHL Telemedicine has rewarded shareholders with a total shareholder return of 120% in the last twelve months. And that does include the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 17% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 5 warning signs for SHL Telemedicine that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CH exchanges.

If you’re looking to trade SHL Telemedicine, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SWX:SHLTN

SHL Telemedicine

Develops and markets personal telemedicine solutions in Israel, Europe, and internationally.

Excellent balance sheet low.

Similar Companies

Market Insights

Community Narratives