- Sweden

- /

- Communications

- /

- OM:NETI B

Discovering Opportunities: Petrolia Among 3 European Penny Stocks

Reviewed by Simply Wall St

As European markets experience a lift from easing trade tensions and optimism over potential U.S. interest rate cuts, investors are increasingly looking for opportunities that might not be immediately apparent in the larger indices. The term "penny stock" may seem outdated, yet it continues to signify potential growth in smaller or newer companies that can offer significant returns when backed by strong financial health. This article explores three such penny stocks in Europe, highlighting their balance sheet resilience and long-term growth potential amidst current market conditions.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Mistral Iberia Real Estate SOCIMI (BME:YMIB) | €1.05 | €22.87M | ✅ 2 ⚠️ 5 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €1.00 | €14.86M | ✅ 3 ⚠️ 4 View Analysis > |

| Maps (BIT:MAPS) | €3.34 | €44.36M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €302.94M | ✅ 3 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €3.12 | €65.81M | ✅ 4 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.97 | €18.58M | ✅ 2 ⚠️ 3 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.57 | €403.92M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.09 | €288.55M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.96 | €31.63M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 336 stocks from our European Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Petrolia (OB:PSE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Petrolia SE, with a market cap of NOK253.85 million, operates through its subsidiaries to rent and sell energy service equipment to the energy industry across Norway, Europe, Asia, and Australia.

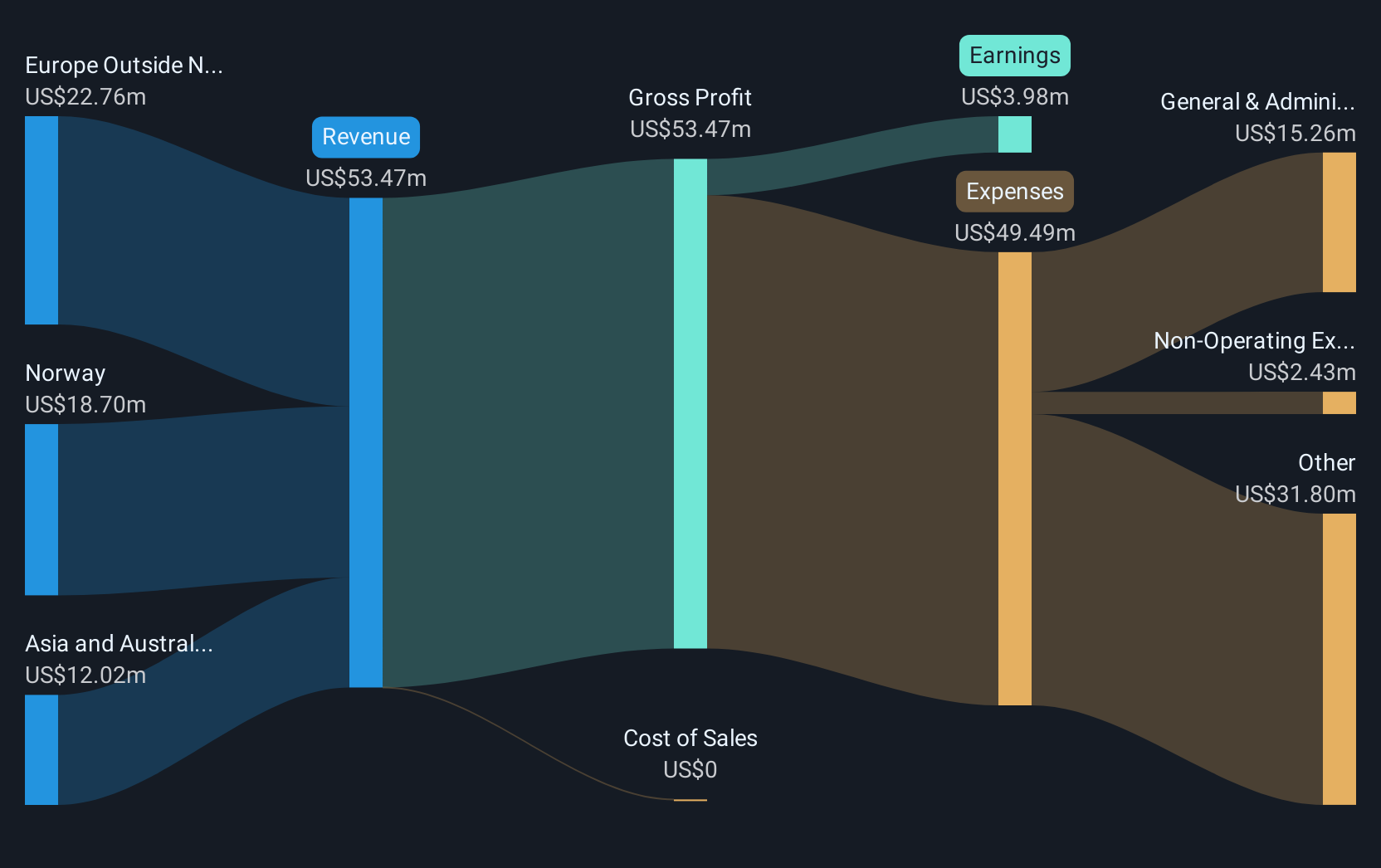

Operations: The company's revenue primarily comes from its Energy Service segment, generating $53.47 million.

Market Cap: NOK253.85M

Petrolia SE has demonstrated significant earnings growth, with a 98% increase over the past year, surpassing both its historical average and industry standards. The company's financial health appears robust, with operating cash flow well covering its debt and more cash on hand than total debt. Its net profit margins have improved to 7.4%, up from last year's 3.7%. While Petrolia's share price has been highly volatile recently, it trades significantly below estimated fair value. However, the return on equity remains low at 7.7%, and weekly volatility is higher than most Norwegian stocks.

- Unlock comprehensive insights into our analysis of Petrolia stock in this financial health report.

- Review our historical performance report to gain insights into Petrolia's track record.

Net Insight (OM:NETI B)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Net Insight AB (publ) offers media network solutions on a global scale and has a market capitalization of approximately SEK1.42 billion.

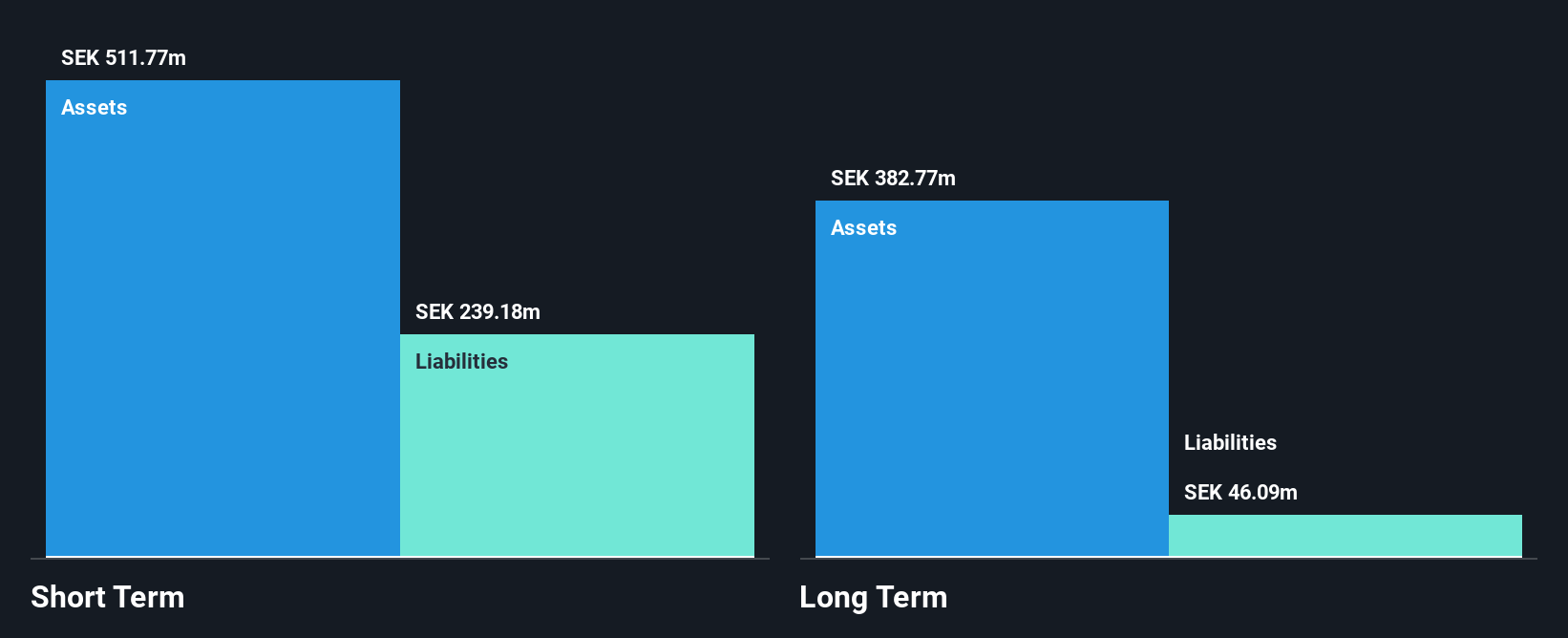

Operations: The company generates revenue primarily from its Media Networks segment, which accounted for SEK546.59 million.

Market Cap: SEK1.42B

Net Insight AB's financial stability is supported by its debt-free status and strong short-term asset position, which comfortably covers both short and long-term liabilities. However, recent earnings have been challenging, with a net loss reported in the latest quarter compared to a profit in the previous year. Despite this setback, the company's involvement in pioneering 6G technology with Turk Telekom highlights its potential for innovation-driven growth. Although trading below estimated fair value offers some appeal, investors should be cautious of its low return on equity and recent negative earnings growth when considering it as a penny stock investment.

- Click to explore a detailed breakdown of our findings in Net Insight's financial health report.

- Explore Net Insight's analyst forecasts in our growth report.

SHL Telemedicine (SWX:SHLTN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: SHL Telemedicine Ltd. operates by offering telemedicine services across Israel, Europe, and other international markets, with a market capitalization of CHF26.06 million.

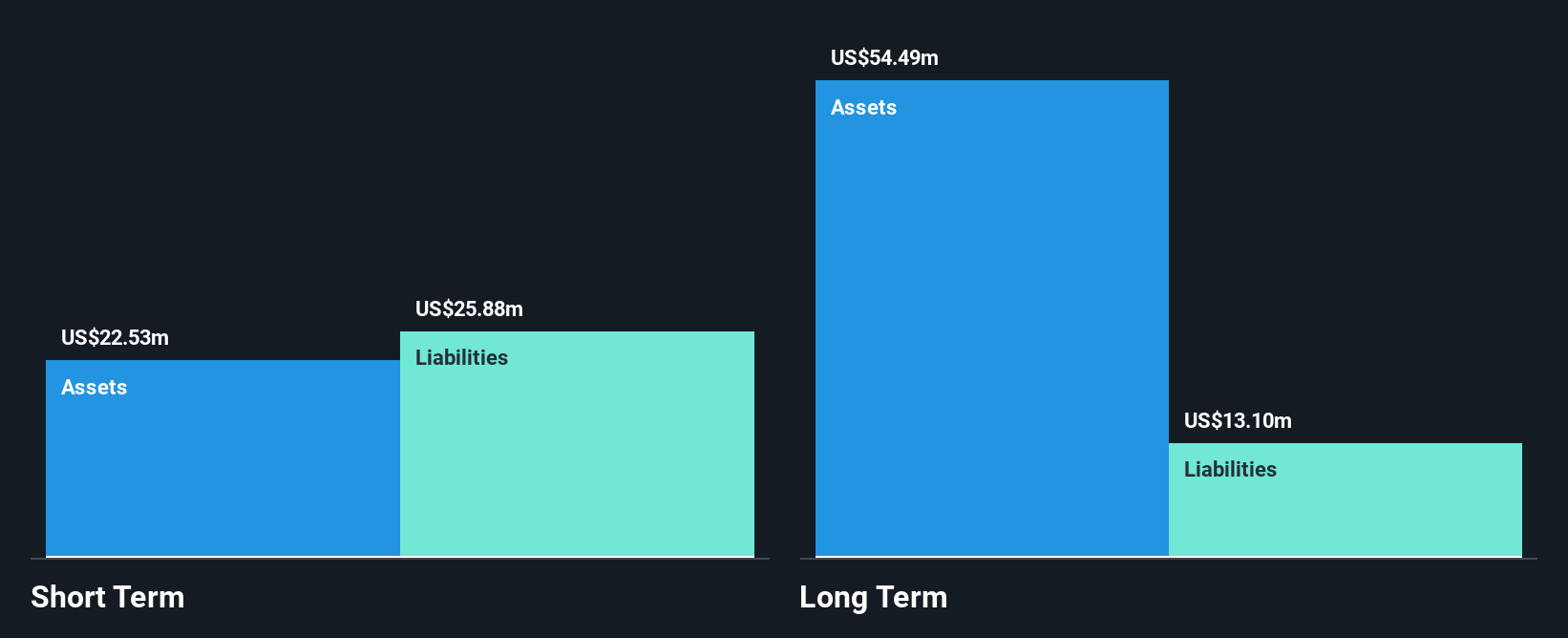

Operations: The company generates revenue of $56.78 million from its telemedicine services.

Market Cap: CHF26.06M

SHL Telemedicine Ltd. operates with a market capitalization of CHF26.06 million and generates revenue of US$56.78 million from its telemedicine services, indicating it is not pre-revenue. The company has a stable financial position with short-term assets exceeding both short and long-term liabilities, alongside more cash than debt, ensuring a sufficient cash runway for over three years if free cash flow remains stable. However, the stock's high volatility and unprofitability pose risks, as earnings have declined significantly over five years despite no recent shareholder dilution or significant management experience in place to drive turnaround efforts.

- Jump into the full analysis health report here for a deeper understanding of SHL Telemedicine.

- Understand SHL Telemedicine's track record by examining our performance history report.

Taking Advantage

- Investigate our full lineup of 336 European Penny Stocks right here.

- Interested In Other Possibilities? This technology could replace computers: discover the 24 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Net Insight might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NETI B

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives