- Switzerland

- /

- Medical Equipment

- /

- SWX:MED

Recent 6.8% pullback isn't enough to hurt long-term Medartis Holding (VTX:MED) shareholders, they're still up 72% over 3 years

By buying an index fund, investors can approximate the average market return. But if you choose individual stocks with prowess, you can make superior returns. For example, the Medartis Holding AG (VTX:MED) share price is up 72% in the last three years, clearly besting the market return of around 16% (not including dividends).

While the stock has fallen 6.8% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

View our latest analysis for Medartis Holding

SWOT Analysis for Medartis Holding

- Debt is well covered by earnings.

- Shareholders have been diluted in the past year.

- Expected to breakeven next year.

- Has sufficient cash runway for more than 3 years based on current free cash flows.

- Good value based on P/S ratio compared to estimated Fair P/S ratio.

- Debt is not well covered by operating cash flow.

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the three years of share price growth, Medartis Holding actually saw its earnings per share (EPS) drop 1.9% per year.

Given the share price resilience, we don't think the (declining) EPS numbers are a good measure of how the business is moving forward, right now. Therefore, it makes sense to look into other metrics.

It may well be that Medartis Holding revenue growth rate of 14% over three years has convinced shareholders to believe in a brighter future. If the company is being managed for the long term good, today's shareholders might be right to hold on.

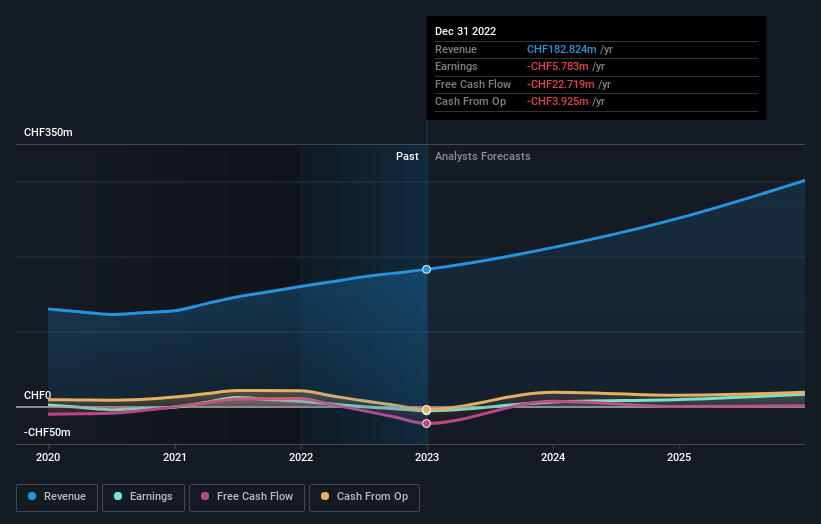

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Medartis Holding's financial health with this free report on its balance sheet.

A Different Perspective

Investors in Medartis Holding had a tough year, with a total loss of 26%, against a market gain of about 2.1%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 0.5% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Medartis Holding better, we need to consider many other factors. For example, we've discovered 2 warning signs for Medartis Holding that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swiss exchanges.

If you're looking to trade Medartis Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:MED

Medartis Holding

A medical device company, engages in the development, manufacturing, and sales of implant solutions worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives