- Switzerland

- /

- Healthcare Services

- /

- SWX:GALE

Galenica AG (VTX:GALE) Investors Are Less Pessimistic Than Expected

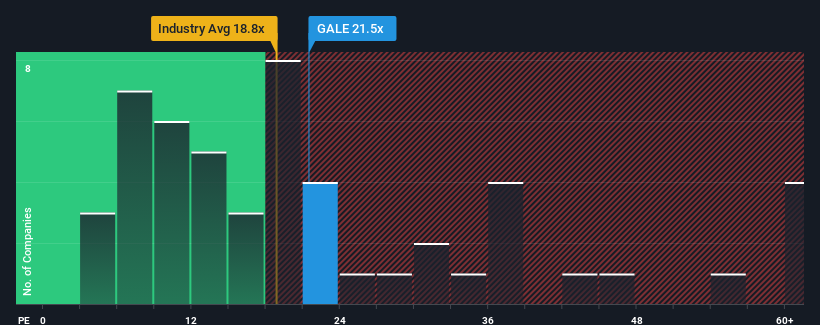

There wouldn't be many who think Galenica AG's (VTX:GALE) price-to-earnings (or "P/E") ratio of 21.5x is worth a mention when the median P/E in Switzerland is similar at about 21x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

There hasn't been much to differentiate Galenica's and the market's earnings growth lately. The P/E is probably moderate because investors think this modest earnings performance will continue. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

See our latest analysis for Galenica

How Is Galenica's Growth Trending?

In order to justify its P/E ratio, Galenica would need to produce growth that's similar to the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 5.1% last year. Still, lamentably EPS has fallen 5.0% in aggregate from three years ago, which is disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the four analysts covering the company suggest earnings should grow by 6.0% each year over the next three years. That's shaping up to be materially lower than the 12% per year growth forecast for the broader market.

In light of this, it's curious that Galenica's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Bottom Line On Galenica's P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Galenica's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Galenica you should know about.

If these risks are making you reconsider your opinion on Galenica, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:GALE

Galenica

Operates as a healthcare service provider in Switzerland and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives