- Switzerland

- /

- Medical Equipment

- /

- SWX:ALC

Is The Market Missing Alcon’s Rebound After Recent Product Expansion News?

Reviewed by Bailey Pemberton

- If you are wondering whether Alcon is quietly becoming a bargain, or if the recent noise around the stock is just that, noise, this section will walk you through what the market might be missing.

- After a choppy year that still leaves the share price down around 17.8% over 12 months and 16.3% year to date, the stock has shown signs of life with an 8.4% gain over the last month, despite being flat over the past week.

- Recent headlines have focused on Alcon expanding its portfolio of vision care and surgical products, alongside strategic investments in advanced eye care technologies. This helps explain why sentiment has started to improve. At the same time, industry commentary around long term demand for ophthalmic treatments has reminded investors that this is a structurally growing market, even if the share price has been lagging.

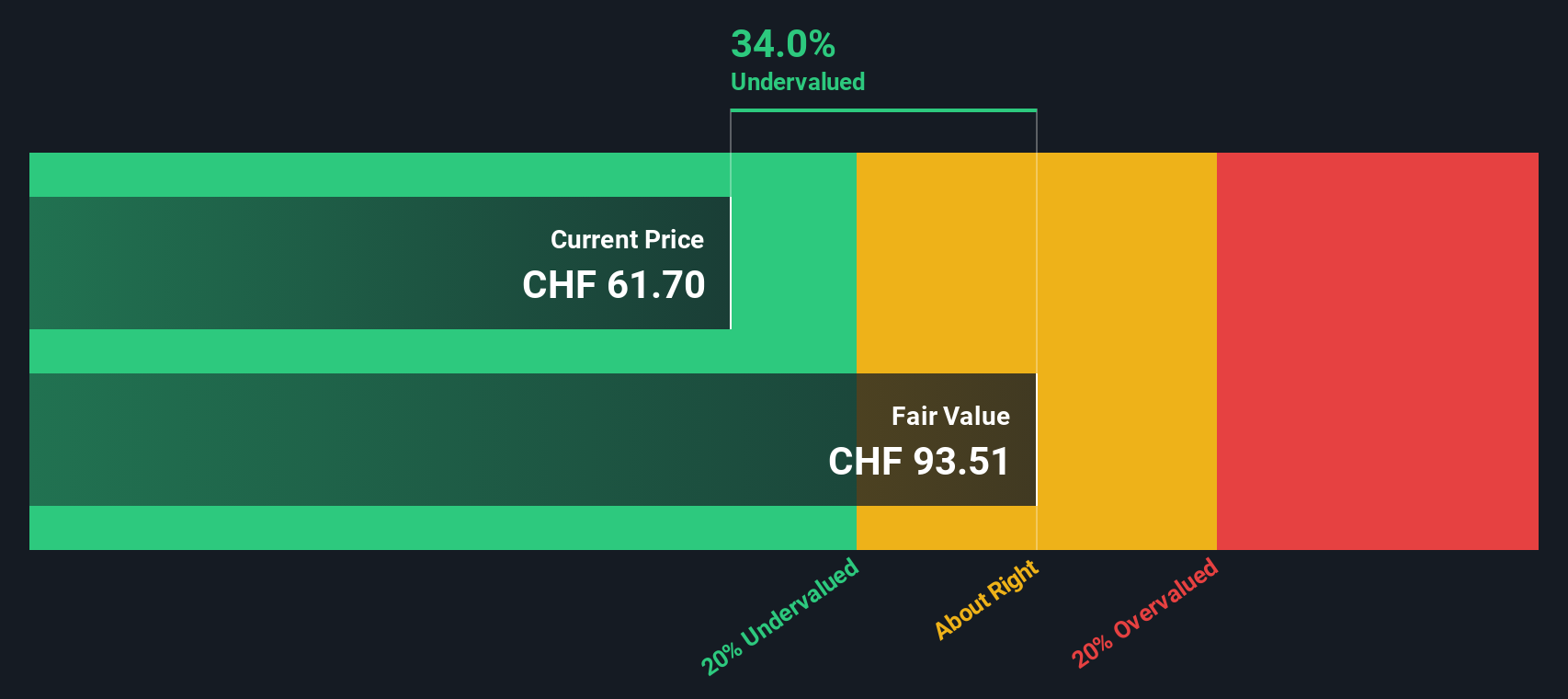

- On our framework, Alcon earns a 3/6 valuation score, meaning it screens as undervalued on half of the key checks we run. In the rest of this article we will unpack what that means across different valuation methods and finish by looking at a more nuanced way to judge whether the stock offers good value.

Approach 1: Alcon Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future and then discounting those cash flows back to today. For Alcon, this is done using a 2 Stage Free Cash Flow to Equity approach that focuses on cash available to shareholders in $.

Alcon’s latest twelve month free cash flow stands at about $1.29 billion, and analysts expect this to rise steadily over time. Independent forecasts, combined with Simply Wall St’s own extrapolations beyond the usual 5 year analyst horizon, indicate free cash flow of roughly $2.70 billion in 2035. These projected cash flows are then discounted back to today to reflect risk and the time value of money.

On this basis, the model estimates an intrinsic value of about $92.61 per share. Compared with the current market price, this suggests Alcon is trading at roughly a 31.0% discount to its DCF fair value, indicating the market may be underpricing its long term cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Alcon is undervalued by 31.0%. Track this in your watchlist or portfolio, or discover 917 more undervalued stocks based on cash flows.

Approach 2: Alcon Price vs Earnings

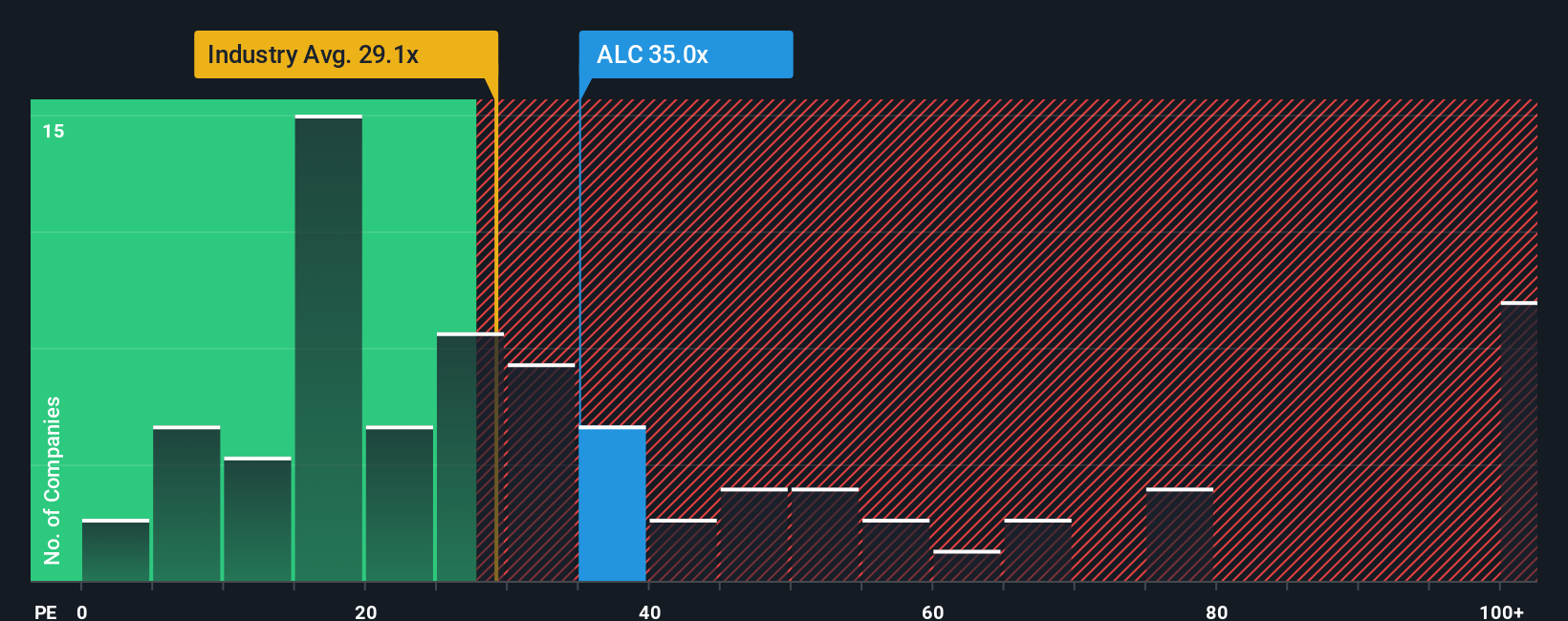

For profitable companies like Alcon, the price to earnings ratio, or PE, is a useful way to gauge value because it directly links what investors pay for the stock to the earnings the business is currently generating.

What counts as a reasonable PE depends on how quickly earnings are expected to grow and how risky those earnings are. Higher growth and lower perceived risk usually justify a higher PE, while slower growth or higher uncertainty call for a lower one.

Alcon currently trades on a PE of about 37.45x, which is richer than the Medical Equipment industry average of roughly 27.71x and above the peer group average of around 23.97x. That might initially make the stock look expensive relative to its sector.

Simply Wall St’s Fair Ratio framework takes this a step further by estimating what PE Alcon should trade on, given its earnings growth outlook, profitability, industry, market cap and key risks. This is more informative than a simple industry or peer comparison, because it adjusts for company specific strengths and weaknesses rather than assuming all businesses deserve the same multiple.

On this basis, Alcon’s Fair Ratio is 36.92x, only slightly below its current PE of 37.45x, suggesting the market is pricing the stock broadly in line with its fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

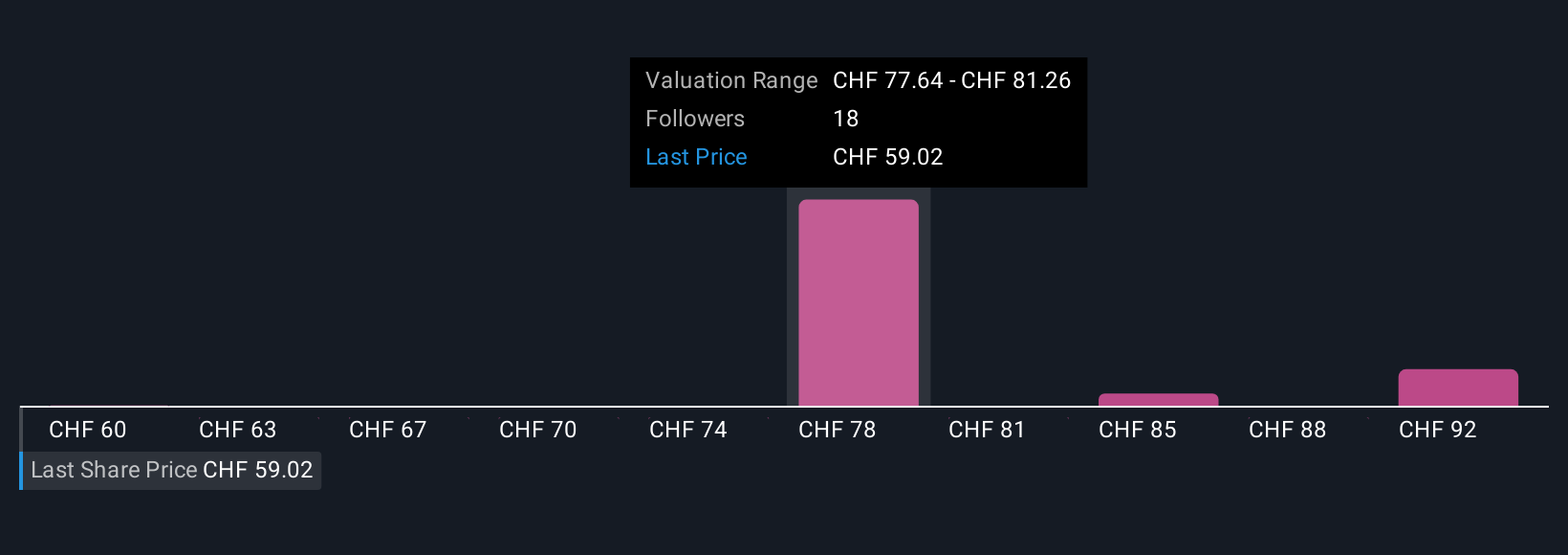

Upgrade Your Decision Making: Choose your Alcon Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a smarter tool on Simply Wall St’s Community page that lets you connect your view of a company’s story with a concrete forecast and a Fair Value you can compare to today’s price.

A Narrative is your own investment storyline for Alcon where you set assumptions for future revenue, earnings and margins, turning that story into a financial model that calculates Fair Value and clearly shows how you view the stock at the current market price.

Because Narratives on Simply Wall St are dynamic, they automatically update when new information lands, like earnings releases or news about product launches and regulatory changes, so your Fair Value view stays aligned with reality without you rebuilding a spreadsheet from scratch each time.

For example, one investor might build an Alcon Narrative that focuses on potential surgical workflow gains, margin expansion and a Fair Value above CHF98, while another takes a more cautious view around competition, integration risks and slower procedure growth, landing closer to CHF62, and both perspectives can coexist and be compared side by side on the platform.

Do you think there's more to the story for Alcon? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:ALC

Alcon

Researches, develops, manufactures, distributes, and sells eye care products worldwide.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026