Emmi AG (VTX:EMMN) will increase its dividend from last year's comparable payment on the 17th of April to CHF15.50. Even though the dividend went up, the yield is still quite low at only 1.7%.

Check out our latest analysis for Emmi

Emmi's Earnings Easily Cover The Distributions

Even a low dividend yield can be attractive if it is sustained for years on end. Prior to this announcement, Emmi's dividend was comfortably covered by both cash flow and earnings. This means that a large portion of its earnings are being retained to grow the business.

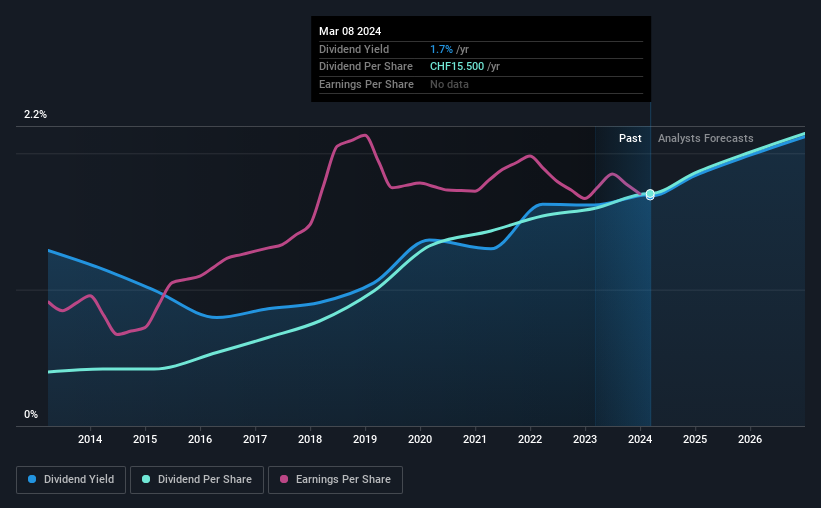

Looking forward, earnings per share is forecast to rise by 37.8% over the next year. Assuming the dividend continues along recent trends, we think the payout ratio could be 37% by next year, which is in a pretty sustainable range.

Emmi Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. Since 2014, the dividend has gone from CHF3.60 total annually to CHF15.50. This works out to be a compound annual growth rate (CAGR) of approximately 16% a year over that time. It is good to see that there has been strong dividend growth, and that there haven't been any cuts for a long time.

The Dividend's Growth Prospects Are Limited

Investors could be attracted to the stock based on the quality of its payment history. Unfortunately things aren't as good as they seem. In the last five years, Emmi's earnings per share has shrunk at approximately 4.4% per annum. Declining earnings will inevitably lead to the company paying a lower dividend in line with lower profits. It's not all bad news though, as the earnings are predicted to rise over the next 12 months - we would just be a bit cautious until this can turn into a longer term trend.

Our Thoughts On Emmi's Dividend

Overall, this is a reasonable dividend, and it being raised is an added bonus. With shrinking earnings, the company may see some issues maintaining the dividend even though they look pretty sustainable for now. This looks like it could be a good dividend stock going forward, but we would note that the payout ratio has been at higher levels in the past so it could happen again.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Given that earnings are not growing, the dividend does not look nearly so attractive. Businesses can change though, and we think it would make sense to see what analysts are forecasting for the company. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Emmi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:EMMN

Emmi

Manufactures and sells dairy products in Switzerland, the United States, Europe, and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026