- Switzerland

- /

- Food

- /

- SWX:BARN

Is Barry Callebaut’s Recent 5% Rally a Sign of a Turning Point in 2025?

Reviewed by Bailey Pemberton

If you’re watching Barry Callebaut’s stock and wondering whether now is the right time to act, you’re not alone. The company’s share price has had a bumpy ride lately, sparking plenty of chatter among market watchers and long-term investors alike. Over just the last week, the stock jumped 5.3%. If you zoom out, however, the bigger picture tells a more cautious tale: losses of 4.8% so far this year and a steep drop of 23.5% over the past twelve months. Even looking back five years, the shares are down over 40%.

What’s driving these moves? Recent shifts in the broader market and changes in how investors think about risk in food producers like Barry Callebaut are likely at play. While no single headline explains the short-term upswing, several trends have contributed to heightened uncertainty. This helps explain why the market can swing sharply in both directions right now.

But let’s get down to the question you care about: is Barry Callebaut undervalued right now, or is there more pain ahead? Our in-depth valuation checks explore six different ways of scoring the company’s current price, and Barry Callebaut only passes one out of six, giving it a value score of 1. What does this mean for would-be buyers or sellers?

We’re about to dive into the details of each valuation approach, unpacking what’s behind that low score and how it fits into the bigger investment puzzle. If you’re looking for an even better framework to understand Barry Callebaut’s true worth, make sure to read to the end.

Barry Callebaut scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Barry Callebaut Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and then discounting those cash flows back to today’s value, reflecting the time value of money. This approach can provide an in-depth look at what the business might truly be worth based on its ability to generate ongoing cash.

For Barry Callebaut, the current Free Cash Flow stands at negative CHF 3,415.8 Million, indicating that the business generated less cash than it consumed over the latest period. Looking ahead, analysts forecast a return to positive cash flows, with projected Free Cash Flow of CHF 1,206 Million in 2026 and CHF 696.5 Million in 2027. Beyond these analyst estimates, further projections are extrapolated, with cash flows gradually trending lower but remaining positive over the next decade.

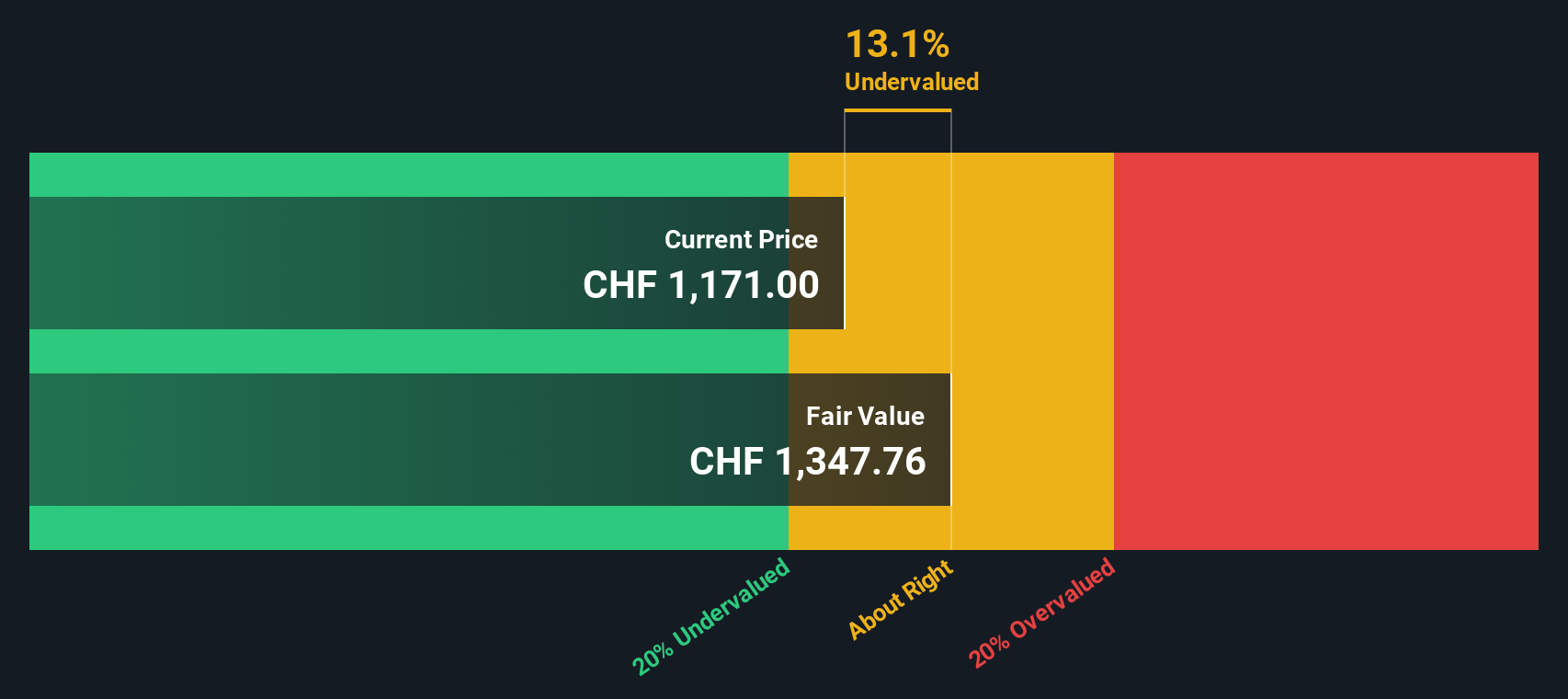

Taking all these future cash flows into account and discounting them to present-day values, the DCF model estimates the intrinsic value of Barry Callebaut at CHF 1,338.55 per share. This figure suggests the stock is currently trading at a 14.2% discount to its intrinsic value, indicating undervaluation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Barry Callebaut is undervalued by 14.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Barry Callebaut Price vs Earnings

The Price-to-Earnings (PE) ratio is the preferred valuation metric for profitable companies because it measures how much investors are willing to pay for each Swiss franc of current earnings. This makes it a valuable tool for assessing whether a stock’s market valuation reflects its true earnings power. Typically, higher growth expectations and lower risk profiles justify higher PE ratios, while slow growth or heightened uncertainty bring that “normal” or “fair” ratio down.

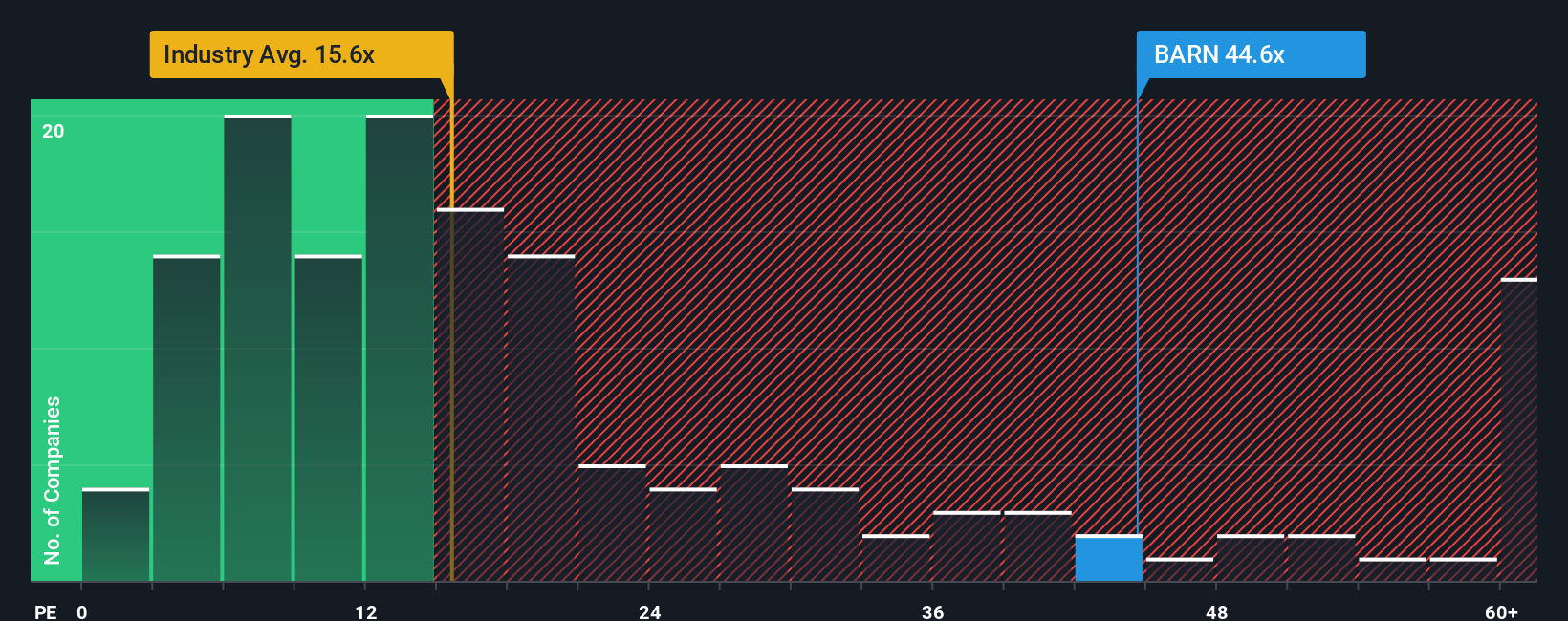

Barry Callebaut currently trades at a PE ratio of 43.7x, which may seem elevated at first glance. When you put this into context, the company is priced significantly above the Food industry average PE of 16.26x and also above the peer group average of 22.06x. This suggests that the market is pricing in strong optimism for the company, or at least expecting it to outperform its industry peers by a wide margin.

However, Simply Wall St’s proprietary “Fair Ratio” metric digs deeper by factoring in Barry Callebaut’s actual earnings growth, industry norms, profit margins, overall risk, and market cap. This provides a nuanced view for this specific company. For Barry Callebaut, the Fair Ratio is calculated at 37.73x, lower than the current PE but above both the industry and peer averages. The Fair Ratio is a more robust benchmark because it captures the company’s unique future prospects and challenges, rather than relying solely on broad peer comparisons.

Since Barry Callebaut’s PE (43.7x) is materially higher than its Fair Ratio (37.73x), the stock appears somewhat expensive relative to what would be considered fair given its fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Barry Callebaut Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, powerful story about how you see a company's future, combining your perspective on its product, market, or management with projected numbers like revenue, earnings, and margins to determine what you think the company is truly worth.

More than just a gut feeling, a Narrative links the company's real-life story and competitive advantages to a dynamic financial model. This helps you visualize how your expectations translate into a fair value per share. Narratives are available right on Simply Wall St's Community page, making this tool accessible to all investors, regardless of experience.

With Narratives, you can quickly compare your fair value to the current share price and see whether this aligns with your view on when to buy, hold, or sell. Because Narratives are updated automatically as news, results, or forecasts change, you always have the most up-to-date perspective at your fingertips.

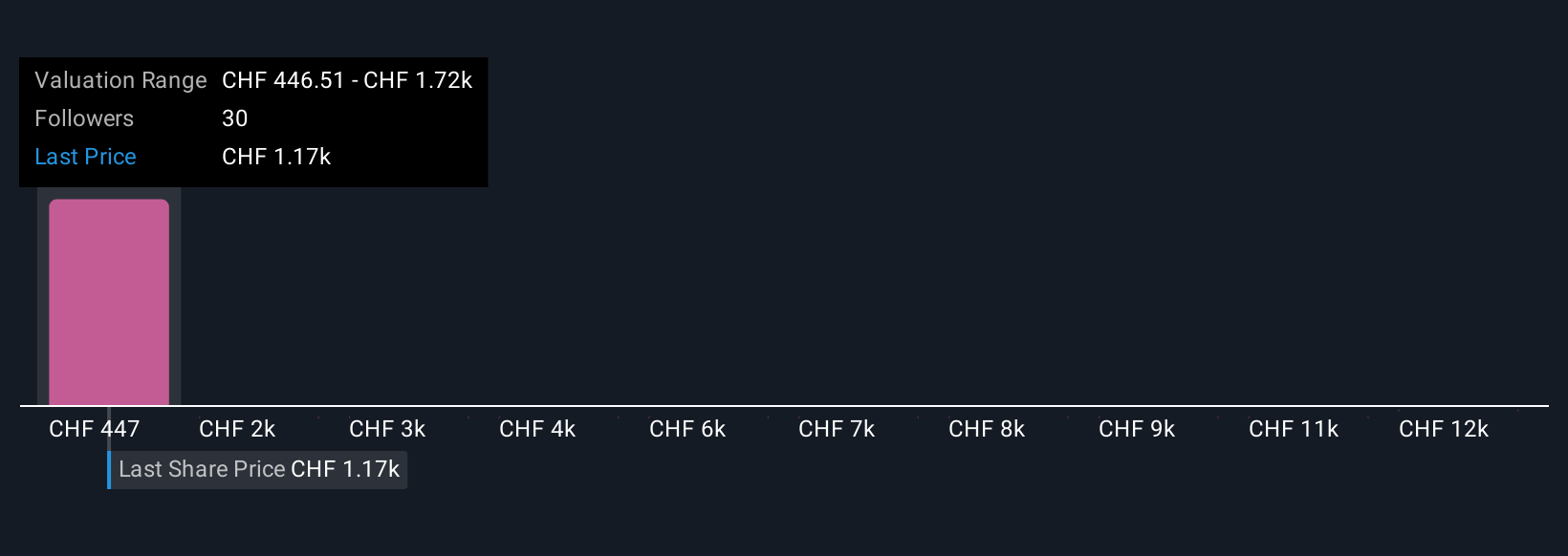

For Barry Callebaut, for example, some investors in the community believe the stock could be worth as much as CHF2,000 per share based on ambitious growth assumptions, while others see a lower fair value around CHF790. This demonstrates how personal Narratives capture a wide range of real investor perspectives on the same company.

Do you think there's more to the story for Barry Callebaut? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Barry Callebaut might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:BARN

Barry Callebaut

Engages in the manufacture and sale of chocolate and cocoa products.

Moderate risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives