- Switzerland

- /

- Capital Markets

- /

- SWX:UBSG

UBS Group (SWX:UBSG) Valuation: Is the Market Overlooking Long-Term Growth?

Reviewed by Simply Wall St

See our latest analysis for UBS Group.

UBS Group's recent 4.6% dip in 1-month share price return has not erased the tailwind from a strong year-to-date gain. Long-term investors have enjoyed a robust 190.7% total shareholder return over five years. Momentum appears to be shifting lately as the market recalibrates expectations following rapid gains.

If this changing momentum has you thinking about new opportunities, it might be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With UBS shares still trading at a slight discount to analyst price targets and impressive multi-year returns in tow, the key question now is whether UBS is undervalued or if future growth is already priced in.

Most Popular Narrative: 6.5% Undervalued

UBS Group's most widely followed narrative suggests its fair value sits above the recent closing price. The consensus sees current levels as a potential bargain, based on a blend of operational improvements, revenue growth, and sector dynamics that have yet to fully play out.

“The ongoing integration of Credit Suisse is progressing ahead of schedule, driving meaningful cost savings, increased scale, and improved operating efficiency. As these synergies are realized through further platform migration and operational streamlining, UBS's net margins and return on equity are likely to improve, supporting higher earnings growth.”

Want to know what assumptions lie behind this confidence? The financial blueprint powering this narrative is focused on accelerating profit margins and an ambitious future earnings target. Curious to uncover which projections were bold enough to boost the fair value? Dive in to see what the consensus is betting on for UBS’s next phase.

Result: Fair Value of $33.35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heightened regulatory requirements or setbacks in integrating Credit Suisse could challenge UBS’s growth outlook. These factors may keep investor caution firmly in play.

Find out about the key risks to this UBS Group narrative.

Another View: What Do Valuation Ratios Reveal?

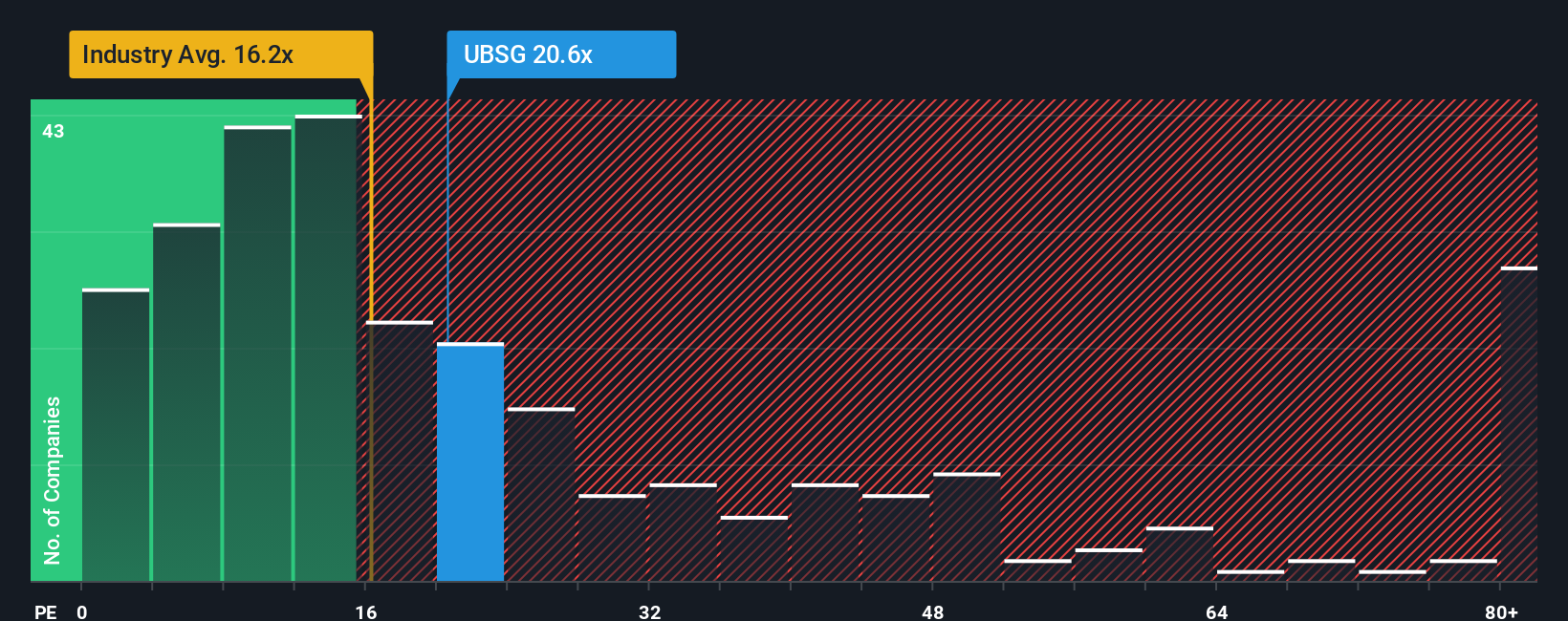

While our first approach points to UBS as undervalued, looking at its price-to-earnings ratio tells a slightly different story. UBS trades at 16.6 times earnings, which aligns with the Capital Markets industry average of 16.3 and is considerably lower than the peer average of 20.9. Compared to its fair ratio of 25.1, the current level suggests there may still be room for the market to re-rate higher, but this would not come without some risks if expectations shift.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own UBS Group Narrative

If the current outlook does not align with your perspective, you can examine the underlying numbers and shape your own narrative in just a few short minutes, all at your own pace. Do it your way

A great starting point for your UBS Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't wait on the sidelines while smarter investors take action. Use Simply Wall Street’s powerful screener to spot hidden opportunities tailored to you.

- Tap into stocks with high dividend yields and steady payouts by checking out these 20 dividend stocks with yields > 3% for potential long-term income.

- Get ahead of the tech curve and target companies fueling healthcare breakthroughs by exploring these 33 healthcare AI stocks, shaping tomorrow’s medical landscape today.

- Capitalize on tomorrow’s trends with disruptive innovators in digital money by reviewing these 81 cryptocurrency and blockchain stocks, driving growth in the blockchain space.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:UBSG

UBS Group

Provides financial advice and solutions to private, institutional, and corporate clients worldwide.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives