- Switzerland

- /

- Capital Markets

- /

- SWX:UBSG

UBS Group (SWX:UBSG): Is the Market Undervaluing Shares After Recent Pullback?

Reviewed by Simply Wall St

See our latest analysis for UBS Group.

While UBS Group has pulled back slightly over the past month, the longer view tells a more positive story. The stock's 1-year total shareholder return stands at 8.4%, and over the past five years, investors have seen total returns of more than 160%. Short-term momentum may have softened, but those holding over the long haul have been rewarded.

If you're curious about what else is catching investors' interest, this could be the right time to broaden your search and discover fast growing stocks with high insider ownership

With UBS Group trading at a moderate discount to analyst targets and strong long-term returns, the big question for investors is whether the current valuation leaves room for upside or if the market is already factoring in all future growth.

Most Popular Narrative: 12% Undervalued

UBS Group's most widely followed narrative suggests fair value sits comfortably above the recent closing price, fueling debate about whether investors are overlooking important earnings drivers in the current valuation.

The ongoing integration of Credit Suisse is progressing ahead of schedule, driving meaningful cost savings, increased scale, and improved operating efficiency. As these synergies are realized through further platform migration and operational streamlining, UBS's net margins and return on equity are likely to improve, supporting higher earnings growth.

What is the formula behind this upbeat valuation call? Hints: efficiency upgrades, bold targets, and margin leaps are all in play. Which big financial leaps are shaping these forecasts? Unpack the full narrative to see the exact mix of growth engines and profit assumptions setting this price target apart.

Result: Fair Value of $33.77 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unexpected regulatory shifts or delays in integrating Credit Suisse could challenge earnings growth. This could potentially shift the outlook for UBS Group in coming quarters.

Find out about the key risks to this UBS Group narrative.

Another View: Is the Market Multiple Sending a Different Signal?

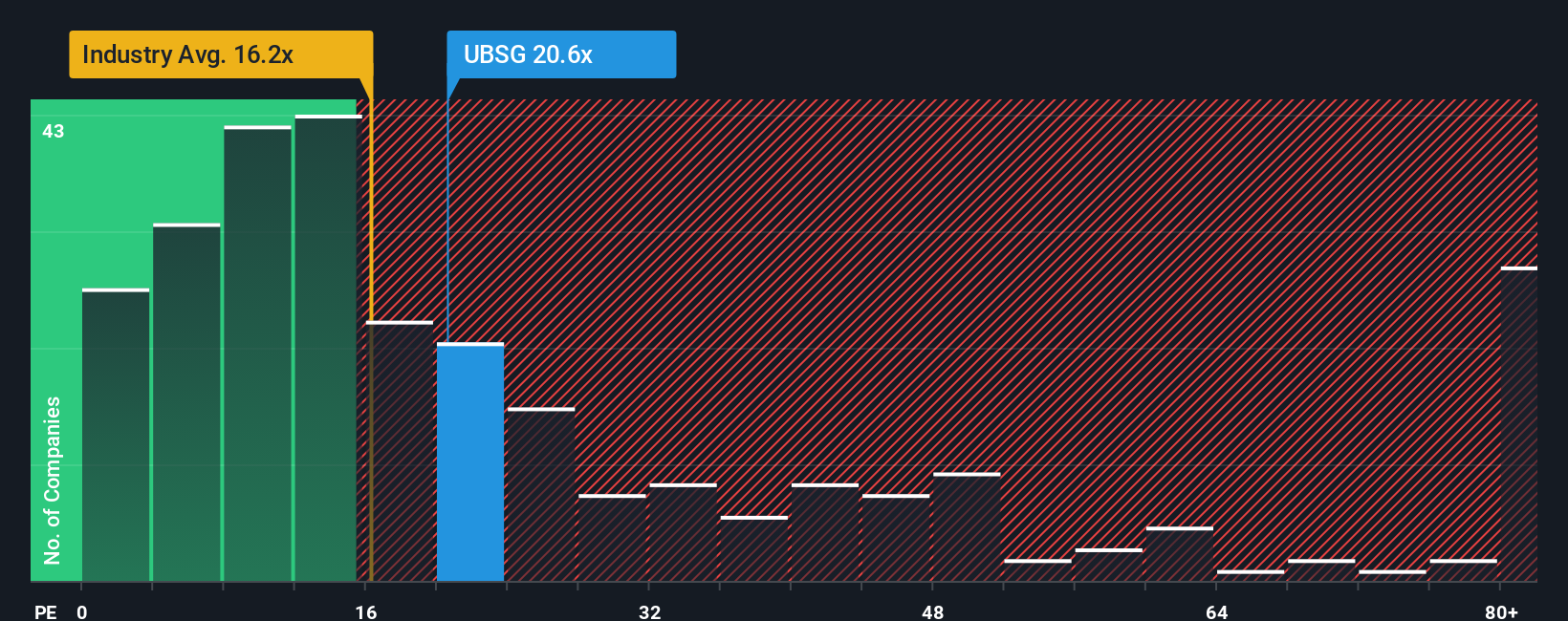

While the most popular view sees UBS Group as undervalued, current valuation based on its price-to-earnings ratio presents a more mixed picture. At 15.9 times earnings, UBS trades above the European Capital Markets industry average of 15.2 times, yet well below the peer average of 20.3 times and our fair ratio estimate of 25.3 times. This creates both risk and opportunity. Will UBS’s multiple fall in line with industry averages or move towards that fair ratio as confidence grows?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own UBS Group Narrative

If you think the story should be told differently, or want to dive into the numbers on your own terms, it's easy to assemble your own UBS Group narrative in just a few minutes: Do it your way.

A great starting point for your UBS Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Unlock new opportunities and get ahead of the crowd by checking out these standout stock collections. Don’t let great investments slip past you. Start building your edge today:

- Target reliable income streams by reviewing these 15 dividend stocks with yields > 3% with yields strong enough to boost your returns year after year.

- Catch the latest breakthroughs shaping healthcare by browsing these 30 healthcare AI stocks and spot innovators transforming medicine with artificial intelligence.

- Seize overlooked value by scanning these 917 undervalued stocks based on cash flows packed with stocks trading below their true potential based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:UBSG

UBS Group

Provides financial advice and solutions to private, institutional, and corporate clients worldwide.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives