Stock Analysis

- Switzerland

- /

- Machinery

- /

- SWX:SRAIL

Three Growth Companies On SIX Swiss Exchange With High Insider Ownership And Earnings Growth Of Up To 23%

Reviewed by Simply Wall St

Over the past week, Switzerland's market has experienced a 1.3% increase, while it has climbed 7.3% over the last year with earnings projected to grow by 8.2% annually. In such an environment, companies with high insider ownership and strong earnings growth can be particularly appealing as they often indicate a management team deeply invested in the company's success.

Top 10 Growth Companies With High Insider Ownership In Switzerland

| Name | Insider Ownership | Earnings Growth |

| Stadler Rail (SWX:SRAIL) | 14.5% | 23.1% |

| Straumann Holding (SWX:STMN) | 32.7% | 20.8% |

| VAT Group (SWX:VACN) | 10.2% | 20.1% |

| Swissquote Group Holding (SWX:SQN) | 11.4% | 13.7% |

| Temenos (SWX:TEMN) | 17.4% | 14.7% |

| Sonova Holding (SWX:SOON) | 17.7% | 9% |

| Gurit Holding (SWX:GURN) | 30.2% | 35.4% |

| SHL Telemedicine (SWX:SHLTN) | 17.9% | 96.2% |

| Sensirion Holding (SWX:SENS) | 20.7% | 75.4% |

| Arbonia (SWX:ARBN) | 28.8% | 100.1% |

We're going to check out a few of the best picks from our screener tool.

Partners Group Holding (SWX:PGHN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Partners Group Holding AG is a global private equity firm that engages in direct, secondary, and primary investments across various sectors including private equity, real estate, infrastructure, and debt, with a market capitalization of approximately CHF 32.31 billion.

Operations: The company generates revenue from several segments, including CHF 1.17 billion from Private Equity, CHF 186.90 million from Real Estate, CHF 379.20 million from Infrastructure, and CHF 211.30 million from Private Credit.

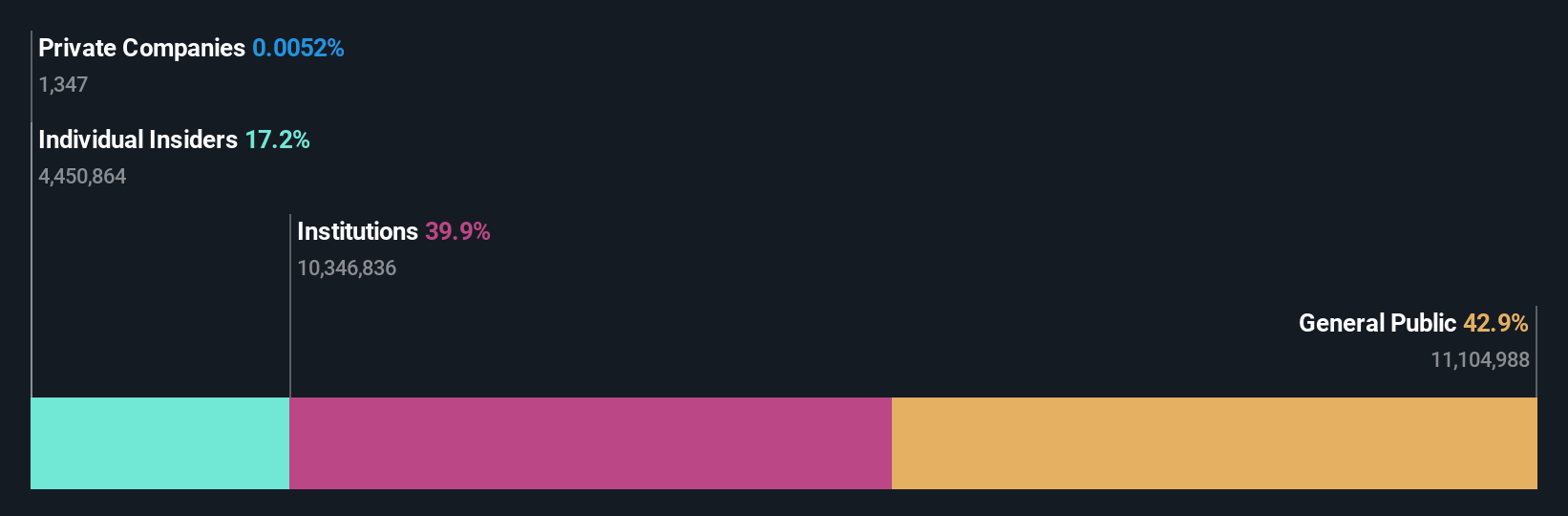

Insider Ownership: 17.1%

Earnings Growth Forecast: 13.6% p.a.

Partners Group Holding AG, a Swiss private equity firm, is poised for robust growth with its revenue forecast to increase by 14.3% annually, outpacing the Swiss market's 4.4%. However, its dividend sustainability is questionable as it's poorly covered by earnings and free cash flows. The company recently completed a CHF 300 million fixed-income offering and is exploring strategic options for Formosa Solar Renewable Power Co., potentially valued up to US$400 million. Despite high debt levels, Partners Group shows promising profit growth forecasts at 13.6% yearly.

- Click here and access our complete growth analysis report to understand the dynamics of Partners Group Holding.

- Upon reviewing our latest valuation report, Partners Group Holding's share price might be too optimistic.

Stadler Rail (SWX:SRAIL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Stadler Rail AG specializes in the manufacture and sale of trains across regions including Switzerland, Germany, Austria, Western and Eastern Europe, the Americas, and the CIS countries, with a market capitalization of approximately CHF 2.60 billion.

Operations: Stadler Rail AG's revenue is primarily derived from three segments: Rolling Stock, which generated CHF 3.12 billion; Service & Components, with revenues of CHF 767.55 million; and Signalling, contributing CHF 102.99 million.

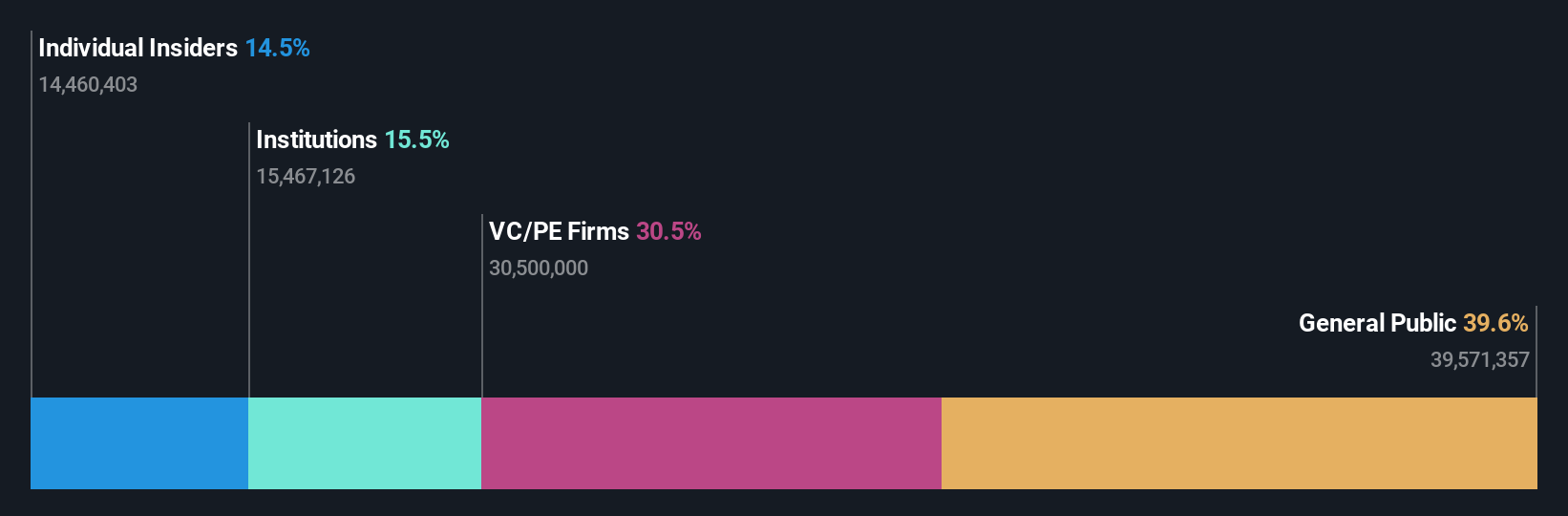

Insider Ownership: 14.5%

Earnings Growth Forecast: 23.1% p.a.

Stadler Rail, a Swiss rail manufacturer, shows promising growth with its earnings expected to increase significantly over the next three years. Despite a slower revenue growth rate of 7.7% per year compared to the broader market's 20%, its earnings are forecasted to outpace the Swiss market's average with an annual growth rate of 23.1%. However, Stadler Rail has an unstable dividend track record and no substantial insider trading activity in recent months. Its price-to-earnings ratio stands favorably at 21x, below the market average of 21.8x.

- Navigate through the intricacies of Stadler Rail with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Stadler Rail is priced higher than what may be justified by its financials.

Temenos (SWX:TEMN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Temenos AG is a global provider of integrated banking software systems, serving banks and financial institutions worldwide, with a market capitalization of approximately CHF 4.75 billion.

Operations: The firm operates globally, offering banking software solutions to various financial entities, with a market capitalization of roughly CHF 4.75 billion.

Insider Ownership: 17.4%

Earnings Growth Forecast: 14.7% p.a.

Temenos, a Swiss software company, recently announced a CHF 200 million share buyback and the selection by Haventree Bank for its digital transformation, highlighting its strategic growth initiatives. Despite trading at 22.9% below its estimated fair value and having high insider ownership, Temenos faces challenges with a high debt level and highly volatile share prices. Forecasted earnings growth of 14.7% per year outpaces the Swiss market's 8.2%, with revenue growth also expected to exceed market averages at 7.6% annually.

- Unlock comprehensive insights into our analysis of Temenos stock in this growth report.

- The analysis detailed in our Temenos valuation report hints at an deflated share price compared to its estimated value.

Where To Now?

- Explore the 16 names from our Fast Growing SIX Swiss Exchange Companies With High Insider Ownership screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Stadler Rail is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SRAIL

Stadler Rail

Through its subsidiaries, engages in the manufacture and sale of trains in Switzerland, Germany, Austria, Western and Eastern Europe, the Americas, the CIS countries, and internationally.

High growth potential with excellent balance sheet.