This article will reflect on the compensation paid to Lukas Ruflin who has served as CEO of Leonteq AG (VTX:LEON) since 2018. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

Check out our latest analysis for Leonteq

Comparing Leonteq AG's CEO Compensation With the industry

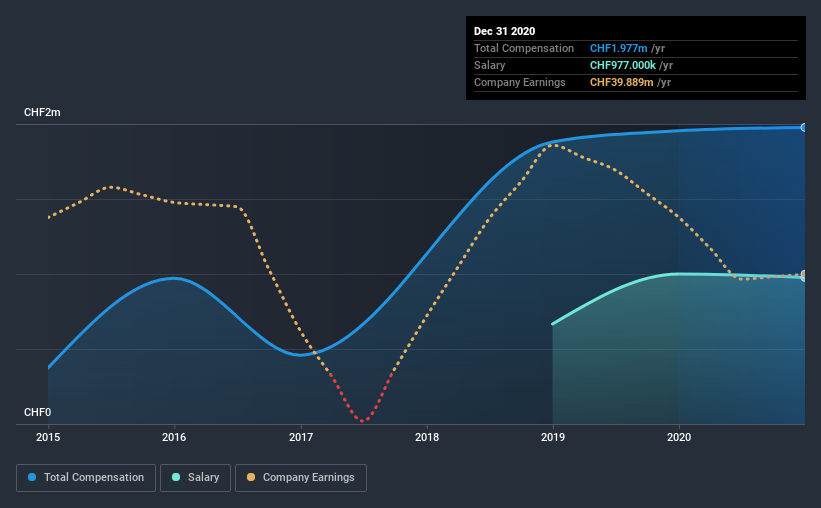

According to our data, Leonteq AG has a market capitalization of CHF864m, and paid its CEO total annual compensation worth CHF2.0m over the year to December 2020. This means that the compensation hasn't changed much from last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at CHF977k.

On examining similar-sized companies in the industry with market capitalizations between CHF357m and CHF1.4b, we discovered that the median CEO total compensation of that group was CHF921k. Accordingly, our analysis reveals that Leonteq AG pays Lukas Ruflin north of the industry median. Furthermore, Lukas Ruflin directly owns CHF73m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CHF977k | CHF1.0m | 49% |

| Other | CHF1.0m | CHF955k | 51% |

| Total Compensation | CHF2.0m | CHF2.0m | 100% |

On an industry level, around 57% of total compensation represents salary and 43% is other remuneration. Leonteq pays a modest slice of remuneration through salary, as compared to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Leonteq AG's Growth

Over the past three years, Leonteq AG has seen its earnings per share (EPS) grow by 14% per year. Its revenue is down 7.6% over the previous year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's always a tough situation when revenues are not growing, but ultimately profits are more important. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Leonteq AG Been A Good Investment?

Given the total shareholder loss of 15% over three years, many shareholders in Leonteq AG are probably rather dissatisfied, to say the least. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

As we noted earlier, Leonteq pays its CEO higher than the norm for similar-sized companies belonging to the same industry. However, we must not forget that the EPS growth has been very strong, but shareholder returns — over the same period — have been disappointing. Although we don't think the CEO pay is too high, considering negative investor returns, it is more generous than modest.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We identified 4 warning signs for Leonteq (1 is a bit concerning!) that you should be aware of before investing here.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

When trading Leonteq or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SWX:LEON

Leonteq

Provides derivative investment products and services in Switzerland, Europe, and Asia, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives