- Switzerland

- /

- Capital Markets

- /

- SWX:CFT

Compagnie Financière Tradition (VTX:CFT) Ticks All The Boxes When It Comes To Earnings Growth

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Compagnie Financière Tradition (VTX:CFT), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

How Fast Is Compagnie Financière Tradition Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. It certainly is nice to see that Compagnie Financière Tradition has managed to grow EPS by 20% per year over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

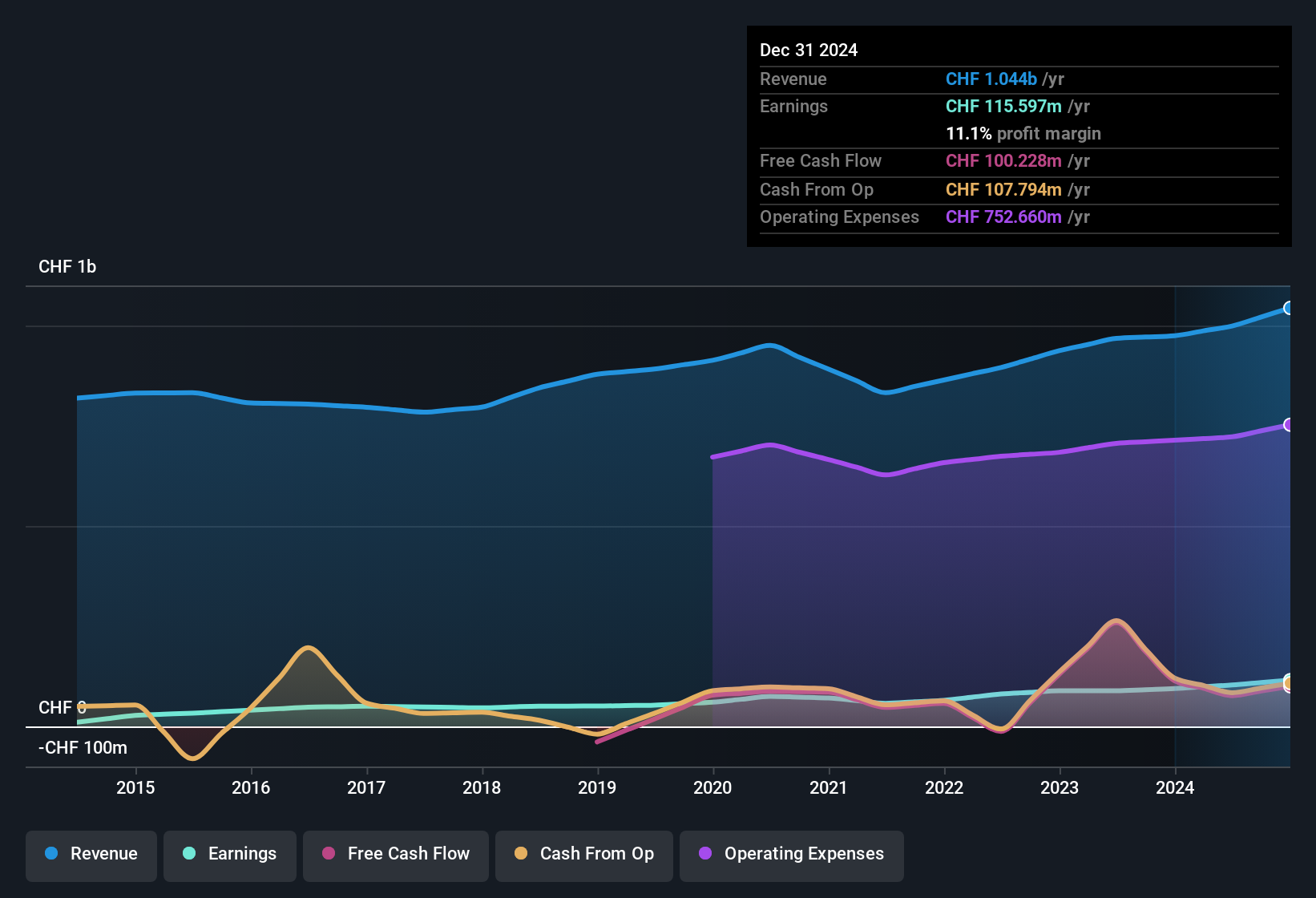

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. EBIT margins for Compagnie Financière Tradition remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 7.1% to CHF1.0b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

See our latest analysis for Compagnie Financière Tradition

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Compagnie Financière Tradition Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. Compagnie Financière Tradition followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. Notably, they have an enviable stake in the company, worth CHF211m. Coming in at 12% of the business, that holding gives insiders a lot of influence, and plenty of reason to generate value for shareholders. Looking very optimistic for investors.

Is Compagnie Financière Tradition Worth Keeping An Eye On?

For growth investors, Compagnie Financière Tradition's raw rate of earnings growth is a beacon in the night. With EPS growth rates like that, it's hardly surprising to see company higher-ups place confidence in the company through continuing to hold a significant investment. Fast growth and confident insiders should be enough to warrant further research, so it would seem that it's a good stock to follow. Once you've identified a business you like, the next step is to consider what you think it's worth. And right now is your chance to view our exclusive discounted cashflow valuation of Compagnie Financière Tradition. You might benefit from giving it a glance today.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Swiss companies which have demonstrated growth backed by significant insider holdings.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:CFT

Compagnie Financière Tradition

Operates as an interdealer broker of financial and non-financial products worldwide.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives