- Switzerland

- /

- Capital Markets

- /

- SWX:CFT

Assessing Compagnie Financière Tradition (SWX:CFT): Does Recent Investor Interest Reflect the Company’s True Valuation?

Reviewed by Simply Wall St

Price-to-Earnings of 16.5x: Is it justified?

Compagnie Financière Tradition is currently trading at a Price-to-Earnings (P/E) ratio of 16.5x, which is higher than both its peer group’s average and the broader industry. This signals that the market is attaching a premium to the company compared to its competitors.

The P/E ratio compares a company's share price to its per-share earnings and provides an indication of how much investors are willing to pay for each unit of net income. For diversified financials, this metric is a key barometer of market expectations for future profitability and growth.

In this case, investors may be overpricing the company’s expected earnings, since the P/E ratio of 16.5x outpaces both the peer average of 14.2x and the European Capital Markets industry average of 15.8x. The premium valuation suggests optimism about Compagnie Financière Tradition’s outlook, but it could also result in a less compelling entry point for new investors if future growth falls short of expectations.

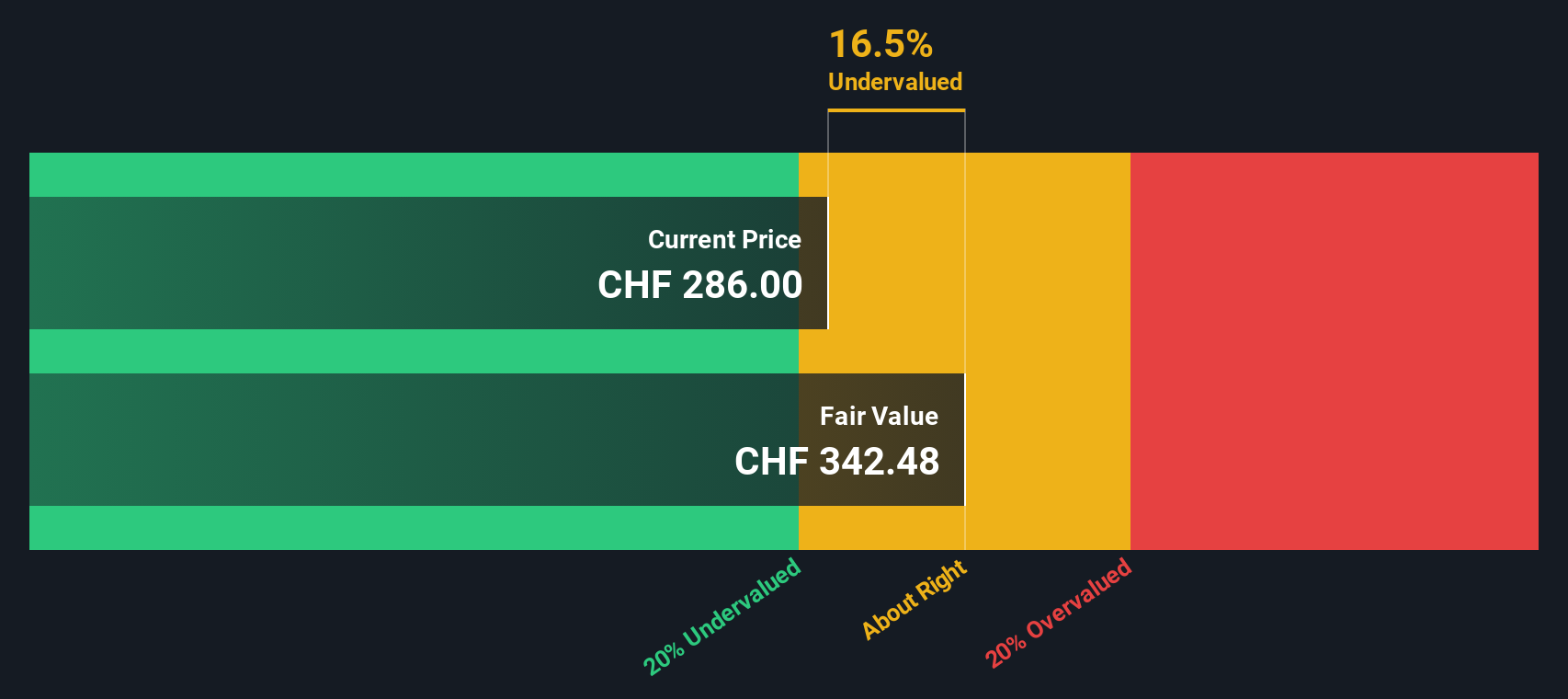

Result: Fair Value of $342.7 (UNDERVALUED)

See our latest analysis for Compagnie Financière Tradition.However, risks remain, such as a shift in market sentiment or slower than expected earnings growth, which could challenge the company’s current momentum.

Find out about the key risks to this Compagnie Financière Tradition narrative.Another View: What Does the DCF Model Say?

While the current market price appears expensive compared to industry averages, our SWS DCF model offers a different perspective and points toward undervaluation. Could the market be overlooking the company’s true potential, or is the optimism already reflected in the price?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Compagnie Financière Tradition Narrative

If you see things differently or want a hands-on approach, you can quickly review the data and develop your own perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Compagnie Financière Tradition.

Looking for more investment ideas?

Smart investors always stay one step ahead. Don’t let the next opportunity slip by. Expand your watchlist using these powerful searches and make your next move with confidence.

- Target stocks with untapped upside by using our screen for undervalued stocks based on cash flows and get ahead of market mispricings before others spot them.

- Ride the AI wave and seize early growth potential by scanning through high-potential companies with AI penny stocks.

- Unlock reliable income streams by selecting companies offering strong yields with our advanced tool for dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About SWX:CFT

Compagnie Financière Tradition

Operates as an interdealer broker of financial and non-financial products worldwide.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives