- Switzerland

- /

- Capital Markets

- /

- SWX:BAER

Top Dividend Stocks To Consider In January 2025

Reviewed by Simply Wall St

As we approach January 2025, global markets are navigating a complex landscape marked by fluctuating consumer confidence and mixed economic signals. Despite these challenges, major stock indexes have shown resilience with moderate gains, highlighting the potential for dividend stocks to offer stability and income in uncertain times. In this context, selecting dividend stocks that demonstrate consistent payouts and strong fundamentals can be an effective strategy for investors seeking reliable returns amidst market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.33% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.36% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.26% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

Click here to see the full list of 1940 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Commercial Bank of Dubai PSC (DFM:CBD)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Commercial Bank of Dubai PSC offers commercial and retail banking services in the United Arab Emirates, with a market cap of AED21.43 billion.

Operations: Commercial Bank of Dubai PSC's revenue segments include Personal Banking at AED1.96 billion, Institutional Banking at AED1.11 billion, and Corporate Banking at AED575.40 million.

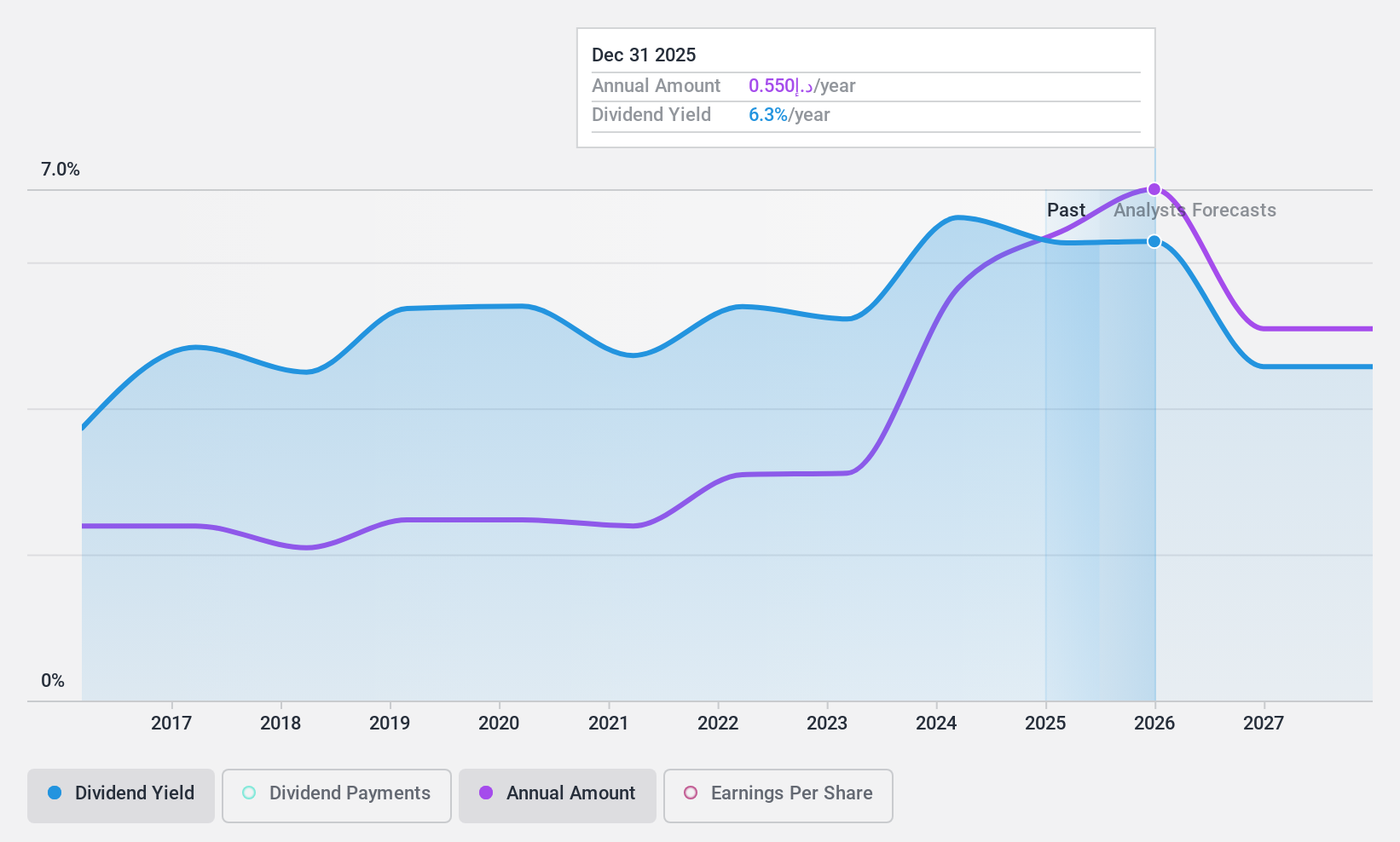

Dividend Yield: 6.2%

Commercial Bank of Dubai PSC offers an attractive dividend yield of 6.18%, ranking in the top 25% of AE market payers, with dividends well-covered by earnings at a payout ratio of 47.1%. The bank's stable and reliable dividend history over the past decade is supported by consistent earnings growth, though it faces challenges with a high bad loans ratio at 5.9%. Recent strategic partnerships, such as a AED 2 billion financing deal with RAK Properties, highlight its active role in regional development initiatives.

- Unlock comprehensive insights into our analysis of Commercial Bank of Dubai PSC stock in this dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Commercial Bank of Dubai PSC shares in the market.

Julius Bär Gruppe (SWX:BAER)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Julius Bär Gruppe AG is a Swiss company offering wealth management solutions across Switzerland, Europe, the Americas, Asia, and internationally with a market cap of CHF12.01 billion.

Operations: Julius Bär Gruppe AG's revenue primarily comes from its Private Banking segment, which generated CHF3.15 billion.

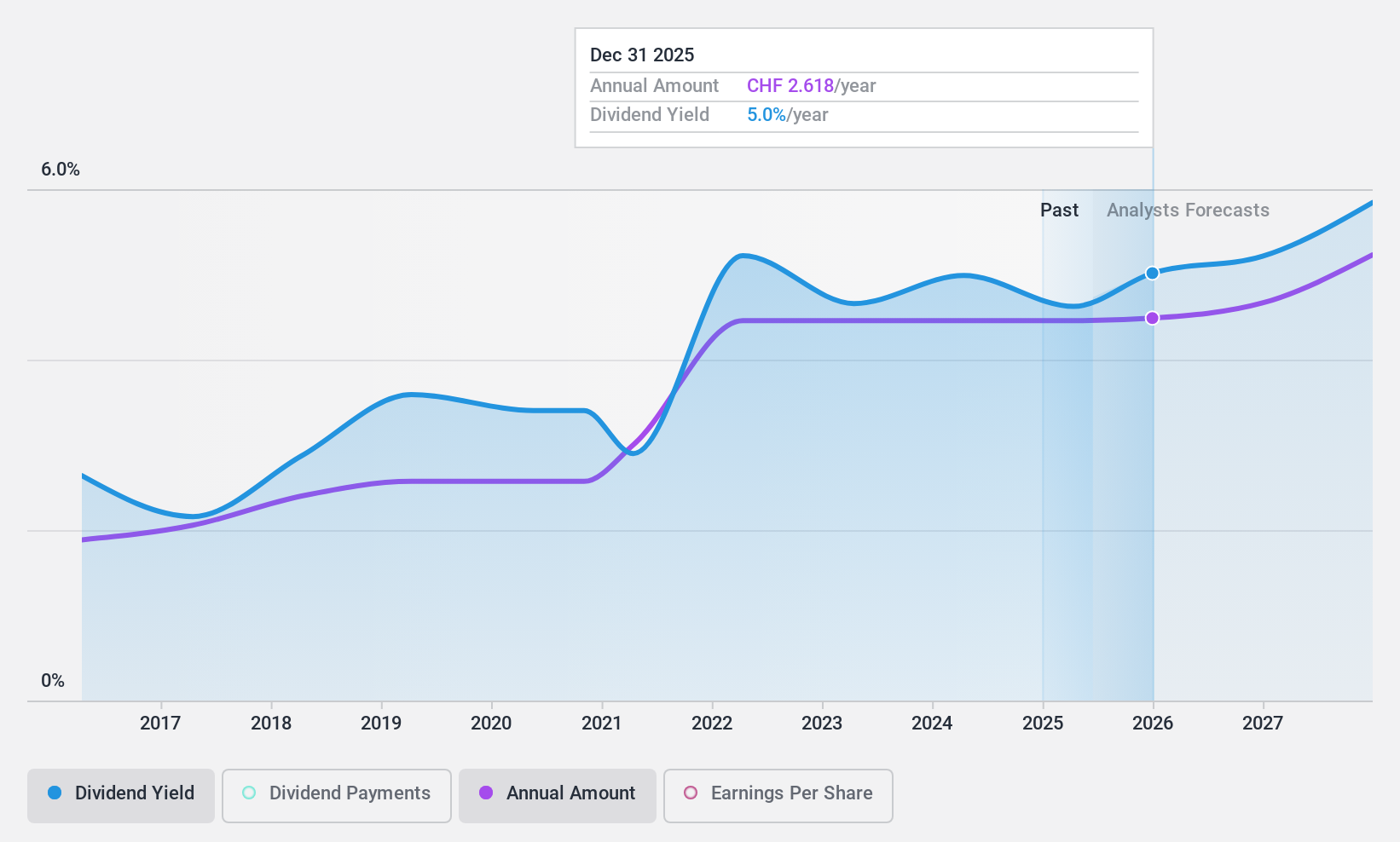

Dividend Yield: 4.4%

Julius Bär Gruppe offers a dividend yield of 4.43%, placing it in the top 25% of Swiss market payers, although its high payout ratio of 142.7% indicates dividends are not well covered by earnings. Despite stable and reliable dividend growth over the past decade, concerns arise from a low allowance for bad loans at 84% and a high bad loans ratio of 2.1%. M&A discussions regarding its Brazil unit may impact future strategic directions.

- Get an in-depth perspective on Julius Bär Gruppe's performance by reading our dividend report here.

- According our valuation report, there's an indication that Julius Bär Gruppe's share price might be on the expensive side.

Nishoku Technology (TWSE:3679)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nishoku Technology Inc. designs and manufactures plastic injection molds, serving markets in Taiwan, the rest of Asia, the United States, Europe, and internationally, with a market cap of NT$8.29 billion.

Operations: Nishoku Technology Inc.'s revenue primarily comes from the provision of electronic components and related products, totaling NT$4.03 billion.

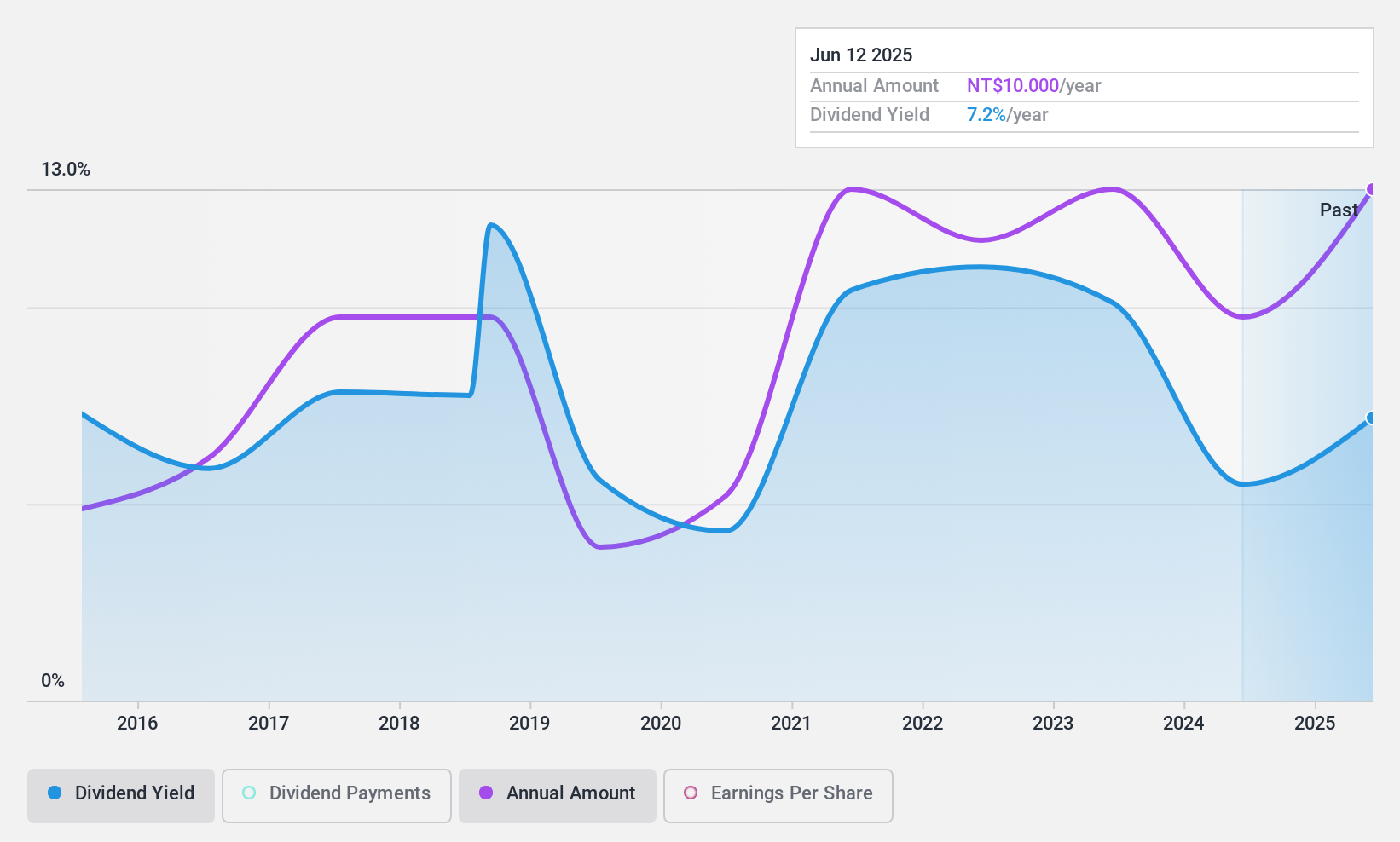

Dividend Yield: 5.7%

Nishoku Technology's dividend yield of 5.7% ranks in the top 25% of the Taiwan market, yet its high cash payout ratio of 138.1% suggests dividends aren't well covered by cash flows. Earnings cover the current payout ratio of 82.6%, but dividend payments have been volatile and unreliable over the past decade, despite some growth. Recent earnings show increased revenue to TWD 3.02 billion for nine months ending September 2024, with net income rising to TWD 548.96 million year-over-year.

- Click here to discover the nuances of Nishoku Technology with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Nishoku Technology's current price could be inflated.

Taking Advantage

- Click here to access our complete index of 1940 Top Dividend Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:BAER

Julius Bär Gruppe

Provides wealth management solutions in Switzerland, Europe, the Americas, Asia, and internationally.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026