- Switzerland

- /

- Capital Markets

- /

- SWX:AIRE

If You Had Bought Airesis' (VTX:AIRE) Shares Three Years Ago You Would Be Down 25%

As an investor its worth striving to ensure your overall portfolio beats the market average. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. Unfortunately, that's been the case for longer term Airesis SA (VTX:AIRE) shareholders, since the share price is down 25% in the last three years, falling well short of the market return of around 18%. And over the last year the share price fell 24%, so we doubt many shareholders are delighted.

See our latest analysis for Airesis

Airesis isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over three years, Airesis grew revenue at 2.1% per year. That's not a very high growth rate considering it doesn't make profits. The stock dropped 8% during that time. Shareholders will probably be hoping growth picks up soon. But ultimately the key will be whether the company can become profitability.

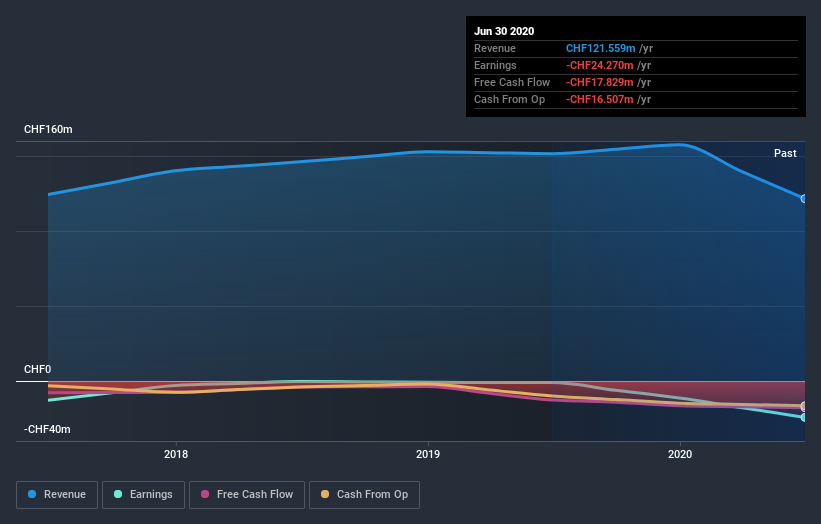

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at Airesis' financial health with this free report on its balance sheet.

A Different Perspective

Airesis shareholders are down 24% for the year, but the market itself is up 1.6%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 2% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Airesis is showing 2 warning signs in our investment analysis , and 1 of those doesn't sit too well with us...

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CH exchanges.

When trading Airesis or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SWX:AIRE

Airesis

A private equity and venture capital firm specializing in early, mid, and late venture, emerging growth, growth capital, turnaround, buyouts, and pre-IPO transactions.

Moderate and slightly overvalued.