- Switzerland

- /

- Building

- /

- SWX:FORN

Does Forbo Holding's (VTX:FORN) CEO Salary Compare Well With Industry Peers?

Stephan Bauer became the CEO of Forbo Holding AG (VTX:FORN) in 2014, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also assess whether Forbo Holding pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

View our latest analysis for Forbo Holding

Comparing Forbo Holding AG's CEO Compensation With the industry

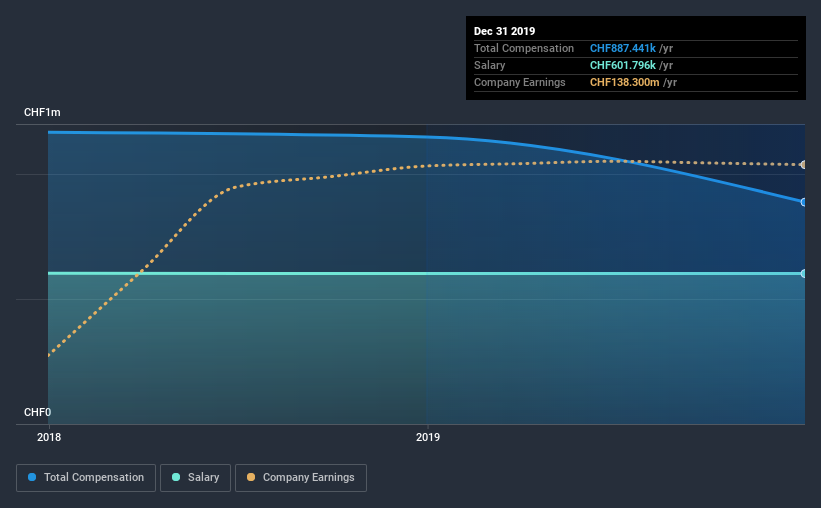

Our data indicates that Forbo Holding AG has a market capitalization of CHF2.2b, and total annual CEO compensation was reported as CHF887k for the year to December 2019. That's a notable decrease of 23% on last year. In particular, the salary of CHF601.8k, makes up a huge portion of the total compensation being paid to the CEO.

On examining similar-sized companies in the industry with market capitalizations between CHF945m and CHF3.0b, we discovered that the median CEO total compensation of that group was CHF2.4m. In other words, Forbo Holding pays its CEO lower than the industry median. Moreover, Stephan Bauer also holds CHF3.6m worth of Forbo Holding stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | CHF602k | CHF602k | 68% |

| Other | CHF286k | CHF546k | 32% |

| Total Compensation | CHF887k | CHF1.1m | 100% |

On a industry level, around 47% of total compensation represents salary and 53% is other remuneration. Forbo Holding is paying a higher share of its remuneration through a salary in comparison to the overall industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Forbo Holding AG's Growth

Over the past three years, Forbo Holding AG has seen its earnings per share (EPS) grow by 5.0% per year. Its revenue is down 3.4% over the previous year.

We would argue that the lack of revenue growth in the last year is less than ideal, but the modest EPS growth gives us some relief. It's hard to reach a conclusion about business performance right now. This may be one to watch. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Forbo Holding AG Been A Good Investment?

With a three year total loss of 8.4% for the shareholders, Forbo Holding AG would certainly have some dissatisfied shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

As previously discussed, Stephan is compensated less than what is normal for CEOs of companies of similar size, and which belong to the same industry. But the EPS growth is lacking, just like the returns (over three years). So while we don't think, Stephan is paid too much, shareholders may hope that business performance translates to investment returns before pay rises are given out.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We did our research and spotted 1 warning sign for Forbo Holding that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you decide to trade Forbo Holding, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account.Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SWX:FORN

Forbo Holding

Produces and sells floor coverings, building and construction adhesives, and power transmission and conveyor belt solutions in Europe, the Americas, Asia Pacific, and Africa.

Very undervalued with flawless balance sheet and pays a dividend.