Three Potentially Undervalued Stocks On SIX Swiss Exchange With Discounts Ranging From 31.3% To 36.8%

Reviewed by Simply Wall St

The Switzerland market has recently experienced a downturn, with the benchmark SMI index closing lower amid profit-taking and concerns over potential interest rate hikes influenced by rising consumer prices in the U.K. This recent pullback follows a prolonged period of gains, highlighting the cyclical nature of stock markets. In such conditions, identifying stocks that appear undervalued could offer investors opportunities for potential value growth as market dynamics evolve.

Top 10 Undervalued Stocks Based On Cash Flows In Switzerland

| Name | Current Price | Estimated Fair Value | Estimated Discount |

| Temenos (SWX:TEMN) | CHF58.00 | CHF84.39 | 31.3% |

| Swissquote Group Holding (SWX:SQN) | CHF270.40 | CHF361.19 | 25.1% |

| COLTENE Holding (SWX:CLTN) | CHF53.00 | CHF77.67 | 31.8% |

| Sonova Holding (SWX:SOON) | CHF291.50 | CHF448.53 | 35% |

| Julius Bär Gruppe (SWX:BAER) | CHF54.28 | CHF95.29 | 43% |

| Comet Holding (SWX:COTN) | CHF340.00 | CHF538.06 | 36.8% |

| SGS (SWX:SGSN) | CHF83.16 | CHF124.13 | 33% |

| Medartis Holding (SWX:MED) | CHF77.00 | CHF122.72 | 37.3% |

| Medacta Group (SWX:MOVE) | CHF122.40 | CHF151.84 | 19.4% |

| Lonza Group (SWX:LONN) | CHF510.60 | CHF679.27 | 24.8% |

Here's a peek at a few of the choices from the screener.

Comet Holding (SWX:COTN)

Overview: Comet Holding AG operates globally, offering X-ray and radio frequency (RF) power technology solutions across Europe, North America, Asia, and other regions, with a market capitalization of approximately CHF 2.64 billion.

Operations: Comet Holding's revenue is generated from three primary segments: X-Ray Systems (IXS) which brought in CHF 116.96 million, Industrial X-Ray Modules (IXM) contributing CHF 100.26 million, and Plasma Control Technologies (PCT) accounting for CHF 193.16 million.

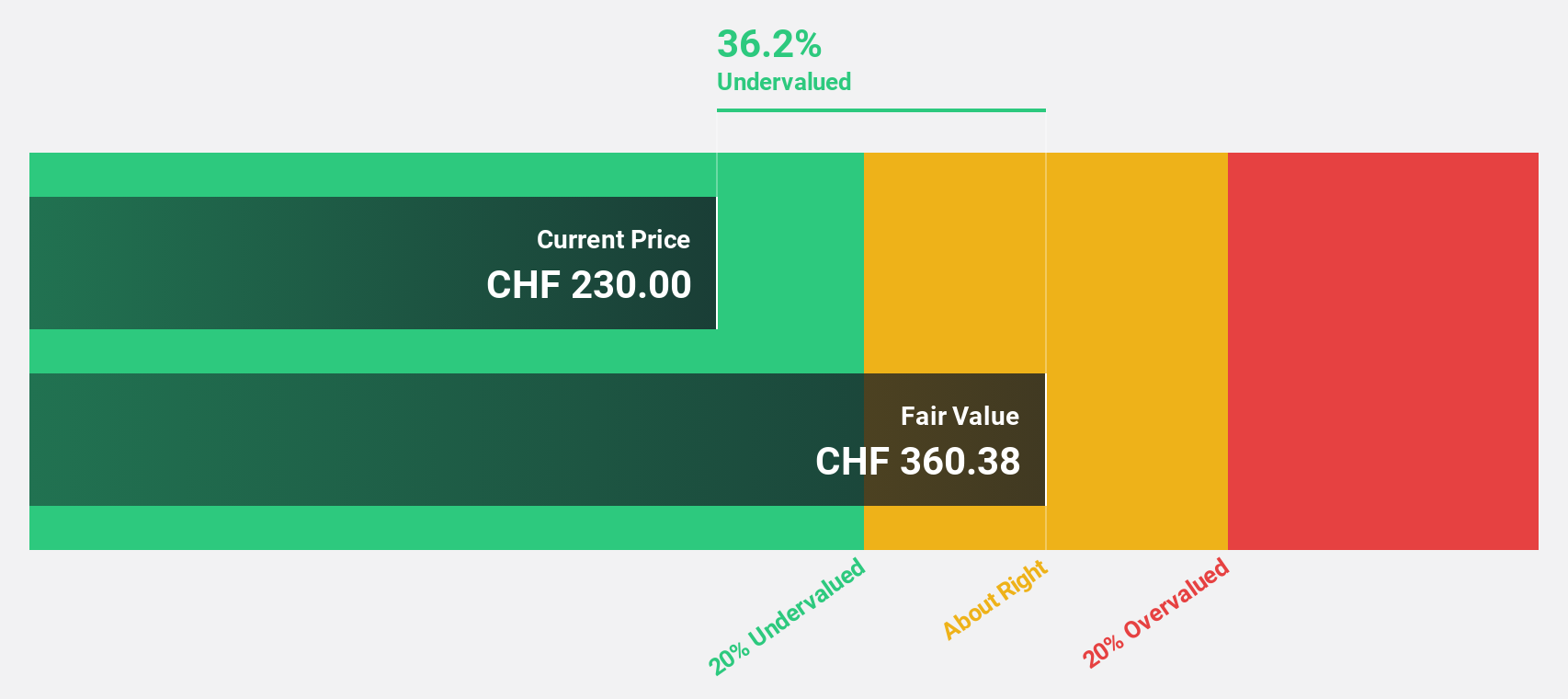

Estimated Discount To Fair Value: 36.8%

Comet Holding AG, with a current trading price of CHF 340, appears undervalued based on discounted cash flow analysis, suggesting a fair value of CHF 538.06. Despite a significant drop in sales and net income in the past year, earnings are expected to rebound strongly with an annual growth rate of 41.27%. However, recent performance shows weakened profit margins from 13.3% to 3.9%. The company's robust forecasted return on equity at 35.1% contrasts these challenges, indicating potential for recovery and growth.

- The growth report we've compiled suggests that Comet Holding's future prospects could be on the up.

- Click here to discover the nuances of Comet Holding with our detailed financial health report.

SGS (SWX:SGSN)

Overview: SGS SA operates globally, offering inspection, testing, and verification services across various regions including Europe, Africa, the Middle East, the Americas, and Asia Pacific, with a market capitalization of CHF 15.74 billion.

Operations: The company's revenue is diversified across several segments, with Industries & Environment generating CHF 2.19 billion, Natural Resources at CHF 1.58 billion, Connectivity & Products contributing CHF 1.25 billion, Health & Nutrition at CHF 0.86 billion, and Business Assurance bringing in CHF 0.75 billion.

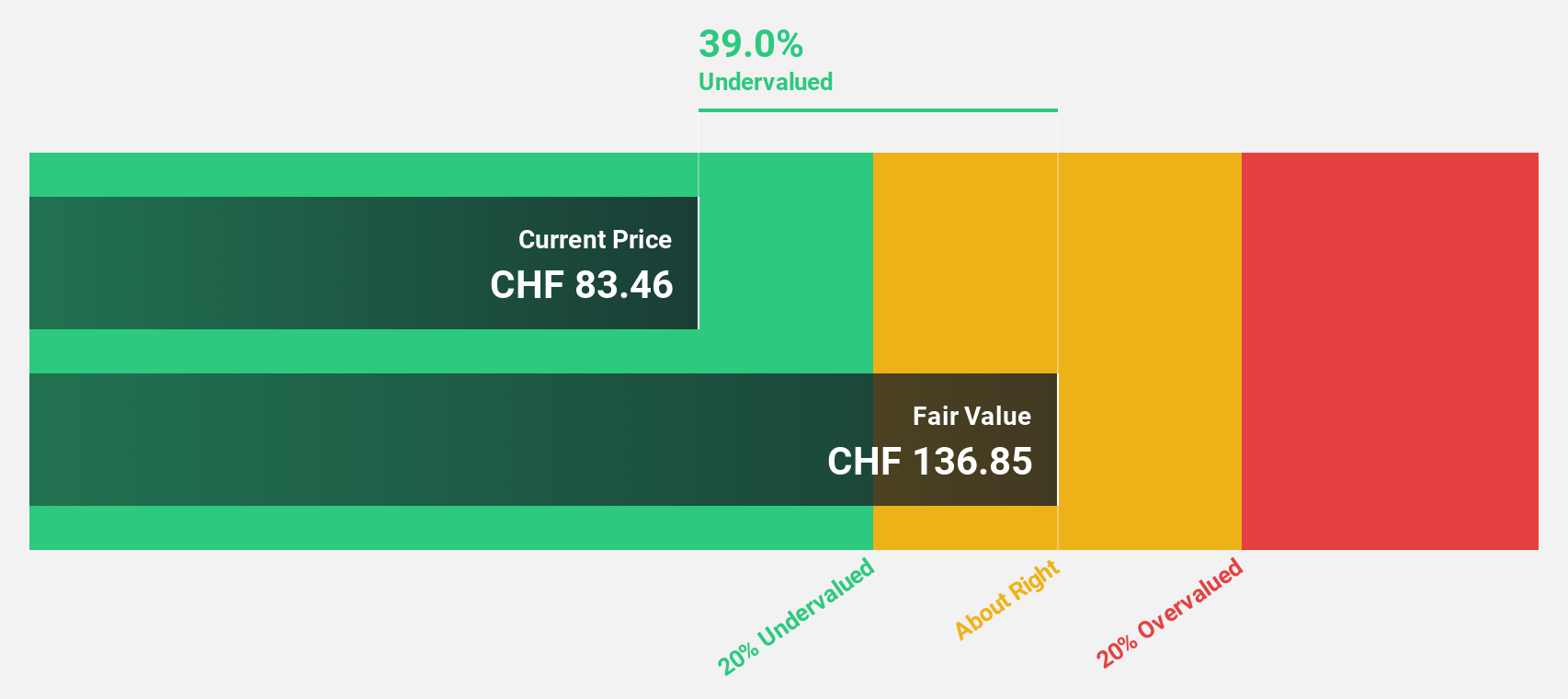

Estimated Discount To Fair Value: 33%

SGS SA, priced at CHF 83.16, trades below its estimated fair value of CHF 124.13, indicating potential undervaluation based on discounted cash flow analysis. Despite a high level of debt and shareholder dilution over the past year, SGS's earnings are expected to grow by 10% annually, outpacing the Swiss market projection of 8.1%. Recent sales reports show a strong organic growth offset by negative currency impacts, with mid to high single-digit growth anticipated for the year.

- Our comprehensive growth report raises the possibility that SGS is poised for substantial financial growth.

- Navigate through the intricacies of SGS with our comprehensive financial health report here.

Temenos (SWX:TEMN)

Overview: Temenos AG is a global provider of integrated banking software systems to financial institutions, with a market capitalization of approximately CHF 4.20 billion.

Operations: The company generates its revenue by marketing and selling integrated banking software systems to financial institutions globally.

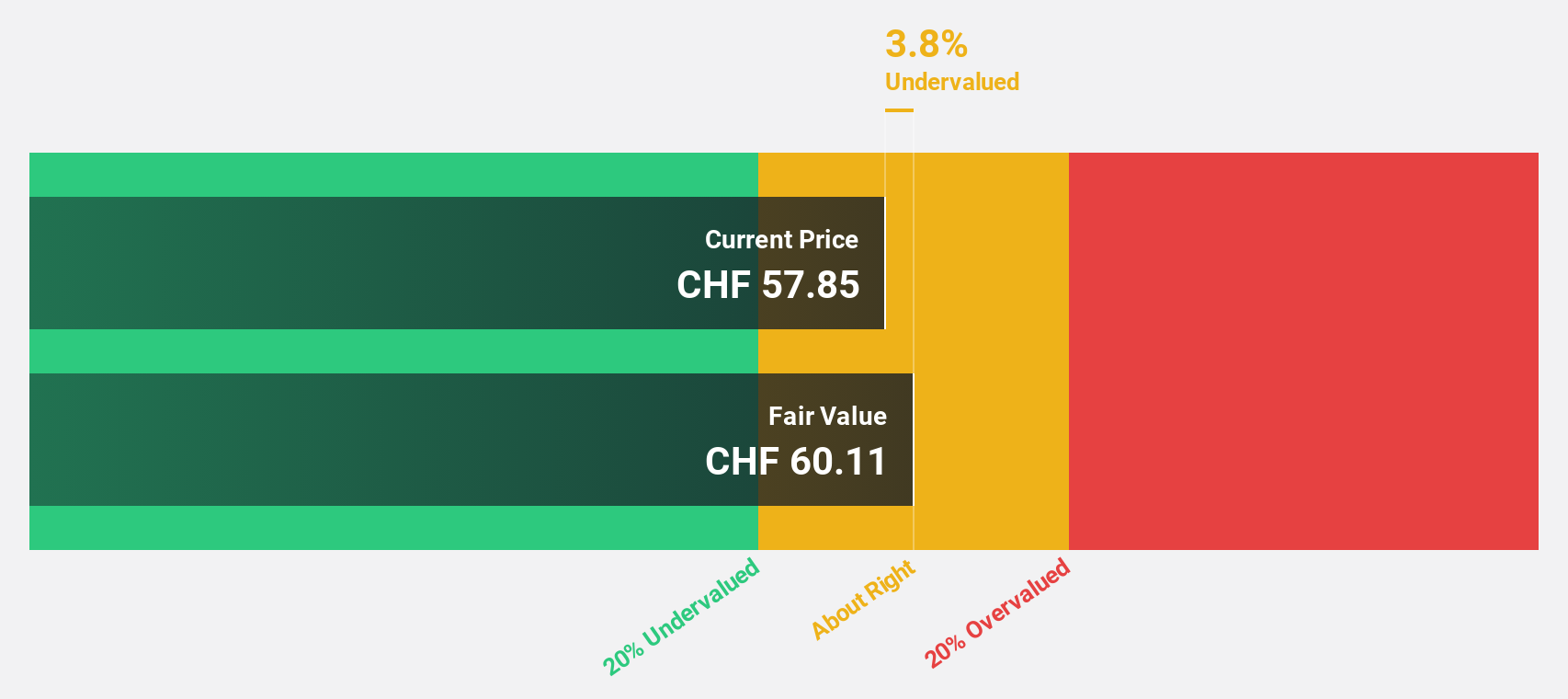

Estimated Discount To Fair Value: 31.3%

Temenos, valued at CHF 58, is considered undervalued with a fair value estimate of CHF 84.39 based on discounted cash flow analysis. It trades at a significant discount to this valuation and has shown robust earnings growth of 14.72% over the past year, outperforming the Swiss market's average. Despite its high debt levels and volatile share price recently, Temenos maintains stable dividends at 2.06%. Recent advancements in its cloud-native banking platform demonstrate significant efficiency improvements and reduced carbon impact, enhancing its appeal in sustainability-focused banking sectors.

- In light of our recent growth report, it seems possible that Temenos' financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of Temenos stock in this financial health report.

Where To Now?

- Dive into all 12 of the Undervalued SIX Swiss Exchange Stocks Based On Cash Flows we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management .

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:COTN

Comet Holding

Provides X-ray and radio frequency (RF) power technology solutions in Europe, North America, Asia, and internationally.

Exceptional growth potential with flawless balance sheet.