- Switzerland

- /

- Machinery

- /

- SWX:VACN

3 Stocks On SIX Swiss Exchange Trading At Up To 49.3% Discount

Reviewed by Simply Wall St

The Switzerland market closed higher on Friday, buoyed by optimism surrounding potential interest rate cuts from the Federal Reserve. With the benchmark SMI posting modest gains, investors are keenly watching for undervalued opportunities that could benefit from these favorable conditions. In this article, we explore three stocks on the SIX Swiss Exchange trading at up to a 49.3% discount, offering potential value amid an optimistic economic outlook.

Top 10 Undervalued Stocks Based On Cash Flows In Switzerland

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| LEM Holding (SWX:LEHN) | CHF1316.00 | CHF1835.93 | 28.3% |

| Swissquote Group Holding (SWX:SQN) | CHF289.20 | CHF570.93 | 49.3% |

| Georg Fischer (SWX:GF) | CHF62.65 | CHF112.78 | 44.4% |

| ALSO Holding (SWX:ALSN) | CHF262.50 | CHF413.97 | 36.6% |

| lastminute.com (SWX:LMN) | CHF18.72 | CHF29.51 | 36.6% |

| Clariant (SWX:CLN) | CHF12.42 | CHF21.54 | 42.3% |

| Comet Holding (SWX:COTN) | CHF313.00 | CHF531.50 | 41.1% |

| Barry Callebaut (SWX:BARN) | CHF1455.00 | CHF2370.57 | 38.6% |

| SGS (SWX:SGSN) | CHF95.54 | CHF144.81 | 34% |

| Dätwyler Holding (SWX:DAE) | CHF172.20 | CHF252.09 | 31.7% |

Let's take a closer look at a couple of our picks from the screened companies.

Swissquote Group Holding (SWX:SQN)

Overview: Swissquote Group Holding Ltd offers a comprehensive range of online financial services to retail, affluent, and professional institutional investors globally, with a market cap of CHF4.30 billion.

Operations: Swissquote Group Holding Ltd generates revenue from Leveraged Forex (CHF93.28 million) and Securities Trading (CHF488.98 million).

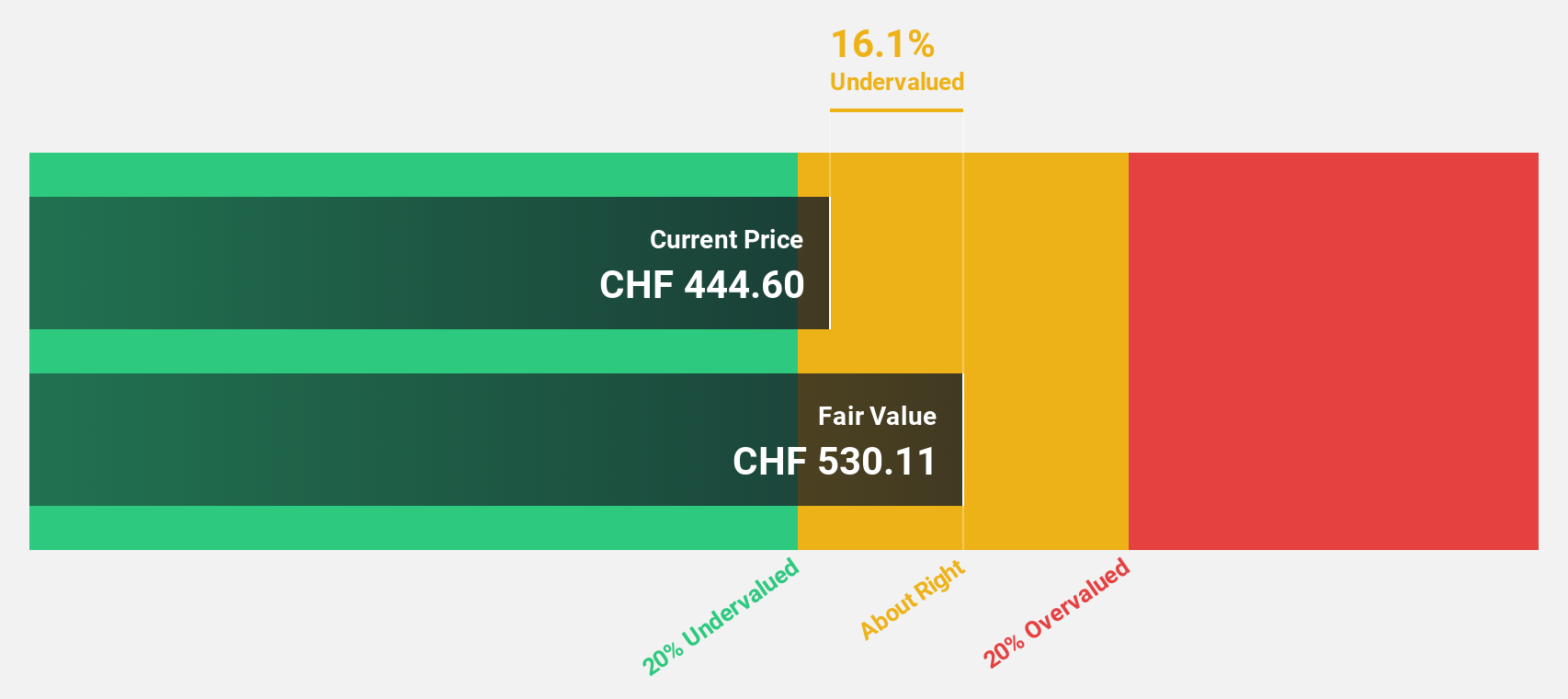

Estimated Discount To Fair Value: 49.3%

Swissquote Group Holding appears undervalued based on cash flows, trading at CHF289.2, significantly below its estimated fair value of CHF570.93. The company's earnings grew by 36.9% over the past year and are forecast to grow 13.07% annually, outpacing the Swiss market's average growth rate of 11.7%. Recent earnings results for H1 2024 showed net income of CHF144.56 million, up from CHF106.53 million a year ago, with basic EPS rising to CHF9.69 from CHF7.15.

- The growth report we've compiled suggests that Swissquote Group Holding's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Swissquote Group Holding.

u-blox Holding (SWX:UBXN)

Overview: u-blox Holding AG develops, manufactures, and markets GPS/GNSS satellite positioning systems for various sectors globally and has a market cap of CHF545.22 million.

Operations: The company generates CHF365.79 million from its Wireless Communications Equipment segment, which supports GPS/GNSS satellite positioning systems across automotive, industrial, and consumer markets worldwide.

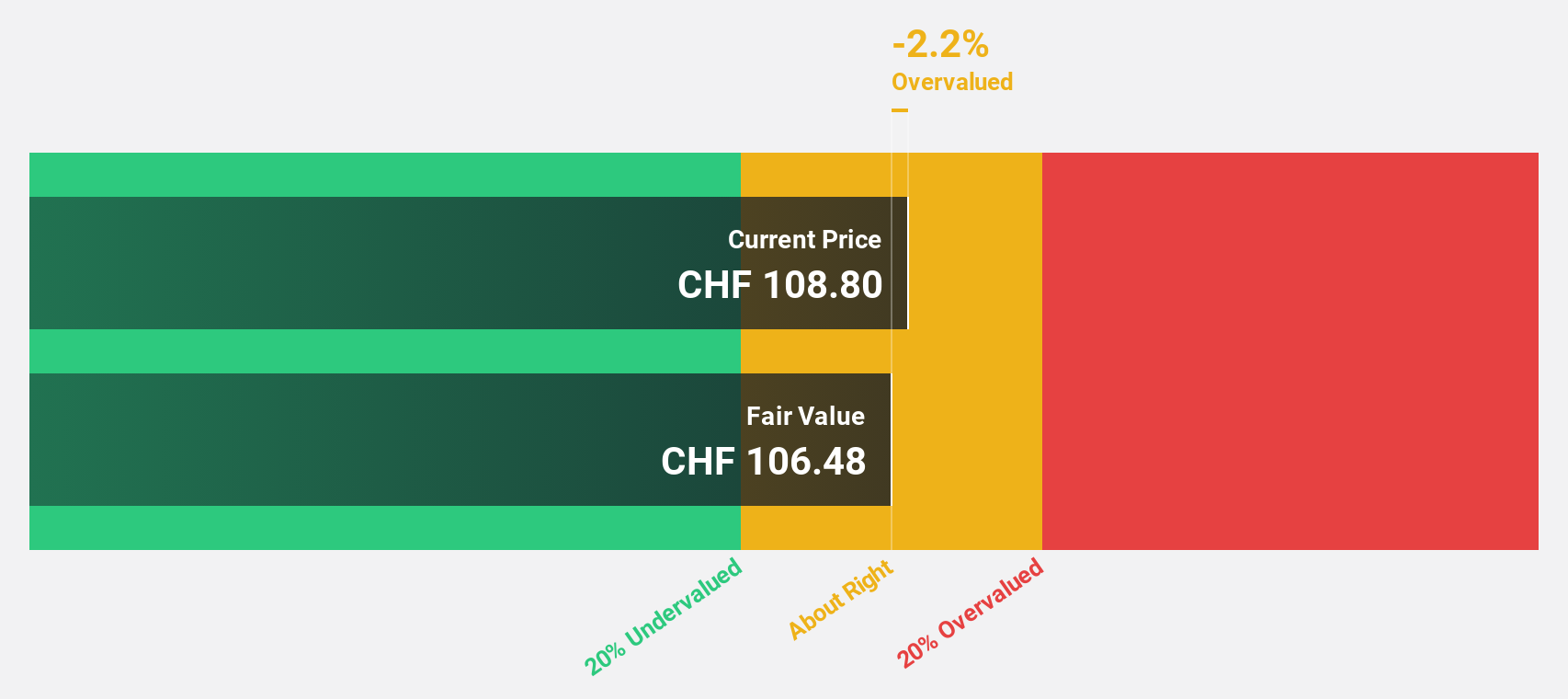

Estimated Discount To Fair Value: 23.9%

u-blox Holding, trading at CHF74, is significantly undervalued with an estimated fair value of CHF97.29. Despite recent earnings showing a net loss of CHF25.79 million for H1 2024, the company is forecast to grow its revenue by 16.7% annually and become profitable within three years. Recent partnerships and product launches in IoT and GNSS markets enhance its growth potential, positioning u-blox well in the expanding micromobility sector valued at US$114.15 billion in 2024.

- Upon reviewing our latest growth report, u-blox Holding's projected financial performance appears quite optimistic.

- Click here to discover the nuances of u-blox Holding with our detailed financial health report.

VAT Group (SWX:VACN)

Overview: VAT Group AG, with a market cap of CHF12.24 billion, develops, manufactures, and supplies vacuum valves, multi-valve units, vacuum modules, and edge-welded metal bellows across Switzerland, Europe, the United States, Japan, Korea, Singapore, China and other international markets.

Operations: Revenue segments for VAT Group AG include Valves at CHF783.51 million and Global Service at CHF163.83 million.

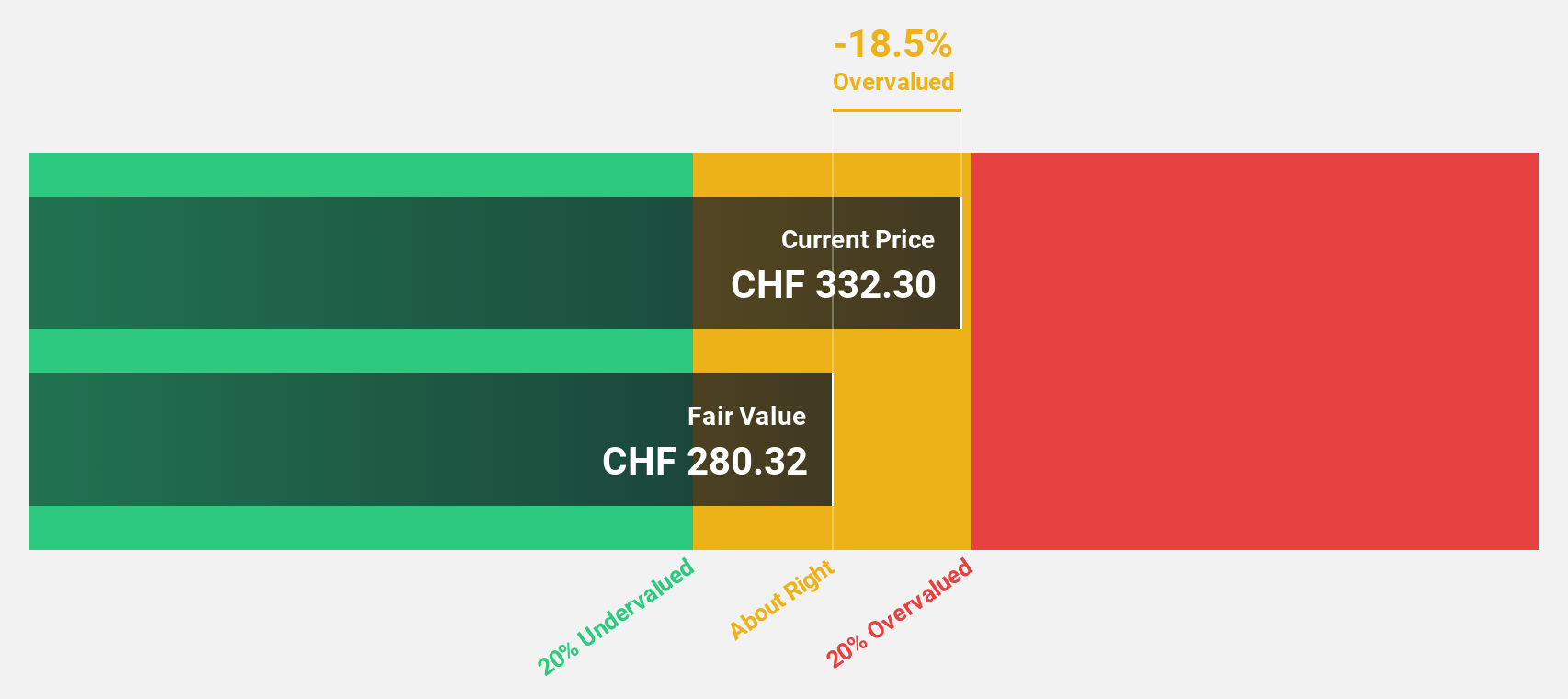

Estimated Discount To Fair Value: 27.1%

VAT Group AG, trading at CHF408.4, is trading 27.1% below its estimated fair value of CHF560.33 based on discounted cash flow analysis. The company's earnings are forecast to grow significantly at 22.48% per year, outpacing the Swiss market's expected growth of 11.7%. Recent H1 2024 results showed a net income increase to CHF94 million from CHF84.2 million a year ago, with basic earnings per share rising to CHF3.14 from CHF2.81.

- According our earnings growth report, there's an indication that VAT Group might be ready to expand.

- Navigate through the intricacies of VAT Group with our comprehensive financial health report here.

Taking Advantage

- Explore the 16 names from our Undervalued SIX Swiss Exchange Stocks Based On Cash Flows screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:VACN

VAT Group

Develops, manufactures, and supplies vacuum valves, multi-valve units, vacuum modules, and edge-welded metal bellows in Switzerland, rest of Europe, the United States, Japan, Korea, Singapore, China, rest of Asia, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives