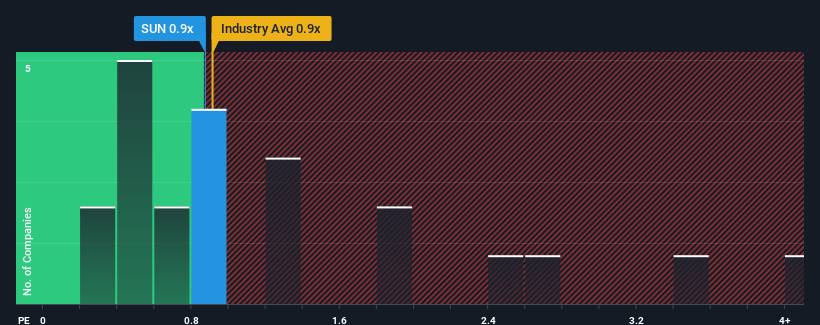

There wouldn't be many who think Sulzer Ltd's (VTX:SUN) price-to-sales (or "P/S") ratio of 0.9x is worth a mention when the median P/S for the Machinery industry in Switzerland is very similar. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Sulzer

What Does Sulzer's P/S Mean For Shareholders?

Sulzer could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Sulzer's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Sulzer's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 2.8%. Still, lamentably revenue has fallen 8.1% in aggregate from three years ago, which is disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 4.9% each year during the coming three years according to the five analysts following the company. With the industry predicted to deliver 4.8% growth each year, the company is positioned for a comparable revenue result.

With this information, we can see why Sulzer is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What Does Sulzer's P/S Mean For Investors?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

A Sulzer's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Machinery industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Sulzer with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on Sulzer, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:SUN

Sulzer

Develops and sells products and services for fluid engineering and chemical processing applications worldwide.

Outstanding track record with excellent balance sheet and pays a dividend.