- Switzerland

- /

- Electrical

- /

- SWX:ROL

Von Roll Holding (VTX:ROL) Share Prices Have Dropped 47% In The Last Three Years

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. We regret to report that long term Von Roll Holding AG (VTX:ROL) shareholders have had that experience, with the share price dropping 47% in three years, versus a market return of about 21%.

Check out our latest analysis for Von Roll Holding

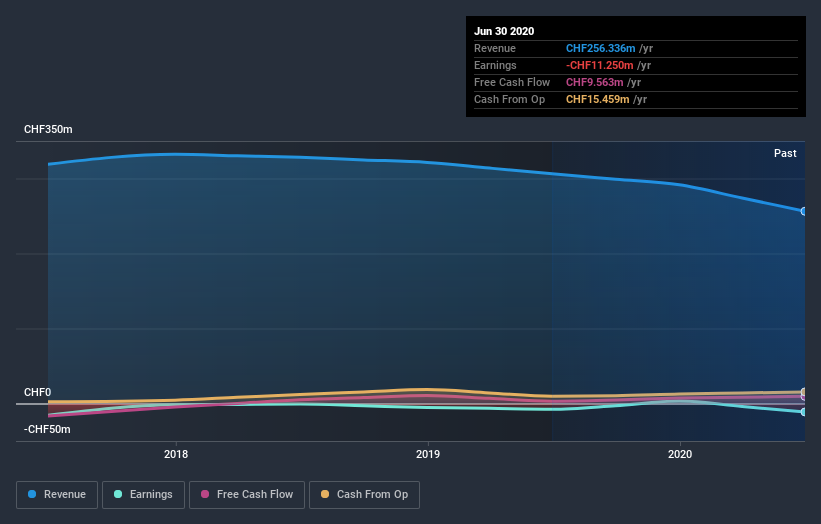

Because Von Roll Holding made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last three years Von Roll Holding saw its revenue shrink by 7.2% per year. That's not what investors generally want to see. The annual decline of 14% per year in that period has clearly disappointed holders. That makes sense given the lack of either profits or revenue growth. However, in this kind of situation you can sometimes find opportunity, where sentiment is negative but the company is actually making good progress.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Von Roll Holding stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

While the broader market gained around 3.1% in the last year, Von Roll Holding shareholders lost 12%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 5%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. You could get a better understanding of Von Roll Holding's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course Von Roll Holding may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CH exchanges.

When trading Von Roll Holding or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SWX:ROL

Von Roll Holding

Produces and distributes electrical insulation materials, winding wires, resins, varnishes, and composite materials in Europe, the Middle East, Africa, Asia, and the Americas.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives