The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Von Roll Holding AG (VTX:ROL) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Von Roll Holding

What Is Von Roll Holding's Net Debt?

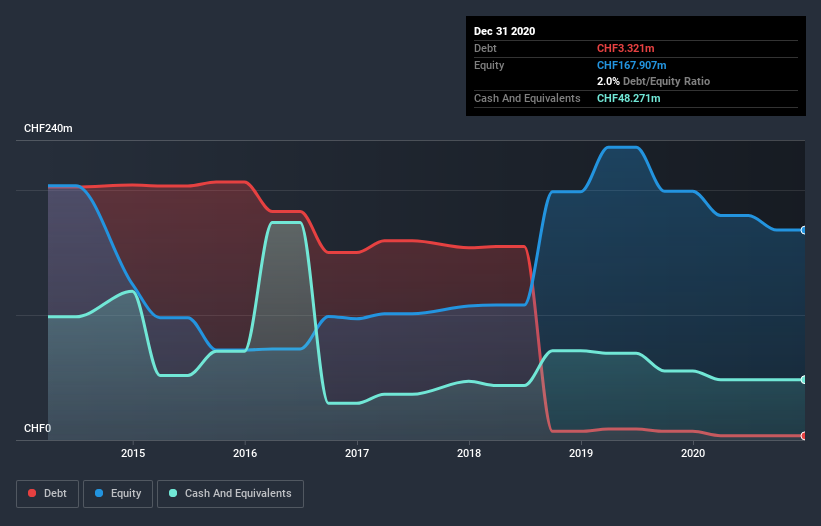

You can click the graphic below for the historical numbers, but it shows that Von Roll Holding had CHF3.32m of debt in December 2020, down from CHF6.93m, one year before. However, its balance sheet shows it holds CHF48.3m in cash, so it actually has CHF45.0m net cash.

How Strong Is Von Roll Holding's Balance Sheet?

The latest balance sheet data shows that Von Roll Holding had liabilities of CHF26.8m due within a year, and liabilities of CHF30.6m falling due after that. Offsetting this, it had CHF48.3m in cash and CHF42.9m in receivables that were due within 12 months. So it actually has CHF33.8m more liquid assets than total liabilities.

This surplus suggests that Von Roll Holding has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Succinctly put, Von Roll Holding boasts net cash, so it's fair to say it does not have a heavy debt load! There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Von Roll Holding will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, Von Roll Holding made a loss at the EBIT level, and saw its revenue drop to CHF212m, which is a fall of 27%. To be frank that doesn't bode well.

So How Risky Is Von Roll Holding?

Statistically speaking companies that lose money are riskier than those that make money. And we do note that Von Roll Holding had an earnings before interest and tax (EBIT) loss, over the last year. And over the same period it saw negative free cash outflow of CHF230k and booked a CHF24m accounting loss. Given it only has net cash of CHF45.0m, the company may need to raise more capital if it doesn't reach break-even soon. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. When we look at a riskier company, we like to check how their profits (or losses) are trending over time. Today, we're providing readers this interactive graph showing how Von Roll Holding's profit, revenue, and operating cashflow have changed over the last few years.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you decide to trade Von Roll Holding, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SWX:ROL

Von Roll Holding

Produces and distributes electrical insulation materials, winding wires, resins, varnishes, and composite materials in Europe, the Middle East, Africa, Asia, and the Americas.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives