- Switzerland

- /

- Construction

- /

- SWX:PNHO

Poenina Holding AG's (VTX:PNHO) Fundamentals Look Pretty Strong: Could The Market Be Wrong About The Stock?

It is hard to get excited after looking at Poenina Holding's (VTX:PNHO) recent performance, when its stock has declined 4.9% over the past month. However, stock prices are usually driven by a company’s financial performance over the long term, which in this case looks quite promising. In this article, we decided to focus on Poenina Holding's ROE.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Put another way, it reveals the company's success at turning shareholder investments into profits.

See our latest analysis for Poenina Holding

How To Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Poenina Holding is:

18% = CHF11m ÷ CHF64m (Based on the trailing twelve months to June 2020).

The 'return' is the yearly profit. One way to conceptualize this is that for each CHF1 of shareholders' capital it has, the company made CHF0.18 in profit.

Why Is ROE Important For Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Poenina Holding's Earnings Growth And 18% ROE

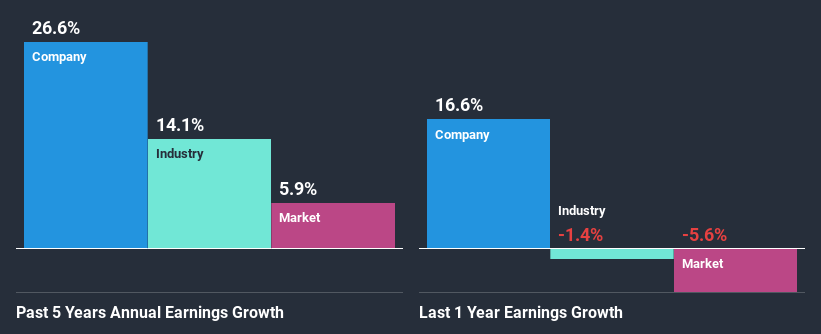

At first glance, Poenina Holding seems to have a decent ROE. Especially when compared to the industry average of 11% the company's ROE looks pretty impressive. This certainly adds some context to Poenina Holding's exceptional 27% net income growth seen over the past five years. However, there could also be other causes behind this growth. For example, it is possible that the company's management has made some good strategic decisions, or that the company has a low payout ratio.

As a next step, we compared Poenina Holding's net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 7.4%.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. Doing so will help them establish if the stock's future looks promising or ominous. Is Poenina Holding fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Poenina Holding Making Efficient Use Of Its Profits?

The high three-year median payout ratio of 54% (implying that it keeps only 46% of profits) for Poenina Holding suggests that the company's growth wasn't really hampered despite it returning most of the earnings to its shareholders.

Additionally, Poenina Holding has paid dividends over a period of three years which means that the company is pretty serious about sharing its profits with shareholders. Upon studying the latest analysts' consensus data, we found that the company's future payout ratio is expected to rise to 65% over the next three years. Regardless, the ROE is not expected to change much for the company despite the higher expected payout ratio.

Conclusion

In total, we are pretty happy with Poenina Holding's performance. In particular, its high ROE is quite noteworthy and also the probable explanation behind its considerable earnings growth. Yet, the company is retaining a small portion of its profits. Which means that the company has been able to grow its earnings in spite of it, so that's not too bad. Up till now, we've only made a short study of the company's growth data. So it may be worth checking this free detailed graph of Poenina Holding's past earnings, as well as revenue and cash flows to get a deeper insight into the company's performance.

When trading Poenina Holding or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Poenina Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SWX:PNHO

Poenina Holding

As of June 29, 2022, Poenina Holding AG was acquired by Burkhalter Holding AG.

Outstanding track record with flawless balance sheet.