As global markets navigate a landscape marked by rising inflation and near-record highs in U.S. stock indexes, investors are increasingly focused on strategies that offer both stability and income. Amidst this backdrop, dividend stocks present an appealing option for those looking to balance potential growth with regular income, especially given their ability to provide returns through consistent payouts even when market conditions fluctuate.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.89% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.58% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.84% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.32% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.55% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.42% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.20% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.29% | ★★★★★★ |

| Archer-Daniels-Midland (NYSE:ADM) | 4.44% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.52% | ★★★★★★ |

Click here to see the full list of 1988 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

SpareBank 1 Ringerike Hadeland (OB:RING)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SpareBank 1 Ringerike Hadeland is a Norwegian financial institution offering a range of banking products and services to both private and corporate customers, with a market cap of NOK6.06 billion.

Operations: SpareBank 1 Ringerike Hadeland generates revenue through its Retail Market (NOK456 million), Business Market (NOK467 million), Property Management (NOK56 million), and IT and Accounting Services (NOK87 million) segments.

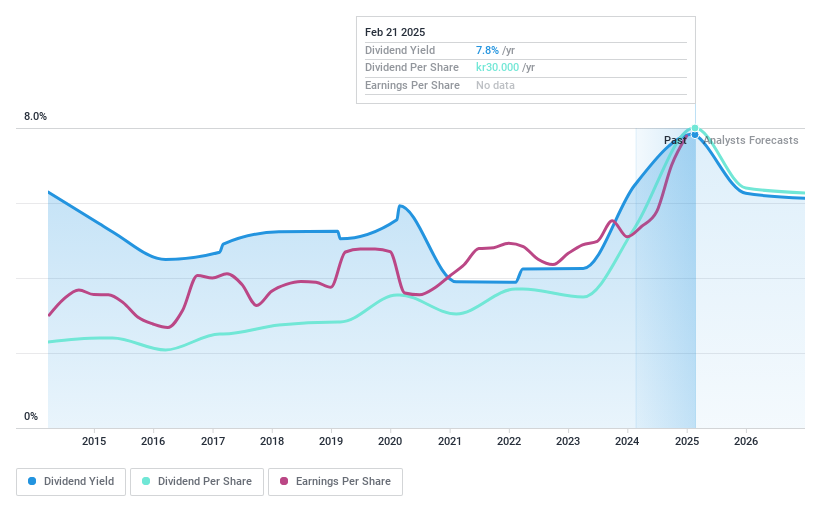

Dividend Yield: 7.8%

SpareBank 1 Ringerike Hadeland offers a reliable dividend, having consistently increased payments over the past decade while maintaining stability. Its current payout ratio of 68.5% indicates dividends are well-covered by earnings and forecasted to remain sustainable at 64.7% in three years, despite an anticipated decline in earnings. Trading below estimated fair value enhances its appeal; however, its dividend yield of 7.82% is lower than top-tier Norwegian payers (9.07%). Recent earnings growth supports ongoing payouts.

- Get an in-depth perspective on SpareBank 1 Ringerike Hadeland's performance by reading our dividend report here.

- Our valuation report unveils the possibility SpareBank 1 Ringerike Hadeland's shares may be trading at a discount.

Food Moments (SET:FM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Food Moments Public Company Limited operates in the production and sale of butchered chicken and processed chicken products, with a market cap of THB3.44 billion.

Operations: Food Moments Public Company Limited generates revenue primarily from the production and distribution of chicken parts (THB5.28 billion) and processed chicken parts (THB2.65 billion).

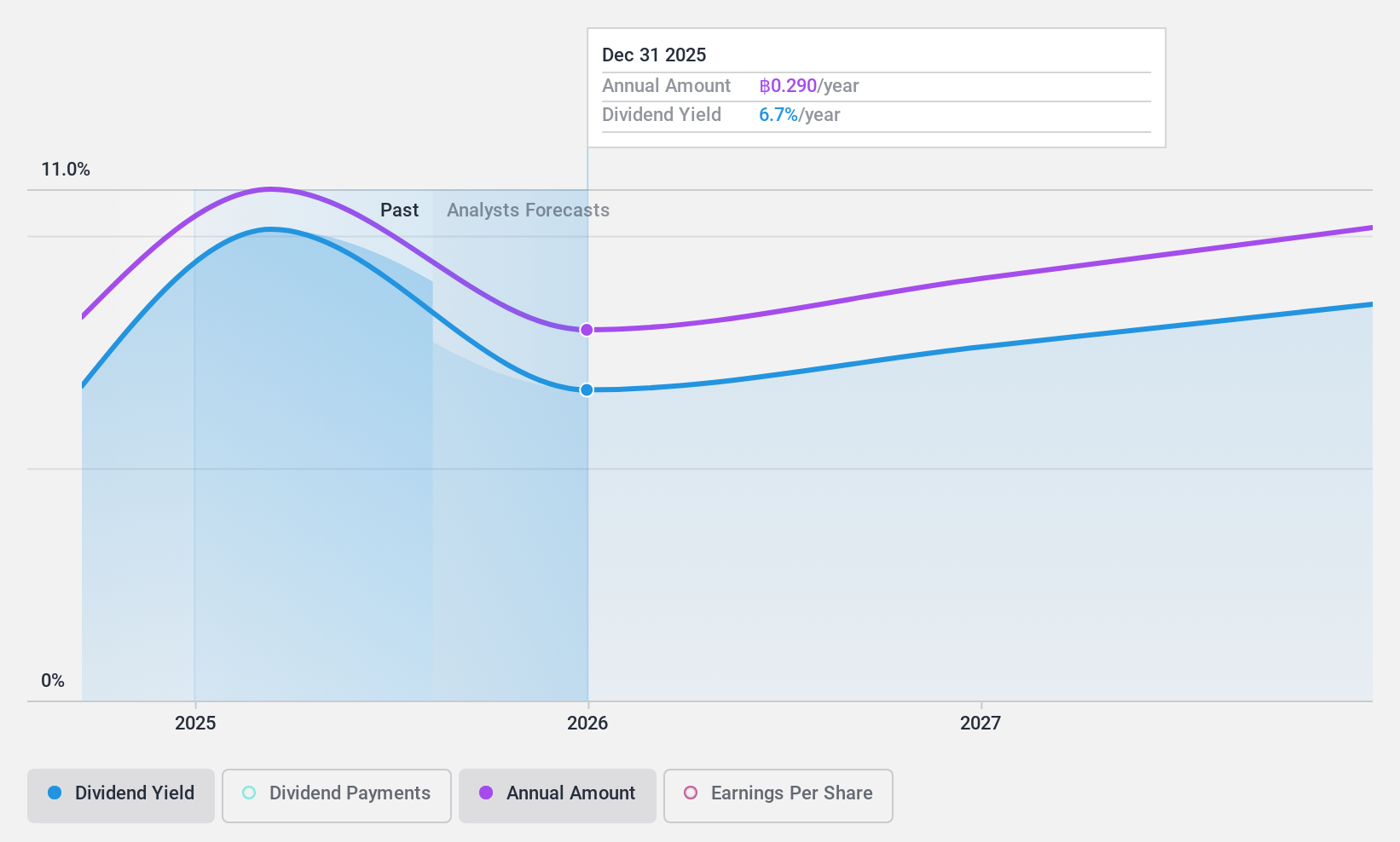

Dividend Yield: 8.6%

Food Moments is trading at 86.5% below its estimated fair value, offering potential value for investors. Its dividend yield of 8.62% ranks in the top 25% of the TH market, supported by a low payout ratio of 23.8%, indicating dividends are well-covered by earnings and cash flows (40.9%). However, as FM only recently began paying dividends, it's too early to assess their stability or growth trajectory over time.

- Take a closer look at Food Moments' potential here in our dividend report.

- Our valuation report here indicates Food Moments may be undervalued.

Phoenix Mecano (SWX:PMN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Phoenix Mecano AG, with a market cap of CHF389.66 million, manufactures and sells components for industrial customers globally through its subsidiaries.

Operations: Phoenix Mecano AG generates its revenue from three main segments: Enclosure Systems (€218.16 million), Industrial Components (€197.28 million), and Dewertokin Technology Group (€348.00 million).

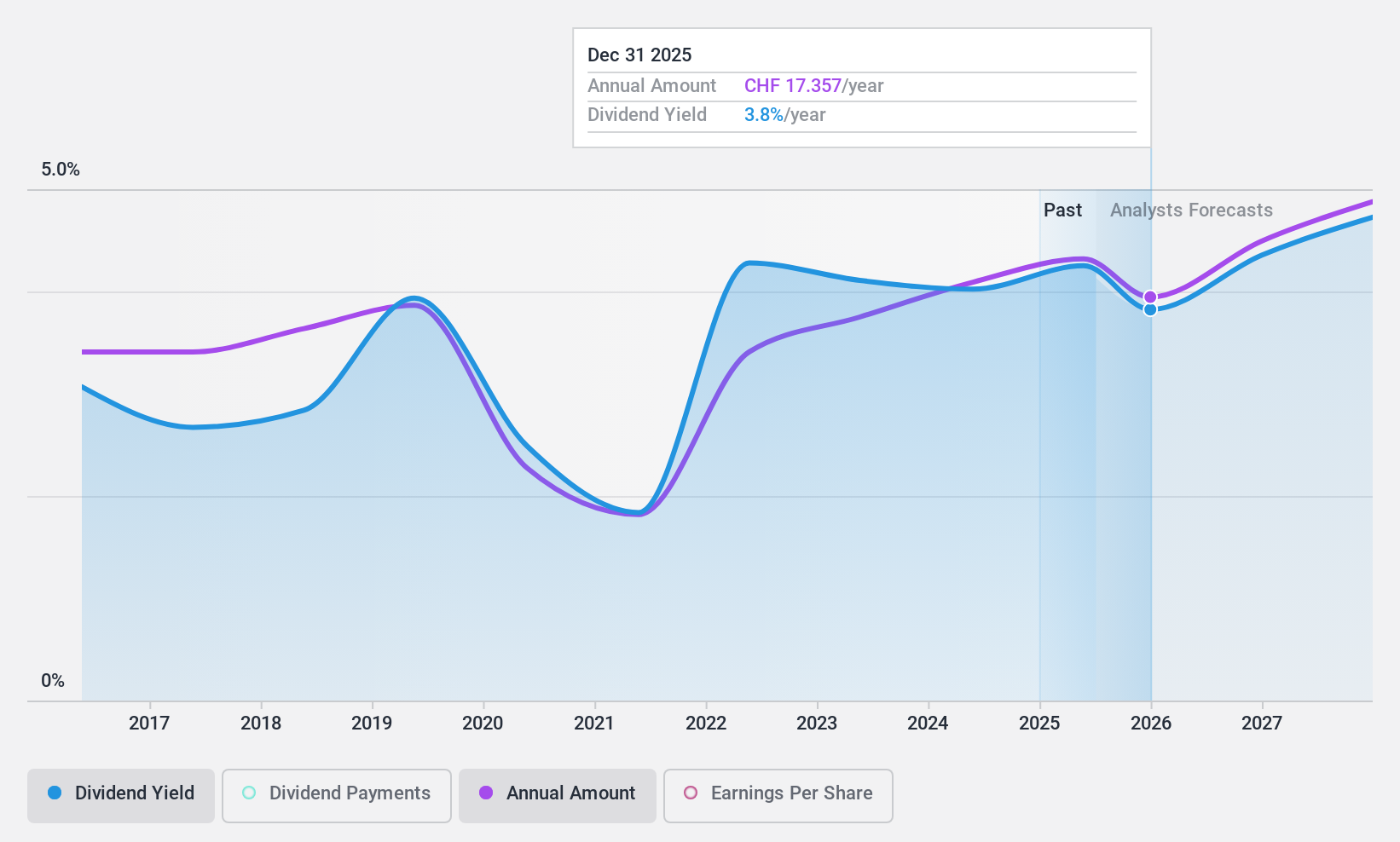

Dividend Yield: 6.7%

Phoenix Mecano's dividend yield of 6.67% is among the top 25% in the Swiss market, yet its sustainability is questionable due to a high cash payout ratio of 118.5%, indicating dividends are not well-covered by free cash flows. Despite a reasonable earnings payout ratio of 72.4%, dividend payments have been volatile over the past decade, reflecting unreliability and potential risk for income-focused investors despite trading below estimated fair value.

- Unlock comprehensive insights into our analysis of Phoenix Mecano stock in this dividend report.

- The valuation report we've compiled suggests that Phoenix Mecano's current price could be quite moderate.

Summing It All Up

- Dive into all 1988 of the Top Dividend Stocks we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:RING

SpareBank 1 Ringerike Hadeland

A financial institution, provides various banking products and services to private and corporate customers in Norway.

Solid track record established dividend payer.

Market Insights

Community Narratives