- Switzerland

- /

- Machinery

- /

- SWX:OERL

What Does The Future Hold For OC Oerlikon Corporation AG (VTX:OERL)? These Analysts Have Been Cutting Their Estimates

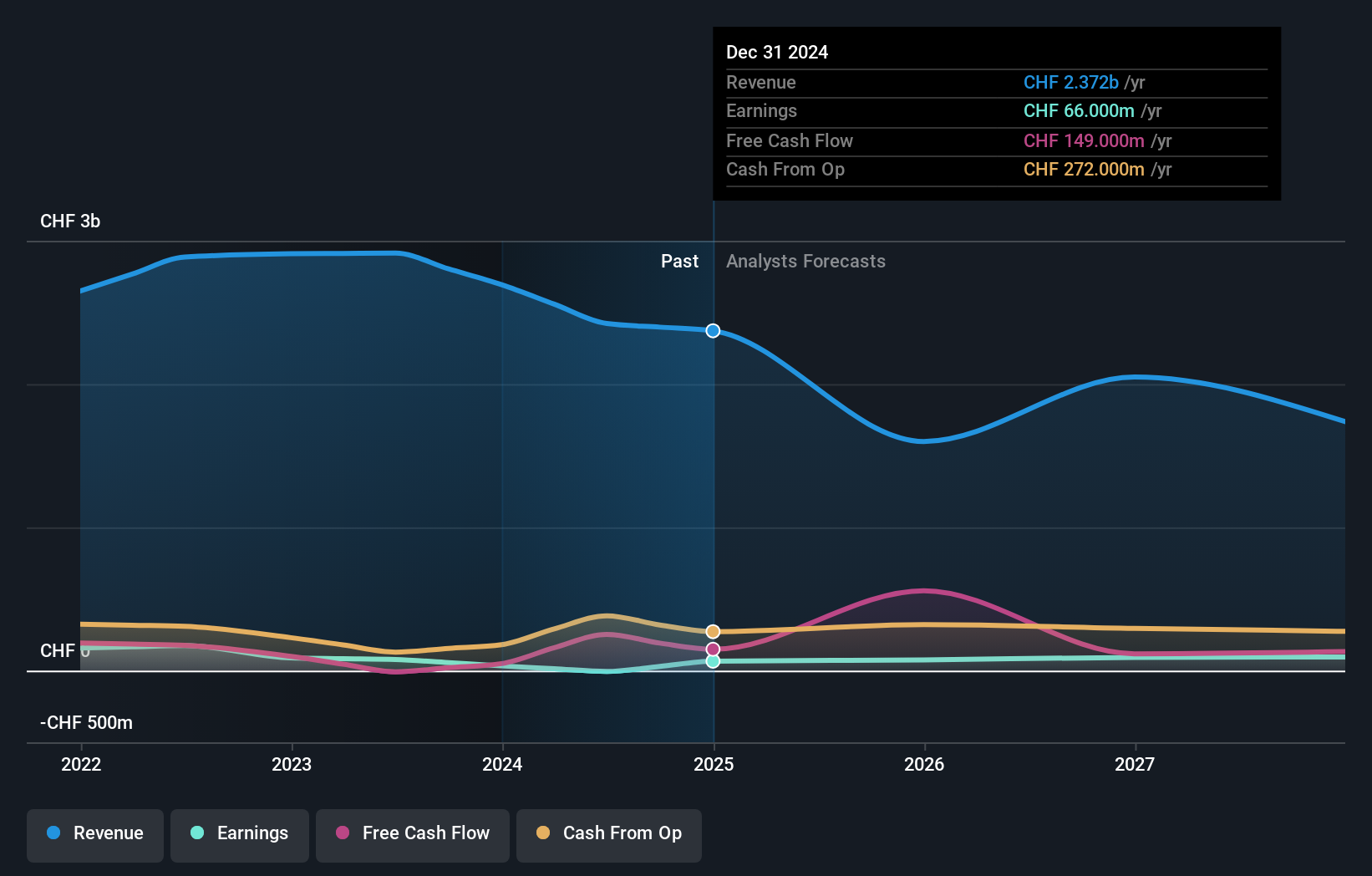

The analysts covering OC Oerlikon Corporation AG (VTX:OERL) delivered a dose of negativity to shareholders today, by making a substantial revision to their statutory forecasts for this year. This report focused on revenue estimates, and it looks as though the consensus view of the business has become substantially more conservative.

Following the latest downgrade, the seven analysts covering OC Oerlikon provided consensus estimates of CHF1.6b revenue in 2025, which would reflect a stressful 33% decline on its sales over the past 12 months. Prior to the latest estimates, the analysts were forecasting revenues of CHF1.8b in 2025. It looks like forecasts have become a fair bit less optimistic on OC Oerlikon, given the measurable cut to revenue estimates.

View our latest analysis for OC Oerlikon

There was no particular change to the consensus price target of CHF4.21, with OC Oerlikon's latest outlook seemingly not enough to result in a change of valuation.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. We would highlight that sales are expected to reverse, with a forecast 41% annualised revenue decline to the end of 2025. That is a notable change from historical growth of 1.7% over the last five years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 5.1% per year. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - OC Oerlikon is expected to lag the wider industry.

The Bottom Line

The clear low-light was that analysts slashing their revenue forecasts for OC Oerlikon this year. They also expect company revenue to perform worse than the wider market. Often, one downgrade can set off a daisy-chain of cuts, especially if an industry is in decline. So we wouldn't be surprised if the market became a lot more cautious on OC Oerlikon after today.

Unfortunately, the earnings downgrade - if accurate - may also place pressure on OC Oerlikon's mountain of debt, which could lead to some belt tightening for shareholders. See why we're concerned about OC Oerlikon's balance sheet by visiting our risks dashboard for free on our platform here.

Another thing to consider is whether management and directors have been buying or selling stock recently. We provide an overview of all open market stock trades for the last twelve months on our platform, here.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:OERL

OC Oerlikon

Provides surface engineering, polymer processing, and additive manufacturing services in Europe, the Americas, and the Asia-Pacific.

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.