- Switzerland

- /

- Electrical

- /

- SWX:LECN

We Think Shareholders Are Less Likely To Approve A Pay Rise For Leclanché SA's (VTX:LECN) CEO For Now

In the past three years, the share price of Leclanché SA (VTX:LECN) has struggled to grow and now shareholders are sitting on a loss. However, what is unusual is that EPS growth has been positive, suggesting that the share price has diverged from fundamentals. The AGM coming up on the 30 September 2022 could be an opportunity for shareholders to bring these concerns to the board's attention. Voting on resolutions such as executive remuneration and other matters could also be a way to influence management. We think shareholders might be reluctant to increase compensation for the CEO at the moment, according to our analysis below.

Check out our latest analysis for Leclanché

How Does Total Compensation For Anil Srivastava Compare With Other Companies In The Industry?

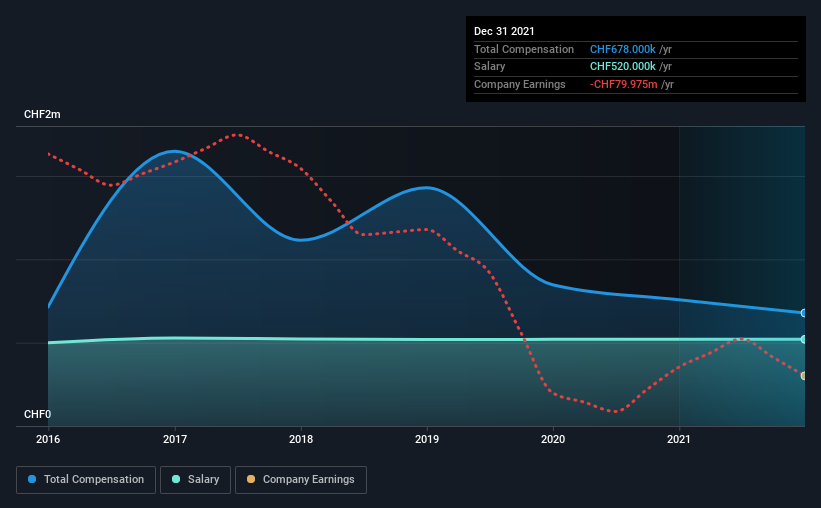

At the time of writing, our data shows that Leclanché SA has a market capitalization of CHF201m, and reported total annual CEO compensation of CHF678k for the year to December 2021. That's a notable decrease of 10% on last year. We note that the salary portion, which stands at CHF520.0k constitutes the majority of total compensation received by the CEO.

On comparing similar companies from the same industry with market caps ranging from CHF98m to CHF392m, we found that the median CEO total compensation was CHF803k. From this we gather that Anil Srivastava is paid around the median for CEOs in the industry.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | CHF520k | CHF521k | 77% |

| Other | CHF158k | CHF236k | 23% |

| Total Compensation | CHF678k | CHF757k | 100% |

On an industry level, roughly 45% of total compensation represents salary and 55% is other remuneration. It's interesting to note that Leclanché pays out a greater portion of remuneration through salary, compared to the industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Leclanché SA's Growth

Leclanché SA has seen its earnings per share (EPS) increase by 23% a year over the past three years. Its revenue is down 13% over the previous year.

Shareholders would be glad to know that the company has improved itself over the last few years. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Leclanché SA Been A Good Investment?

With a total shareholder return of -58% over three years, Leclanché SA shareholders would by and large be disappointed. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

Shareholders have not seen their shares grow in value, rather they have seen their shares decline. The fact that the stock price hasn't grown along with earnings may indicate that other issues may be affecting that stock. Shareholders would probably be keen to find out what are the other factors could be weighing down the stock. At the upcoming AGM, shareholders will get the opportunity to discuss any issues with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

CEO pay is simply one of the many factors that need to be considered while examining business performance. That's why we did our research, and identified 4 warning signs for Leclanché (of which 3 shouldn't be ignored!) that you should know about in order to have a holistic understanding of the stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:LECN

Leclanché

Designs, develops, and manufactures customized turnkey energy storage solutions for electricity generation and transmission, mass transportation, heavy industrial machines, and specialty low voltage battery systems.

Slight risk with weak fundamentals.

Similar Companies

Market Insights

Community Narratives