Leclanché SA (VTX:LECN) shares have had a really impressive month, gaining 28% after a shaky period beforehand. Unfortunately, despite the strong performance over the last month, the full year gain of 5.6% isn't as attractive.

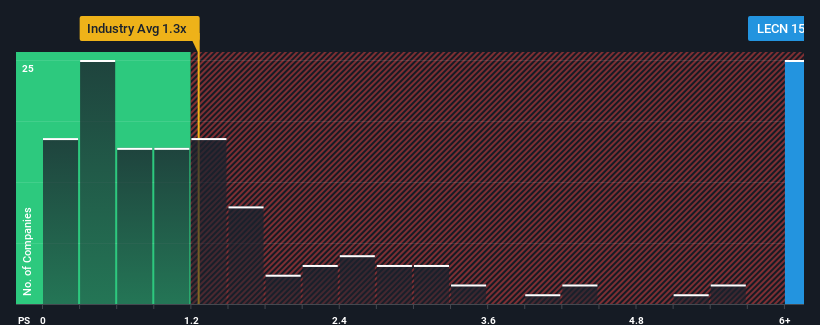

Following the firm bounce in price, you could be forgiven for thinking Leclanché is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 15.2x, considering almost half the companies in Switzerland's Electrical industry have P/S ratios below 1.3x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Leclanché

How Has Leclanché Performed Recently?

Recent times have been quite advantageous for Leclanché as its revenue has been rising very briskly. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Leclanché's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as Leclanché's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an exceptional 73% gain to the company's top line. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 1.1% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Comparing that to the industry, which is predicted to deliver 3.3% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this information, we find it concerning that Leclanché is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What Does Leclanché's P/S Mean For Investors?

Shares in Leclanché have seen a strong upwards swing lately, which has really helped boost its P/S figure. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Leclanché revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. Right now we aren't comfortable with the high P/S as this revenue performance is highly unlikely to support such positive sentiment for long. Should recent medium-term revenue trends persist, it would pose a significant risk to existing shareholders' investments and prospective investors will have a hard time accepting the current value of the stock.

There are also other vital risk factors to consider and we've discovered 5 warning signs for Leclanché (4 are a bit unpleasant!) that you should be aware of before investing here.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:LECN

Leclanché

Designs, develops, and manufactures customized turnkey energy storage solutions for electricity generation and transmission, mass transportation, heavy industrial machines, and specialty low voltage battery systems.

Slight risk with weak fundamentals.

Similar Companies

Market Insights

Community Narratives