- Switzerland

- /

- Machinery

- /

- SWX:KARN

We Think The Compensation For Kardex Holding AG's (VTX:KARN) CEO Looks About Right

Under the guidance of CEO Jens Fankhänel, Kardex Holding AG (VTX:KARN) has performed reasonably well recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 15 April 2021. Here is our take on why we think the CEO compensation looks appropriate.

View our latest analysis for Kardex Holding

How Does Total Compensation For Jens Fankhänel Compare With Other Companies In The Industry?

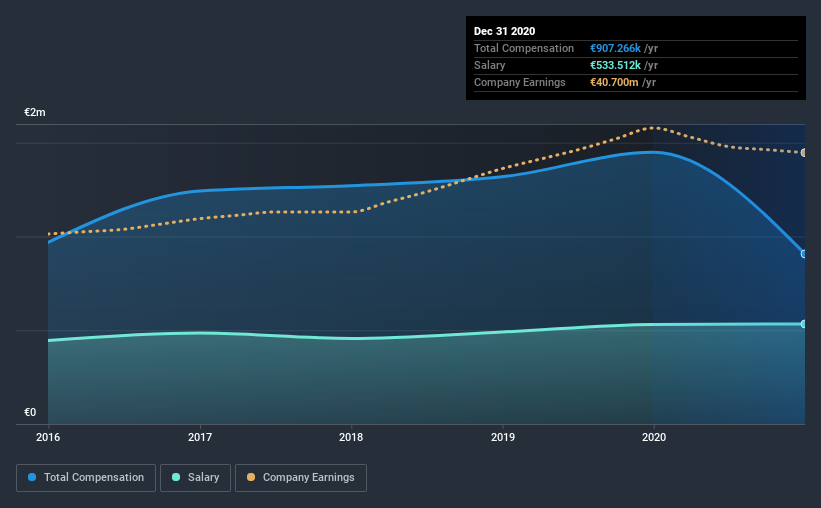

At the time of writing, our data shows that Kardex Holding AG has a market capitalization of CHF1.5b, and reported total annual CEO compensation of €907k for the year to December 2020. Notably, that's a decrease of 37% over the year before. Notably, the salary which is €533.5k, represents a considerable chunk of the total compensation being paid.

In comparison with other companies in the industry with market capitalizations ranging from CHF925m to CHF3.0b, the reported median CEO total compensation was €996k. So it looks like Kardex Holding compensates Jens Fankhänel in line with the median for the industry. Moreover, Jens Fankhänel also holds CHF187k worth of Kardex Holding stock directly under their own name.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | €534k | €531k | 59% |

| Other | €374k | €918k | 41% |

| Total Compensation | €907k | €1.4m | 100% |

Speaking on an industry level, salary and non-salary portions, both make up 50% each of the total remuneration. Kardex Holding is paying a higher share of its remuneration through a salary in comparison to the overall industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Kardex Holding AG's Growth

Over the past three years, Kardex Holding AG has seen its earnings per share (EPS) grow by 8.6% per year. In the last year, its revenue is down 12%.

We generally like to see a little revenue growth, but the modest EPS growth gives us some relief. It's hard to reach a conclusion about business performance right now. This may be one to watch. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Kardex Holding AG Been A Good Investment?

We think that the total shareholder return of 63%, over three years, would leave most Kardex Holding AG shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. In saying that, any proposed increase to CEO compensation will still be assessed on how reasonable it is based on performance and industry benchmarks.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. In our study, we found 2 warning signs for Kardex Holding you should be aware of, and 1 of them is significant.

Switching gears from Kardex Holding, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

When trading Kardex Holding or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kardex Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SWX:KARN

Kardex Holding

Provides intralogistics solutions; and supplies automated storage solutions and materials handling systems worldwide.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives